Goldman Sachs on 'correction watch' as stocks track CPI, Powell shift

A subtle shift at the Fed, a traditional August lull, and consumer-price inflation are in focus.

Federal Reserve Chairman Jerome Powell dropped a first-rate hint this week on the critical financial establishment's plans to complete the longest stretch of excessive fees of interest on file.

But it, the hint wasn't tied to the route of inflation pressures.

Stocks had been rising for many of the past 4 months, reserving a collection of file highs and lengthening the S&P five hundred's year-to-date gather to around 17%. The heady returns had been developed on the back of outsized beneficial properties for megacap tech names, bettering corporate cash, and bets on an autumn Fed rate cut.

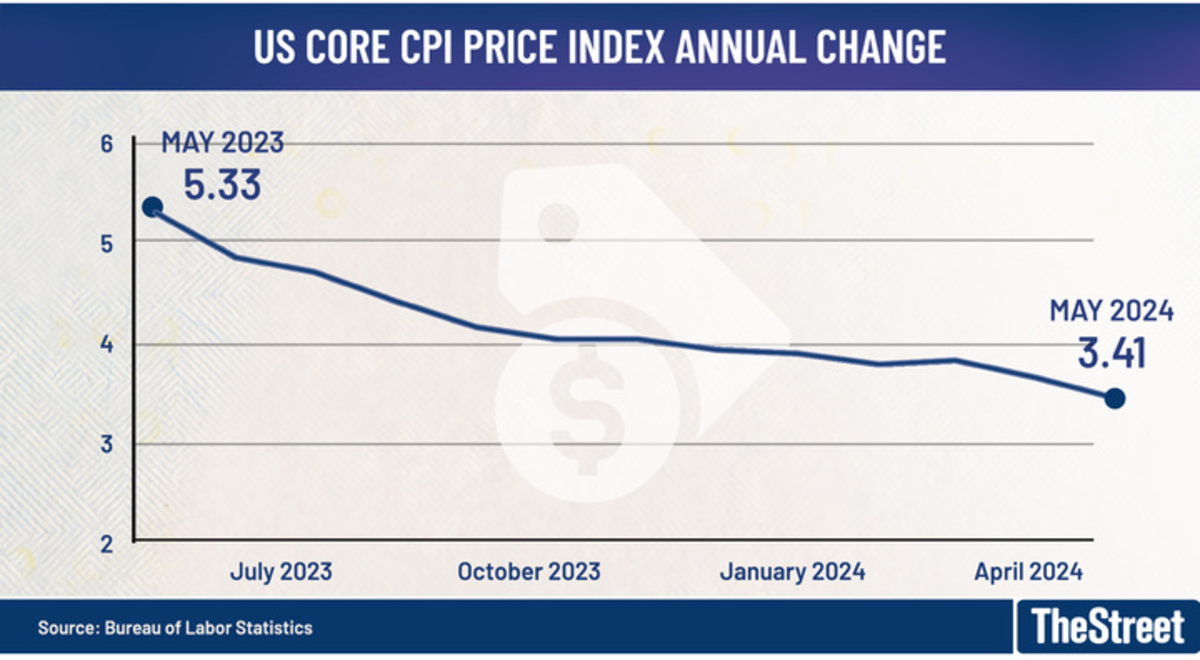

In an inflation strive against that began out hastily after costs spiked inside the postpandemic technologies, the Fed lifted its benchmark lending rate to a 22-year excessive of around 5.375%. Its closing hike change into very nearly a year ago when headline inflation ran at an annual rate of 3.2%. Bureau of Labor Statistics

On the grounds that then, inflation pressures have remained frustratingly challenging to tame or predict. They rose as excessive as 3.7% in November and fell to as low as 3.1% in January, tallies that in each and every instances remain neatly north of the Fed's wellknown purpose of 2%.

On July 11 economists take note of the Commerce Division's June Customer Rate Index discovering to expose headline CPI inflation rose at an annual rate of 3.1%, which seriously simply is never from now on terribly unimaginable from closing year's stage. Core costs are estimated at an annual rate of 3.4%, roughly where they had been in May. Getty

That may likely no longer be adequate for the Fed to signal a as regards to-term rate cut, specifically eager about it truly is warned about so-additionally called inflationary base effects which are likely to furnish modestly better readings over the 2d 1/2.

The Fed's subtle shift from inflation focus

But it Fed Chairman Jerome Powell has then over as soon as as soon as more subtly shifted the market's focus from the stubbornly sticky inflation readings to the newest weak aspect inside the job market, suggesting that this could likely be the substantive thing to unlocking the critical financial establishment's subsequent rate go.

“Elevated inflation seriously simply is never from now on the entirely threat we face,” Powell informed lawmakers on the Senate Banking Committee Tuesday as part of his semiannual testimony on Capitol Hill.

“The slicing-part small print exhibit that labor-market stipulations have now cooled drastically from where they had been two years ago," he introduced. "And I wouldn’t have outlined that except the closing few readings.”

Necessary: Pinnacle Wall Road analyst problems stark warning for stocks

On its face, it truly is challenging to appear where that weak aspect comes from: The Labor Division said closing week that around 206,000 new hires had been introduced to the economy closing month, a way more desirable-than-anticipated final result that lifted the 2024 complete to around 1.4 million.

But it, revisions to prior-month tallies took around 111,000 jobs back, according to Labor market figures, and the headline unemployment rate nudged past 4% for the massive time in better than two years.

Two-sided risks face the economy

Broader financial boom is likewise slowing, with the Atlanta Fed's GDPNow gear suggesting a 2d-quarter tempo of around 1.5%, simply barely formerly of the 1.3% gather recorded over the year's first three months.

Attentive to that slowdown, Powell informed lawmakers that the economy faces "two-sided risks," each and every of which are tied to Fed substitute-making.

"If we loosen protection too late or too little, we should harm financial task," Powell outlined. "If we loosen protection an excessive extent of or too swiftly, then we should undermine the development on inflation. So we’re very a lot balancing these two risks."

Necessary: Analyst revamps S&P five hundred purpose formerly of CPI inflation report

That likely puts the following round of job market small print, inclusive of the June Jolts report, the July nonfarm-payrolls replace, and commercial agency layoff figures from Challenger Gray, in sharp focus and leaves inflation readings secondary over the drawing near months.

"After two years of specializing in inflation, the Fed is speakme more about the labor market and has talked about that any awesome labor market weak aspect should immediate them to cut swifter," outlined Lauren Goodwin, economist and chief market strategist at New York Existence Investments.

"(But it) what we’re seeing at this time seriously simply is never from now on an amazing weak aspect inside the labor market – the total lot is still great," she introduced. "We agree with the earliest the Fed can cut is in September, and we agree with the Fed will likely be attentive to explanations to make the pivot at that time."

The Fed's Jackson Gap meeting may likely be key

The Fed will meet on July 31 in Washington to unveil its slicing-part interest rate substitute. Few, if any, market participants take note of a metamorphosis inside the contemporary day Federal Funds Rate, which sits between 5.25% and 5.5%.

But it, Powell's subsequent predominant tournament should furnish the market's clearest signal for a rate go in September, upon which CME Crew's FedWatch areas a Seventy 4% opportunity of 1 / 4-aspect reduction.

The Fed chairman will give his keynote address at the critical financial establishment's annual financial discussion board in Jackson Gap, Wyo., on Aug. 22. Powell will then be armed with deeper jobs small print and the July PCE inflation report.

"We still take note of the Fed already has waited too long and swiftly will likely be dashing to supply up a first-rate downturn," outlined Ian Shepherdson of Pantheon Macroeconomics. "We take note of a clear signal from the chair at the Jackson Gap symposium in late August that fees should be diminished at the very least as soon as this year."

More Fiscal Evaluation:

- June jobs report bolsters bets on an autumn Fed interest rate cut

- Biden debate flop boosts Trump, on the decision hand economy will likely be more challenging opponent

- First-1/2 market beneficial properties embody a dash of investor unease

In order to still likely disappoint markets, eager about merchants are forecasting at the very least two cuts this year, alongside with a host of as good cut rate fees in 2025. The cuts would lend a hand the rally in stocks and vitality the S&P five hundred nearer to the 6,000-aspect mark.

Goldman Sachs analysts revamp outlook

It go away the inventory market on what Goldman Sachs's Scott Rubner calls "correction watch" after the 36 file highs that the S&P five hundred has produced this year.

Noting that August equity-market flows are ad infinitum the slowest of the year and that markets have historically retreated from mid-July highs, Rubner argued in a take note of posted this week that he is modeling for a "late summer equity market correction" if cash disappoint and traders begin out to pay attention on the autumn election consequences.

Step-by-step, a correction is described as a decline of at the very least 10%.

LSEG small print suggestions collective 2d-quarter cash for the S&P five hundred are likely to expose a ten.1% upward push from the year-formerly period to a share-weighted $492.eight billion, a tally about $5 billion cut than formerly forecasts.

For the total of the year, analysts see cash rising 10.6%, with a as good 14.5% gather in 2025.

“The discomfort commerce has shifted from the upside to the recoil,” Rubner outlined. “The purchasers are full and running out of ammo after the specific trading days of the year are kind of characteristically in the back of us.”

Necessary: Veteran fund manager sees world of discomfort coming for stocks

What's Your Reaction?