Jensen Huang just changed Nvidia: Here’s what you need to know

Nvidia surpassed expectations again, but this time it's not about the beat. The chipmaker made $57 billion in sales and had a gross margin of 73.6%. This is the ninth quarter in a row in which it has done better than expected. But CEO Jensen Huang thinks the true narrative isn't about how much ...

Nvidia surpassed expectations again, but this time it's not about the beat.

The chipmaker made $57 billion in sales and had a gross margin of 73.6%. This is the ninth quarter in a row in which it has done better than expected.

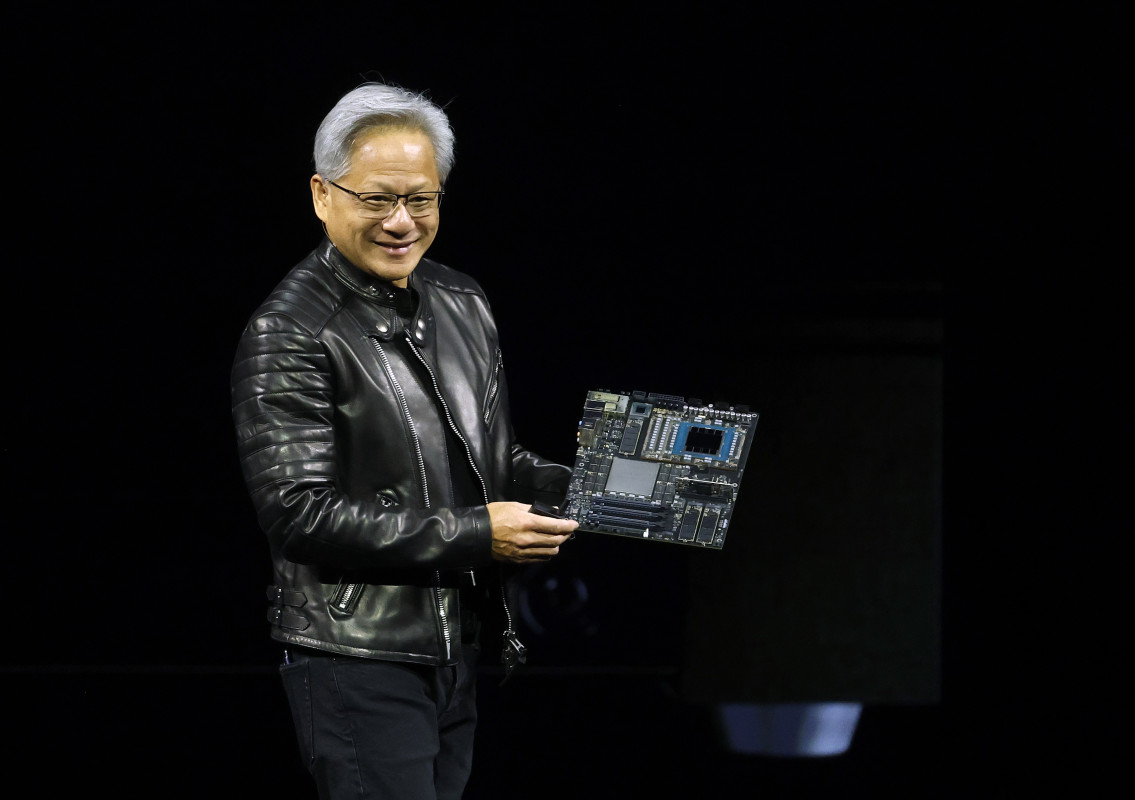

But CEO Jensen Huang thinks the true narrative isn't about how much money Nvidia makes. It's a matter of infrastructure and whether it can continue turning power into profits at a 75% clip.

What was more important was how CEO Jensen Huang characterized the company's future.

Huang said it plainly:

He does not see Nvidia as a semiconductor firm, but as an infrastructure utility that turns power into tokens, intelligence, and money.

"The clouds are sold out," he added, noting that all of Blackwell, Hopper, and Ampere's GPUs are in use. Management said it is attempting to maintain the mid-70s through fiscal 2027 and aims for a 75% gross margin next quarter.

The premium multiple stays the same if Nvidia can protect that margin band. The narrative changes quickly if it breaks. Photo by Justin Sullivan on Getty Images

Nvidia beat the street again, but this one number matters most

- Revenue:$57 billion, up 62% year over year and 22% from Q2

- Data Center: $51 billion, up 66% year over year

- Q4 Revenue Guidance: $65 billion ±2%

- Gross Margin: 73.6% (non-GAAP); guided to ~75% next quarter

Why Nvidia’s business now looks more like a utility than a chipmaker

The critical factor isn't only beating sales targets. Nvidia is going deeper into every data center and rack.

It's more than just a provider; it's a platform with its own networking (NVLink, InfiniBand, Spectrum) and CUDA software stack. That integration affords it pricing power and, more critically, protection for its margins.

Related: Microsoft’s $80B AI shift: What it does to your money

The true test has already begun. Inventory was up 32% from one quarter to the next. Supply commitments rose 63%.

That means Nvidia thinks it can keep its margins without having to lower prices on its most essential products, which is good news for investors.

Here’s what could mess with Nvidia’s hot streak

Huang remarked that electricity and permission are "easy" problems to tackle. But if installations can't keep up with orders, inventory will grow faster than sales, and margins will fall.

Another worry is the cost of inputs. Memory, parts, and system builds are still going up. Nvidia won't be able to hold the line if those expenses exceed its mix and software benefits.

Related: Wait until you see what Nvidia just did to your money

The corporation is also counting on a seamless transfer from Blackwell to Rubin. The narrative also falls apart if Rubin does.

There is always a danger with bespoke chips from hyperscalers. But Huang's answer is easy: Nvidia executes every model of AI in every cloud and in every step. That range could still be its moat.

Related: Three billionaires just issued a shocking Nvidia warning

Forget the whispers about revenue. The most important thing right now is whether Nvidia meets its gross margin target.

Investors should also see whether networking is growing faster than the main business. It's the part of the rack that sticks out the most and makes the most money.

And keep an eye on the stock. The plot changes if it builds up without money coming in.

Own Nvidia? This is the line you don’t want it to cross

If you own Nvidia, the following quarter's gross margin is your line in the sand. The business argues it can sustain revenue even if it has to invest a lot of money to launch new products and create infrastructure.

That's the type of signal that might support a high multiple and reward those who hang on to their stocks for a long time. But if the margin goes down, this might turn into a momentum trade with less room to fall.

More Nvidia:

- Nvidia makes a major push for quantum computing

- Nvidia’s next big thing could be flying cars

- Bank of America revamps Nvidia stock price after meeting with CFO

Nvidia is still the best company for anybody who wants to go into AI.

But you're not simply betting on demand. You're wagering that Jensen Huang can keep prices high and grow without losing quality.

Keep an eye on the edges. They'll tell you more than any new product release.

What if Nvidia misses that 75% margin target?

This is how the story may go for investors, depending on how the next quarter goes:

- Nvidia's potential multiple is 50 to 60x if the margin maintains over 75%. In the "AI infrastructure leader" bracket, the stock is expected to progress higher.

- When the margin drops below 73%, the market may suffer mix or price pressure. Value might tumble to 45–50 times projected earnings. Share price risk: 10% to 20% drop.

- If the margin falls below 70%, rivals, increasing costs, and overcapacity become concerns. The stock may decline more than 25% with a fresh rating.

For those who plan to hang onto their stocks for a long time, the most important thing isn't that Nvidia achieved its sales target; it's whether the company can still improve its margins.

Nvidia’s margin is more than a stat: It’s the stock’s safety net

Jensen Huang is changing what Nvidia represents. It doesn't create chips. Rather, it's a powerhouse for AI infrastructure that turns megawatts into money-making intelligence.

The stock's multiple is secure and probably going up if it stays over the 75% gross margin barrier. But confidence goes down when margins break. The band is now more important than the rhythm.

Related: Palantir fans: You’re not going to like what just happened

What's Your Reaction?