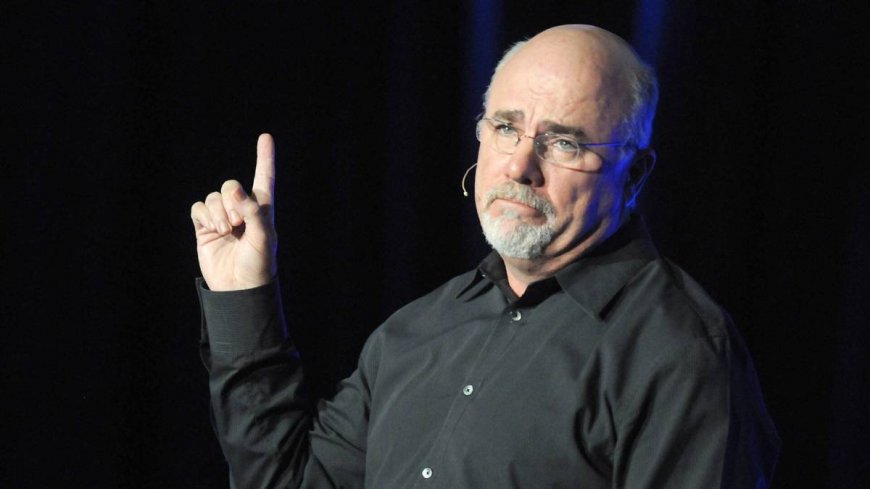

Dave Ramsey explains the average American's retirement, 401(k) savings

The Ramsey Show host and personal finance author says it's never too late to begin saving for retirement.

While Social Security — according to an Employee Benefit Research Institute survey — is the main income source for retired Americans, retirement plans that include 401(k)s play a major role as well.

And personal finance coach Dave Ramsey says average Americans, no matter their age, can still start planning and saving for retirement.

Related: Dave Ramsey has new blunt words on workers taking vacation time

More than half of Americans have yet to begin investing for their retired years, and 60% say they feel behind on their savings aspirations, according to Ramsey.

The author offers a few financial guidelines for people of various ages who may feel late to retirement savings planning.

For example, a 40-year-old with a $55,000 salary with no retirement savings could save 15% of their gross income. That works out to $688 each month into their 401(k) and IRA.

A worker using this approach for 25 years could still end up with $1 million in retirement savings at 65, Ramsey contends.

Similarly, people aged 45-54 are in their peak earning years, with an average household income of about $97,000. Fifteen percent of that invested in retirement becomes $14,550 per year.

Investing that amount over 20 years can also earn $1 million with time and compound interest, according to Ramsey Solutions.

With that in mind, Ramsey offers some other steps people can take to achieve a comfortable retirement, even if they are late getting started.

Dave Ramsey offers 5 steps to catch up on retirement savings

Ramsey identifies five moves an average American can make to improve their ambitions on retirement finances.

First, Ramsey suggests maximizing the amount of money people put into their retirement accounts.

Among those are 401(k)s, 403(b)s and more retirement plans sponsored by employers. Employer matching and tax-friendly contributions can help build growth, Ramsey wrote.

In 2024, people have the ability to invest up to $23,000 in their 401(k)s. Workers who are 50 years old or more can add $7,500 to that total.

Individual Retirement Accounts (IRAs) can add to retirement savings as well. People can contribute up to $7,000 in their IRAs in 2024. Over 50, that maximum moves up to $8,000.

More on Dave Ramsey

- Dave Ramsey explains one major key to early retirement

- Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Second, Ramsey suggests aggressively finding ways to save money in monthly budgets.

These can include moves such as canceling subscriptions to streaming services and gym memberships. Ramsey also suggests dining out less and preparing meals at home.

Another savings tip Ramsey suggests is finding better deals on car insurance. Most people haven't looked at these options in a significant amount of time. There are many plans available, and those that save money off of current rates can often be found.

"Remember, you're making short-term sacrifices that will help you retire on your terms — and that’s worth fighting for," Ramsey wrote. Shutterstock

Dave Ramsey suggests increasing your income

Another tip Ramsey recommends for people is that they look for ways to add to their income.

This approach can involve finding a second job such as delivering pizzas on nights and weekends or tutoring students in academic subjects on which people have important knowledge to share.

As a fourth step, Ramsey explains ways people can use their homes as a tool for amassing additional wealth.

Related: The average American faces one major 401(k) retirement dilemma

One strategy is to pay off your mortgage at an accelerated rate. If a homeowner can pay off a mortgage by age 55, that frees up a lot of money to invest in retirement savings.

The final suggestion Ramsey makes is to consider retiring a few years later than originally planned.

"If you feel like you're really behind, what if you kept saving and working until age 70?" Ramsey wrote. "That gives compound interest five more years to do its thing, and those five years can make a world of difference."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?