Walmart Stock Has Been on Fire. Here's the Dip-Buying Opportunity.

Walmart stock has rallied in 11 of the past 12 sessions, creating a great buy-the-dip setup.

Retail stocks have been struggling -- but not Walmart (WMT) - Get Free Report.

The retail giant's shares are up in 11 of the past 12 trading sessions and finished higher in seven straight.

That streak may come to an end Friday, with the shares currently down almost 1% on the day. But a dip would be healthy as investors look to continue driving this name higher.

Don't Miss: SoFi Stock Has Doubled in a Month; Here's the Trade

The momentum has been recent since the post-earnings response from Walmart was not that encouraging. The shares rallied 1.3% on the day it reported, then fell in five straight days before finding a bottom.

While we’ve seen poor price action out of retail stocks lately, Walmart and Costco (COST) - Get Free Report have been trading much better.

Walmart in fact is fresh off 52-week highs, and that's got us looking for a buy-the-dip opportunity.

Trading Walmart Stock

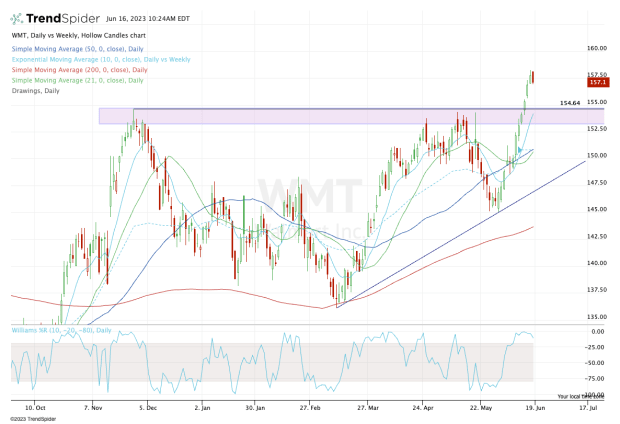

Chart courtesy of TrendSpider.com

The low- to mid-$150s has played a big role in Walmart’s price action for more than three years now. More recently though, the $154 to $155 zone has been stiff resistance.

This area rejected Walmart stock in the fourth quarter of 2022, as well as in the first and second quarters of 2023. With the stock’s recent win streak catapulting shares above this level now, the bulls are enjoying the breakout.

The key to keeping the breakout going? Trend support must come into play on the dips, and what had been resistance levels must turn into support.

Don't Miss: Alphabet Stock Lags in the FAANG Race. Can It Catch Up?

In this case, if the stock soon tests down into the $154 to $155 area, the bulls could have a decent buying opportunity at hand. That decent opportunity becomes an excellent opportunity if it aligns with the 10-day moving average.

In that scenario, the bulls can look to buy the dip and perhaps see a rebound back toward the $158 area. Above $158, and the all-time high up at $160.77 could be on the table.

On the downside, failure to hold support in the $154 to $155 area could put the 10-week, 21-day and 50-day moving averages in play. Currently those measures all come into play near $152.50.

For now, the bulls are in firm control of Walmart stock. Until that changes, a buy-the-dips approach could prove fruitful for traders.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

What's Your Reaction?