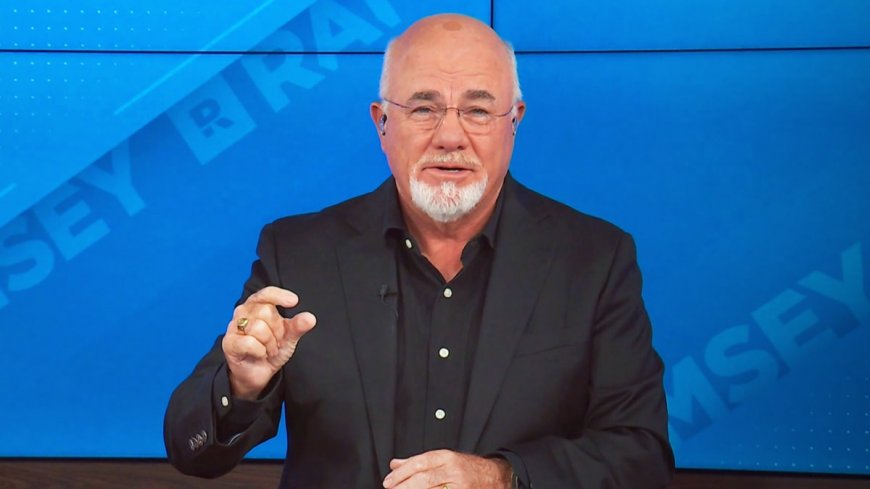

Dave Ramsey Shares the Top Money Mistake He Sees People Make

In an exclusive interview with TheStreet, the radio host explains.

Personal finance experts have long lists of money issues people have to make decisions about.

They see common mistakes made on a regular basis. They have a wide range of opinions on how to handle them.

DON'T MISS: Dave Ramsey Explains Why It's a Great Time To Buy a House

In an exclusive interview with TheStreet's Editor-in-Chief Sara Silverstein, author and radio host Dave Ramsey revealed the most common mistake he sees people repeatedly make (video above).

"Of all the people that you've mentored over the years, what is the biggest mistake that you see over and over again that you wish you can help people get over?" Silverstein asked.

Ramsey offered an answer that was more about personal discipline than financial technicalities.

"I think folks continue to try to fix the money thing with math," he said. "And I'm a math nerd. I'm formally trained in finance. I've got a finance degree."

"I've got all these letters and licenses and crap after my name that says I'm supposed to know something about this," he added. "And it turns out that personal finance is 80% behavior, 20% head knowledge in math."

The Importance of Personal Behavior and Discipline

Ramsey said the most important issue with money is often a behavioral one.

"The problem with my money is the guy I shave with. If I can get this guy in the mirror to behave, he can be skinny and rich," he said. "But he's got issues, you know, and it's a problem. And once people get that idea that, you know, you can't fix this with math, you can't fix it with get-rich-quick, you can't fix it with a secret."

Ramsey transitioned into talking about how important it is to create and live within a budget.

"There's not a secret. It's controlling (yourself) and saying, I'm going to live on less than I make intentionally with a plan called a budget," he said. "And I'm going to systematically get out of debt, build savings, build investments, increase my generosity as a series of intentional acts -- incremental acts -- over time."

The personal finance personality then discussed possibilities for the future, once living on a budget becomes a behavioral norm.

"And these are the people that have well-rounded, solid marriages," Ramsey continued. "Their kids still like them and they become multimillionaires. And it's very, very possible. It's very, very probable anyone can do it. But the problem, the reason most people don't, is most of us refuse to face the guy in our mirror."

Investing For Retirement

Once one is able to successfully stick to a fixed budget, then one can begin setting aside some money to invest for the future.

Ramsey believes that mutual funds are the best approach to investing.

"When it comes to investing, the last thing you want to do is treat your retirement portfolio like the Kentucky Derby and bet it all on one horse," wrote his company's website, Ramsey Solutions. "That’s why you should spread your investments equally across four types of mutual funds: growth and income, growth, aggressive growth, and international."

"That keeps your portfolio balanced and helps you minimize your risks against the stock market’s ups and downs through diversification," Ramsey added. "All diversification means is you’re spreading your money out across different kinds of investments, which reduces your overall risk if a particular market goes south."

Some people, however, choose to invest in the stock market directly. Many experts generally suggest getting started by buying shares of familiar companies whose products are commonly used.

These might include retail, entertainment and technology stocks such as Amazon (AMZN) - Get Free Report, Apple (AAPL) - Get Free Report, Costco (COST) - Get Free Report, Disney (DIS) - Get Free Report, Netflix (NFLX) - Get Free Report and Microsoft (MSFT) - Get Free Report.

Ramsey also believes, once a person is out of debt, that buying a home is a vital part of investing for retirement. About the only form of debt that Ramsey does not entirely oppose is that which involves equity on a house.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?