Dave Ramsey says it's time to buy a house; mortgage rates decline

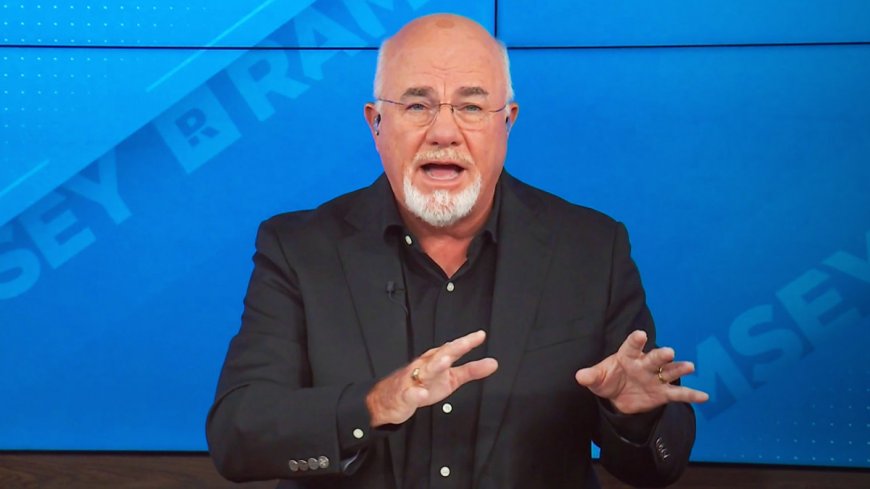

The radio host shares thoughts on being ready to make the real estate move.

Mortgage rates significantly shifted lower in November and personal finance expert Dave Ramsey says, if you are ready, now may be the time to buy a house.

But being ready means a few critical things need to be in place before taking the jump.

Related: Royal Caribbean and Carnival Cruise passengers face a new charge

Ramsey first advises people considering the big decision to keep in mind that it's not for everybody all the time.

"Ever heard someone say everyone should buy a house? Or that renting is a lot like flushing a whole bunch of money down the toilet every month?" he asked on Ramsey Solutions. "Yeah, we’ve heard that stuff too. And it’s nonsense! The truth is, not everyone should buy a house."

The bestselling author is not being pessimistic. But he is setting up the financial reality for people who want to purchase a home. And now may well be the time to do it.

"If you sign the dotted line on a new home when you aren’t prepared financially and emotionally, the house will wind up being a curse instead of a blessing," Ramsey suggested. "It will wind up owning you instead of the other way around. When you are prepared to buy a house, though, it can be a wonderful blessing for your family and a great way to build wealth."

Ramsey offered a list of the critical things to consider when making the determination that the major financial opportunity is in order. David McNew/Getty Images

Make sure you are free of debt

Ramsey emphasizes the need to get rid of all of your debts and to have an emergency fund established.

"The first step in making sure you’re financially ready to buy a house is paying off all your debt and saving up a full emergency fund," Ramsey wrote. "That's right — it’s time to say goodbye to your credit card balance, car payments, student loans and everything else you owe money for. Then, you'll want to build up an emergency fund worth 3–6 months of your typical expenses."

Ramsey then offers some words about setting up a down payment plan.

"A 20% down payment is ideal since it means you’ll avoid paying for private mortgage insurance (PMI) — a fee that insures the lender (not you) pays if you don’t make your mortgage payments," he wrote. "If you’re a first-time home buyer, a 5–10% down payment is okay, but plan to pay that pesky PMI and work on getting rid of it ASAP."

The personal finance media personality warns people to anticipate house payment realities and home maintenance as part of preparations.

"The next sign you’re ready to buy a house is when your budget can handle house payments. Specifically, your monthly house payment should never be more than 25% of your take-home pay," Ramsey wrote. "Why? When your house payment eats up more than a fourth of your take-home pay, your budget will be way too tight. Tying up that much of your income in a house payment won’t leave you enough money to put toward other important financial goals like saving for retirement. That’s what we call house poor."

Be ready for closing costs

"Some home sellers cover closing costs to sweeten the deal — but don't bank on it," he advised. "On average, the buyer's portion of closing costs will be around 3–4% of your home’s purchase price. For a $300,000 home, that’s anywhere between $9,000 — $12,000."

These include:

- A loan origination fee

- Home inspection

- Appraisal

- Prepaid property taxes and mortgage insurance

- Title insurance

- Recording fees

- Underwriting fees

Ramsey also wants potential home buyers to be sure they can manage cash flow for moving expenses and, importantly, know they are in a place where they plan on staying put for a while.

"Another thing to think about is whether you’re at a place in life where you’re ready to stay in your city for more than a few years. Most of the time, buying a house is a bad idea if you’re not planning to live in it for at least five years," Ramsey wrote.

"Why? Because it usually takes at least five years for a home’s value to grow enough to keep you from losing money when you resell it. For example, if you stay in a home for three years and its value only increases by 3% in that time, you wouldn’t even make back the money you spent on closing costs if you sold the house."

The 30-year fixed-rate mortgage fell to an average of 7.22% in the week ending Nov. 30, down from 7.29% the previous week, according to Freddie Mac.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?