Dave Ramsey makes 3 blunt real estate and home-buying predictions now

Here's what to know if you're thinking about buying a house.

Most those that're potentially buying a house are trying and get essentially the most modern, most reliable expert advice on the state of the housing market they're going to before signing on the dotted line.

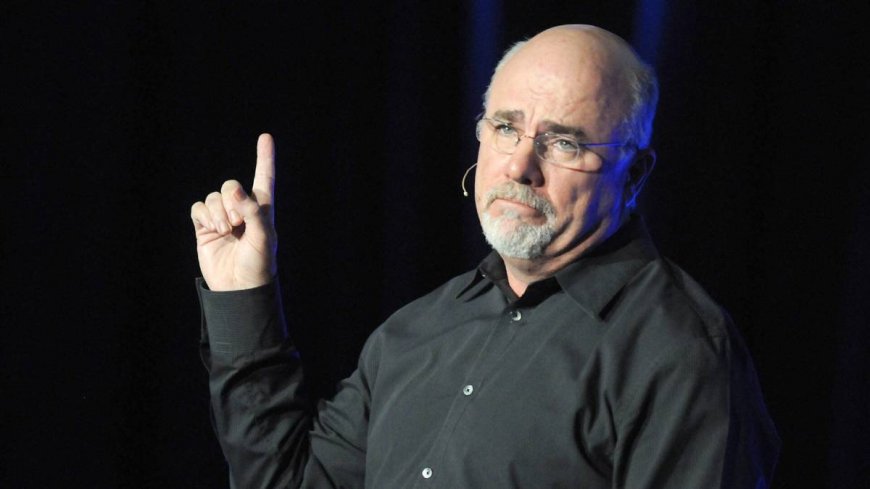

But personal finance author and radio host Dave Ramsey explains that real estate market professionals do one of several vital most best they're going to to use on hand data to make guesses about future trends, but no prediction is a hundred% guaranteed.

Related: Dave Ramsey bluntly speaks on interest rates and mortgages

Ramsey also emphasizes one major factor that has to be in place whatever the state of the housing market: The prospective buyer of a house will deserve to have their own personal finances in good enough shape to make the move. Buying a house, of course, is generally considered to be the largest investment the common American makes.

So naturally, the largest determinant of 1's ability to buy a house is one's financial readiness. Ramsey advises against, in most situations, placing an excessive amount of emphasis on housing market conditions.

That said, Ramsey offers three predictions for the housing marketplace for as a minimum remainder of the calendar year.

- Interest rates will decrease.

- A crash world wide the housing market is now now not drawing close.

- Housing inventory is maybe going to stay low through December.

And he explains similarly what these predictions, assuming they hold, mean for potential home buyers.

Dave Ramsey explains mortgages and the speed of interest outlook

Mortgage interest rates increased at an awfully quick percent between 2021 and 2023, primarily it could possibly well be because Federal Reserve was once again and again raising the federal funds rate at some stage in that point in its effort to wrestle inflation.

In August 2024, the common 30-year mortgage experienced an enormous drop, to six.forty seven%. And the mortgage rate will likely fall even similarly world wide the next couple of months, because the Fed meets on Sept. 17 and 18 with a high expectation it would likely be lowering the federal funds rate.

"For the housing market overall, this suggests buyer demand should percent up at some stage in remainder of 2024 because more people can have the flexibleness to offer you with the money for a mortgage," wrote Ramsey Solutions.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to lead clear of

- Ramsey shares important advice on mortgages

Ramsey then offers some specifics on what it means to be financially prepared enough to make the acquisition. David McNew/Getty Images

Ramsey clarifies what it means to be financially in a position to shop for a house

Because Ramsey said prospective home purchasers should now now not pay close attention to the housing market as a significant component world wide the their decisions about when to shop for, the non-public finance personality took your time to explain the factors to which individuals has to be paying attention.

Related: Dave Ramsey has major warning on retirement, 401(k), Social Security

So Ramsey provided a list of requirements potential home buyers should check off before making the enormous purchase.

- Being debt-free.

- Having an emergency fund in place of three- to six-months worth of costs.

- Having a mortgage payment it truly is now now no more than 25% of your monthly income.

- Having a down payment of 20% or more of the associated fee of the home.

- It's possible you are going to be in a position to also pay closing costs without taking them out of your down payment.

"Should you don’t meet these qualifications, it doesn’t matter if the market is in your favor," wrote Ramsey Solutions. "Buying a house may well be a curse in place of a blessing."

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?