Stock Market Today: Stocks edge higher on soft-landing bets, Treasury bond rally

Improving service sector activity and a healthily cooling job market are adding to bets on a 'soft landing' for the U.S. economy that could power stocks higher over the coming months.

Check back for live updates throughout the trading day.

U.S. equity futures bumped higher Wednesday, building on yesterday's sharp pullback in Treasury yields, as investors continue to bet that the Federal Reserve will be able to execute a so-called 'soft landing' for the world's biggest economy by taming inflation while avoid recession.

Updated at 8:24 AM EST

Workin' for a livin'

Payroll processing group ADP published its National Employment Report for the month of November, which showed a net gain of 103,000 new private sector jobs that fell just shy of the Street's 130,000 forecast.

Chief economist Nela Richardson said the hiring trends, as well as slowing pay increases, "suggests the economy as a whole will see more moderate hiring and wage growth in 2024."

Stocks were little-changed following the data release, with futures contracts tied to the S&P 500 indicating and 10 point gain, while benchmark 10-year note yields eased to 4.173%.

Updated at 8:02 AM EST

A little help from the bonds

U.S. mortgage rates fell another 20 basis points last week, to the lowest levels since late August, amid one of the biggest Treasury market rallies on record that could provide an important boost to home affordability heading into next year.

Related: Mortgage rates tumble as bond markets see lower Fed rates by early spring

Updated at 7:35 AM EST

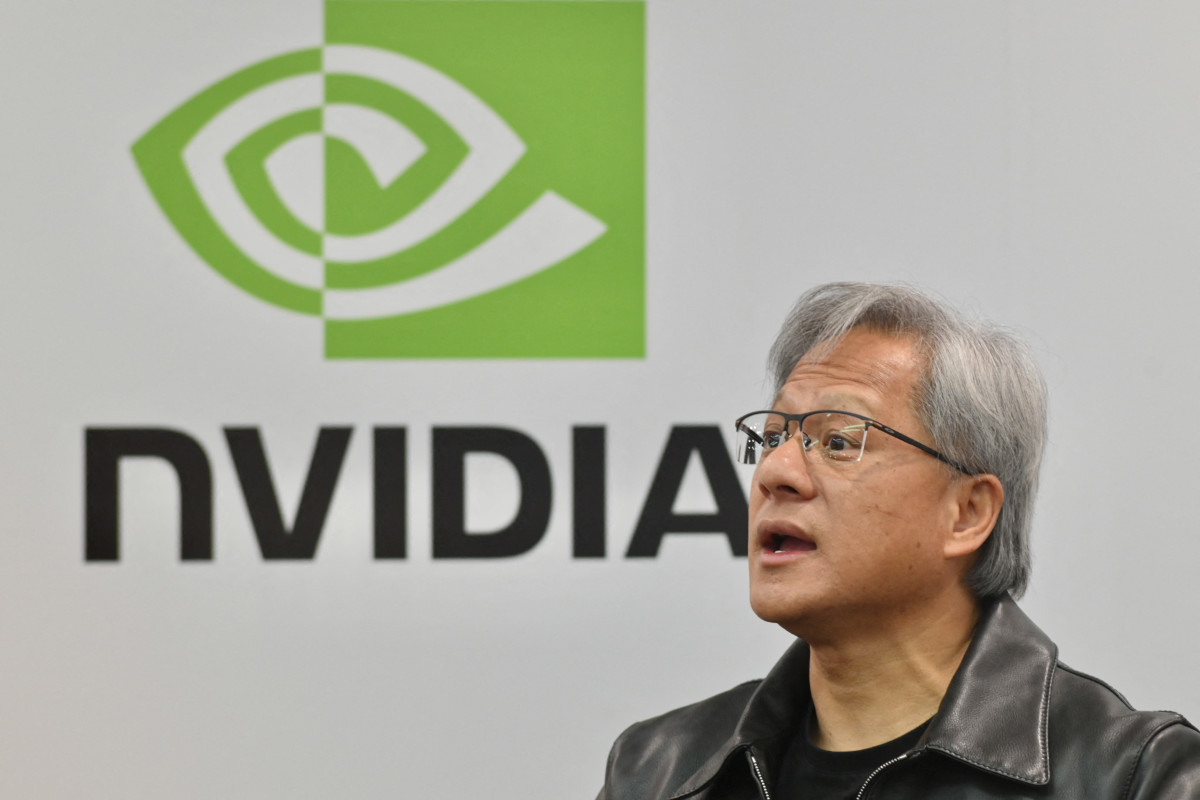

Chip detente

Nvidia (NVDA) - Get Free Report shares are edging higher in pre-market trading after CEO Jensen Huang told an event in Singapore that the chipmaker is working with the U.S. government to build an AI-focused semiconductor it can sell to customers in China.

Related: Nvidia higher as CEO is working with U.S. to meet China AI-export rules

Stock Market Today

Stocks were mixed throughout most of the Tuesday session, with the Nasdaq ending modestly higher by the close of trading, as benchmark 10-year Treasury note yields fell to the lowest levels since early September following softening jobs data and solid reading of November services activity.

The Labor Department's October Jolts report showed a big decline in open positions, to the lowest levels since March of 2021, while the final reading of the ISM services-sector survey showed modest improvement in the biggest driver of U.S. growth over the month of November.

Both readings added to bets that the economy is cooling enough to slow inflation but not to the point where it slips into recession over the coming months.

Stocks are starting to reflect that view heading into the final trading weeks of the year. That's particularly with respect to the market's key volatility gauge, CBOE Group's VIX index, which is holding near five-year lows, last trading at 12.83 in the overnight session.

At that level, traders are expecting daily swings of around 0.79%, or 36 points, for the S&P 500 over the next 30 days, down from around 57 points in late October.

Global oil prices are also slipping lower, despite efforts from Saudi Arabia and other OPEC members to talk up the efficacy of their recent production cuts, as looming recessions in Europe and a fading recovery in China add to mounting demand concerns in the coming year.

Brent crude contracts for February delivery were marked 51 cents lower in the early New York session at $76.71 per barrel while WTI contacts for January fell 54 cents to a near five-month low of $71.78 per barrel, helping U.S. gasoline prices fall to $3.216 per gallon, according to AAA data.

On Wall Street, stocks are looking at a modestly positive start to the session ahead of ADP's National Employment report prior to the opening bell. Futures contracts tied to the S&P 500 indicate a 7 point gain and those linked to the Dow Jones Industrial Average are priced for a 50 point advance.

The tech-focused Nasdaq, meanwhile, is called 35 points higher thanks in part to premarket gains for Nvidia (NVDA) - Get Free Report and Tesla (TSLA) - Get Free Report.

In overseas markets, Europe's Stoxx 600 was marked 0.3% higher in early Frankfurt trading. The euro slipped to 1.0786 against the U.S. dollar on renewed European Central Bank rate cut bets, which helped Germany's DAX index hit a fresh record 16,578.15 points at the start of trading.

Overnight in Asia, the regionwide MSCI ex-Japan benchmark rose 0.6% into the close of trading, thanks to a mixed rebound for stocks in China. Japan's Nikkei 225 ended the session 2.04% higher as the index rebounded from its biggest single-day decline in six weeks.

- Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.

What's Your Reaction?