Morgan Stanley reveals top stock picks, including Nvidia

The S&P 500 has climbed 17% year to date.

Now may no longer be the identical time to focus on for stocks, with the S&P five hundred buying and selling within 2% of its July sixteen doc extreme.

Valuations are stretched. The S&P five hundred’s forward rate-income ratio used to be 21 as of Aug. sixteen, good above its five-yr general of 19.4 and its 10-yr general of 17.9, in line with FactSet.

A whole lot of authorities, jointly with hedge fund supervisor Doug Kass and creator The Street Knowledgeable's Day after day Diary, feel we’re due for a correction.

To make particular, bulls say potent commercial company income will proceed to propel the market improved. Blended S&P five hundred income has registered whopping boom of 10.9% for the second quarter, in line with FactSet. Justin Sullivan/Getty Photography

The combo entails the 93% of S&P five hundred organizations that have advised income already and analyst forecasts for the remainder. Analysts mission a income increase of 5.2% for the third quarter, in line with FactSet.

In truth, it in aspect of fact is a methods prepared to’t harm to have some stocks to focus on for in principles on every celebration you settle upon the time is sweet.

Morgan Stanley put collectively a document of pinnacle inventory picks that can almost always characteristically be good in that regard.

Right the subsequent are five of their inventory picks, in alphabetical order, consisting of Morningstar’s review of every, in line with CNBC.

Morgan Stanley’s pinnacle inventory picks

Apple (AAPL)

Morningstar moat ranking: broad, that suggests it sees the corporate having competitive advantages to be capable to final in any case twenty years. Morningstar sincere magnitude estimate: $185. Thursday quote: $224.

Associated: Analysts review Apple inventory rate hit from Google antitrust ruling

“Now we have got faith Apple has cemented a chronic-time length role atop the patron electronics company with a you have gotten a wiser category ecosystem of tightly integrated hardware, tool application, and offerings,” wrote Morningstar analyst William Kerwin.

“We count number on potent income boom in fiscal 2025, as users amplify their iPhones to take profit of Apple’s generative synthetic intelligence capabilities.”

DraftKings (DKNG)

Morningstar moat: none, that suggests it sees no sustainable competitive profit. Morningstar sincere magnitude estimate: $47. Thursday quote: $35.30.

Associated: Analysts alter DraftKings inventory rate target following income

“DraftKings has elevated its considerable day to day myth figure out routines role, first neatly-conventional in 2012, into concept about between the very meaningful head positions within the North American figure out routines making of venture and iGaming market,” wrote Morningstar analyst Doug Wasiolek. And it’s a increasing market.

“Workout routines making of venture and iGaming are presently legal in round forty and seven states, respectively. And we count number on the diverse handful to be extra to every market within the subsequent few years.”

Eli Lilly (LLY)

Morningstar moat ranking: broad. Morningstar sincere magnitude estimate: $580. Thursday quote: $953.

You’ve characteristically heard of Lilly’s blockbuster drug for diabetes/weight loss: Mounjaro/Zepbound. (It’s one drug with two names).

Associated: Goldman Sachs spots most great inventory-buying and selling danger

“Eli Lilly's progressive tradition and potent financial dedication to increasing the subsequent know-how of medicinal drug set the corporate along with its neighbors and gasoline its long-time length boom,” wrote Morningstar analyst Damien Conover.

“Lilly holds company-considerable boom potential, because the corporate is launching a ramification new blockbusters and patent losses are fading.”

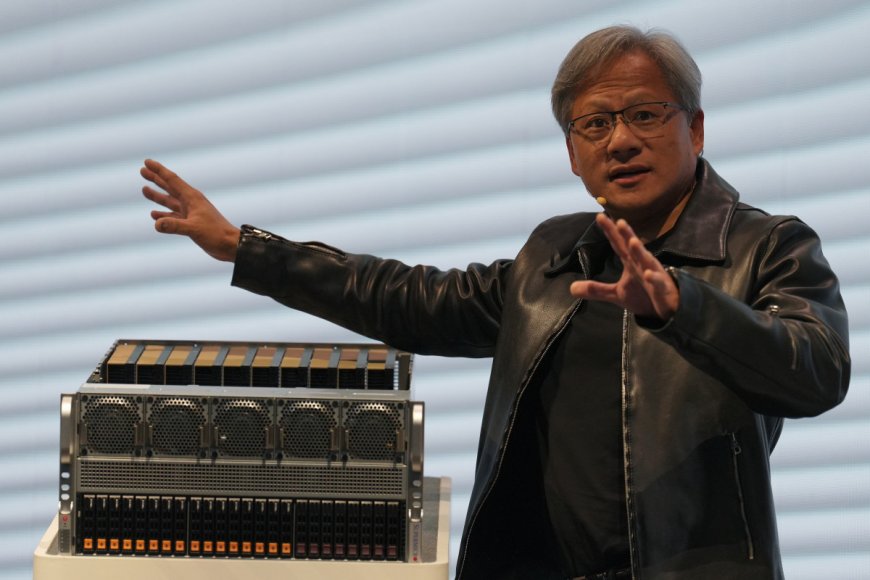

Silicon chips and potato chips

Nvidia (NVDA)

Morningstar moat ranking: broad. Morningstar sincere magnitude estimate: $105. Thursday quote: $124.

Associated: Analyst resets Nvidia inventory rate target previous income

Now now not fantastically, Morningstar analyst Brian Colello likes the corporate for its “market administration in images processing gadgets.”

Those are hardware and tool application methods wanted to enable the “exponentially increasing market round synthetic intelligence,” he brought up.

“As a outcome, we count number on tech titans to try to to find second-sources or in-home solutions to diversify faraway from Nvidia in AI. On the determination hand most seemingly these efforts … won’t supplant, Nvidia’s AI dominance.”

PepsiCo (PEP)

Morningstar moat ranking: broad. Morningstar sincere magnitude estimate: $176. Thursday quote: $a hundred seventy five.

Fund Manager Interviews:

- Fund supervisor picks three best-of-breed stocks (together with Chevron)

- Fund supervisor picks three blue chip stocks

- $10 billion fund supervisor picks three most straightforward stocks

“Following years of anemic boom resulting from operational missteps and underinvestment, administration has labored to good PepsiCo’s ship. We feel there's big room to head,” wrote Morningstar analyst Dan Su.

Going forward, Pepsi should income from:

- “secular tailwinds within the snack commercial,

- boom initiatives in p.c. out appealing beverage sub-classes (jointly with vigor drinks),

- enormously improved than a couple of emerging markets (jointly with Latin The United States, Africa, and Asia-Pacific), and

- an integrated commercial edition facilitating improved fine commercialization,” he brought up.

Turning to come again to the market as a entire, the remainder you do, proceed with caution. “Careful inventory resolution according to idiosyncratic causes is principally extreme within the edition of ecosystem,” Morgan Stanley brought up.

The creator of this story owns shares of Apple, Eli Lilly and PepsiCo.

Associated: Veteran fund supervisor sees world of pain coming for stocks

What's Your Reaction?