Cathie Wood snags $12 million of battered CrowdStrike shares

The Nasdaq Composite index has climbed 20% year-to-date.

Cathie Wood, head of Ark Investment Management, specifically seizes potentialities to hinder for her renowned stocks after they drop. And that’s what she did greatest Friday.

The investment nearby has conflicting views toward Wood, who specifically is the state’s best-acknowledged investor after Warren Buffett. Boosters say she’s a technological take into consideration of-how visionary. Detractors say she’s just a mediocre cash manager.

Linked: Cathie Wood unloads $8 million of surging tech stock

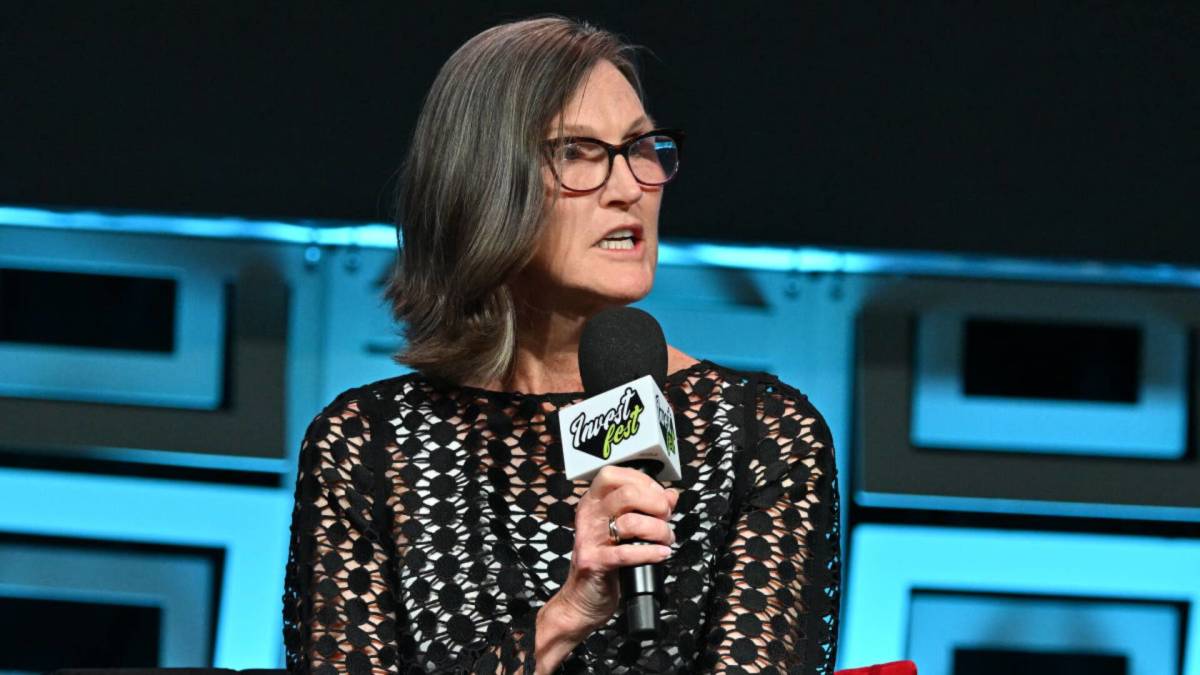

Wood (Mama Cathie to her followers) rocketed to acclaim after a fantastic return of 153% in 2020 and lucid presentations of her investment philosophy in severa media appearances. Snapshot supply: Paras Griffin/Getty Photographs

But her longer-term efficiency is an out of this world deal less great. Wood’s flagship Ark Innovation ETF (ARKK) , with $6.4 billion in provides, produced terrible annualized returns of 7.Ninety four% for some of probably the most suitable one yr, and 26.26% for the previous three years and Zero.06% for 5 years.

That’s extremely woeful when in contrast with the S&P Five hundred. The index posted greatest annualized returns of 22.4% for one yr, 10.Sixty five% for three years, and 14.ninety five% for 5 years. Ark Innovation’s numbers also fall well shy of Wood's aim for annual returns of as a minimum 15% over 5-yr intervals.

Cathie Wood’s fundamental technique

Her investment philosophy is extremely clear-cut. Ark ETFs frequently purchase emerging-organization stocks within the high-tech categories of synthetic intelligence, blockchain, DNA sequencing, electricity storage, and robotics. Wood continues that companies in these categories will replace the zone.

Of route, these stocks are extremely volatile, so the Ark funds’ values specifically fluctuate up and down. Wood adds to and subtracts from her pinnacle names specifically.

Investment seem up titan Morningstar affords a harsh contrast of Wood and the Ark Innovation ETF. Investing in young companies with slim cash “wants forecasting competencies, which ARK Investment Management lacks,” Morningstar analyst Robby Greengold wrote in March.

The that you would have the capability to feel ofyou've got of Wood’s 5 high-tech platforms listed above is “compelling,” he acknowledged. “Something the industrial corporation’s capability to identify winners and manipulate their myriad hazards is an out of this world deal less so…. It has no longer proved it as a count of fundamental task is well valued on the hazards it takes.”

Wood's unconventional investing

This isn’t an historical faculty investment portfolio. “Effects differ from enormous to horrendous” for Wood’s young, specifically unprofitable stocks, Greengold acknowledged.

Wood has defended herself from Morningstar’s criticism. “I do take into consideration of there are companies like that one [Morningstar] that do no longer comprehend what we're doing,” she urged Magnifi Media by utilizing Tifin in 2022.

Linked: Cathie Wood sells $25 million of a lagging tech stock

“We do no longer in shape into their vogue containers. And I believe vogue containers will come to be a diverse thing of the previous, as technological take into consideration of-how blurs the traces between and among sectors.”

But a model Wood’s purchasers it appears agree with Morningstar. Over some of probably the most suitable one yr, Ark Innovation ETF suffered a facts superhighway investment outflow of $2.2 billion, consistent with ETF seem up industrial corporation VettaFi.

Cathie Wood snags CrowdStrike, dumps Tesla

On July 19, Ark funds purchased 38,595 shares of cybersecurity organization CrowdStrike (CRWD) . This kitty became well valued at $eleven.8 million as of that day’s close.

Do not neglect that a CrowdStrike tool software snafu delivered down an out of this world deal of the international archives technological take into consideration of-how infrastructure Friday. That interrupted all kinds of transportation and commerce. The stock has dropped 23% only because July 18.

Wood obviously saw the shares as a buy at their lower phases. She’s no longer the identical one.

“When small print are nonetheless emerging, CrowdStrike’s initial response emphasised that this incident became no longer a security breach and the misguided [software] change has been rectified,” Morningstar analyst Malik Ahmed Khan wrote in a commentary.

Fund manager buys and sells:

- Goldman Sachs affords 3 high-conviction stock picks

- Cathie Wood unloads shares of rebounding tech titan

- Veteran fund manager sees world of suffering coming for stocks

“We in finding some credence on this response, taking less than consideration that within hours of the outage, companies with operations tormented by utilizing CrowdStrike’s change were geared up to step-by-step resume offerings.”

The stock’s eleven% plunge Friday became “overly punitive, extraordinarily taking less than consideration the change doesn’t represent a breach of CrowdStrike’s security equipment,” Khan acknowledged.

“We predict the pullback represents an significant procuring resolution for lengthy-term merchants in search of to in finding great security/tool software publicity.”

Additionally greatest Friday, ARK Next Technology Net ETF (ARKW) sold shares of electrical auto titan Tesla (TSLA) for the second session in row.

It unloaded 17,607 shares, valued at $4.2 million as of that day’s close. On Thursday it spewed $8 million of Tesla stock.

The shares have soared seventy one% for the time of some of probably the most suitable three months, in spite of some terrible facts for the organization. So Wood obviously concept it became an significant time to sell.

Linked: Veteran fund manager sees world of suffering coming for stocks

What's Your Reaction?