Nvidia is key to Nasdaq record as chip rival confirms AI hype

The Nasdaq has yet to follow it benchmark rivals to record highs this year. Nvidia could change that.

Wall Street hit a fresh all-time high again this week, with the S&P 500 coming within a whisker of the 5,000 point mark for the first time on record, powered partly by outsized gains for the market's biggest tech stocks.

The broadest measure of U.S. blue-chip shares has risen more than 21% since bottoming out in late October, confirming a solid bull market heading into the start of the year, powered by the end of the Federal Reserve's rate-hiking cycle, stronger-than-expected fourth-quarter earnings, and a surprisingly resilient domestic economy.

Yet despite the meteoric gains for the so-called Magnificent 7 mega stocks, which delivered the lion's share of the S&P 500's impressive early-year rally, the tech-focused Nasdaq is still some 1.5% from its all-time high reached in November 2021.

"This year’s Mag 7 performance looks much different than last year. For example, the equal weight Mag 7 index was outperforming the S&P 500 by 23% at this time last year, compared to this year’s roughly 5% year-to-date delta over the broader market," said LPL Financial's chief technical strategist, Adam Turnquist.

He also notes that Amazon, Meta Platforms, Microsoft, and NVIDIA (NVDA) have contributed to nearly 75% of the S&P 500’s total return this year, "more than double the contributions from the top four stocks during this time last year."

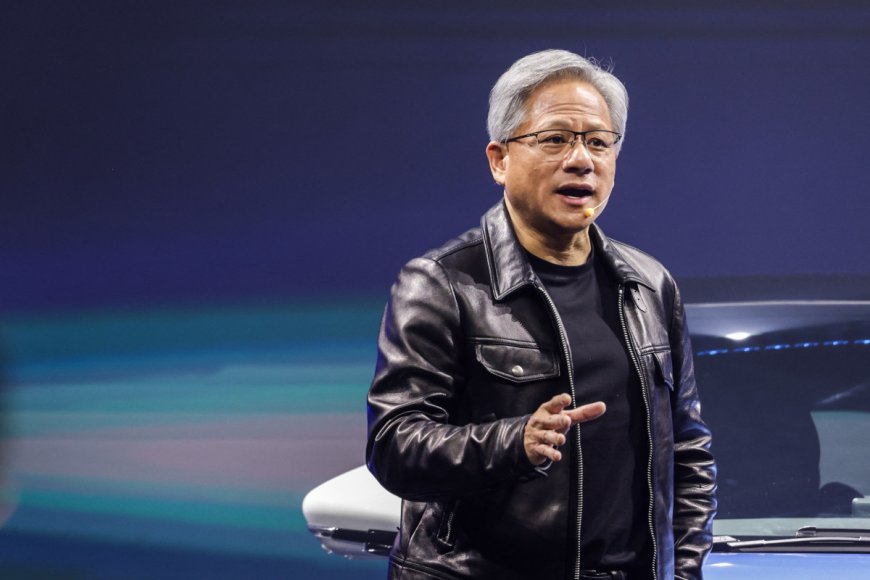

With nearly all of those companies having reported December quarter earnings over the past two weeks, the Nasdaq's push for a fresh record high to match the S&P 500 and the Dow Jones Industrial Average could rely on the final Magnificent 7 update of the season. TheStreet/Shutterstock/Slaven Vlasic/Stringer/Getty Images

Nvidia earnings could trigger record highs

Nvidia, the world's biggest AI chipmaker with a hammerlock on market share in the tech sector's most significant development since the birth of the internet three decades ago, will publish its fourth-quarter earnings on Feb. 21.

Its prospects for another market-moving update were given a shot in the arm, so to speak, from a blowout performance from Arm Holdings, the chip design group owned by Japan's SoftBank, which was listed on the Nasdaq in September of last year.

Arm Holdings, which designs chipmaking blueprints and earns the bulk of its revenue from royalty payments, also sells semiconductors that support Nvidia's AI-focused data center chips.

Related: Analysts revamp Palantir stock price targets on new AI outlook

The Cambridge, U.K.-based group said fiscal 2024 revenues would grow 19% to around $3.1 billion with a big bump in earnings, which it sees rising to $1.22 per share.

The stock soared more than 47% into the close of trading Thursday, the biggest one-day since the September IPO and a move that added nearly $50 billion to its market value.

"ARM posted strong F3Q (Dec) results and F4Q (Mar) guidance, which were both well above expectations. The upside was mainly driven by an increase in Armv9 [architecture used for an array of smartphone and consumer products chips] ... additional growth drivers were improving smartphone demand, China, a broader recovery in semis, and share gains in auto and cloud," said KeyBanc Capital Markets analyst John Vinh.

AI hype story gets a shot in the Arm

But Arm's robust outlook was also tied partly to AI demand and will only add more upside potential for Nvidia when it posts earnings and a near-term outlook later this month.

Nvidia was one of Arm's biggest financial supporters heading into the September IPO and tried to buy the group in 2022 before being thwarted by regulators in the U.K. who were concerned the $40 billion deal would stifle competition.

Analysts see the group posting revenues of around $20.2 billion for the three months ending in December, a more than three-fold increase from a year earlier

The stock is up an astonishing 45.1% for the year, having more than tripled its market value over the past twelve months to around $1.73 trillion, and may need to significantly outperform Wall Street in order to move another leg higher and drive the Nasdaq to a new record high.

Related: Analyst reveals new Nvidia stock price target on revamped AI outlook

Goldman Sachs analyst Toshiya Hari, who added Nvidia stock to the investment bank's conviction buy list earlier this week, sees the potential for a 3% to 5% beat on both fourth-quarter revenues and the current-quarter outlook "mainly due to incremental supply gains offset by China restrictions and some transition effects prior to [the] B100 accelerator launch."

Nvidia will launch the next-generation B100 Blackwell in its AI-focused lineup later this year, adding more heft to its revenue prospects and easing some supply chain issues tied to its H100 benchmark.

More AI Stocks:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- AI stock soars on new guidance (it's not Nvidia!)

- Big tech stocks are doubling down on AI

"We believe Nvidia will remain the industry gold standard for the foreseeable future given its robust hardware and software offerings, and the pace at which it continues to innovate," Hari wrote in a recent client note that boosted his Nvidia price target to $800 per share.

And with Nvidia representing around a 5% weight for the Nasdaq 100, the fourth-highest of the index, even a modest upside move could have an outsized influence.

"We believe the key narrative for 4Q earnings season is the beginning of the AI Revolution hitting the shores of the broader tech landscape being led by (CEO Satya Nadella and Microsoft along with the Godfather of AI (CEO Jensen Huang) and Nvidia," said Wedbush analyst Dan Ives.

"If (business) customers wait to green light AI deployments, they go to the back of the line given the chip/ GPU shortages forming around AI with Nvidia the only game in town," he added.

And if they speed up spending, that might send Nvidia and the Nasdaq to the top of the heap.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?