What Is Discretionary Income? Definition, Calculation & Importance

What Is Discretionary Income? A person’s discretionary income is what they have left over from their disposable income (i.e., income after taxes) after all necessities have been paid for. Common necessities include food, shelter, medicine, and clothing. In other words, discretionary income is what ...

What Is Discretionary Income?

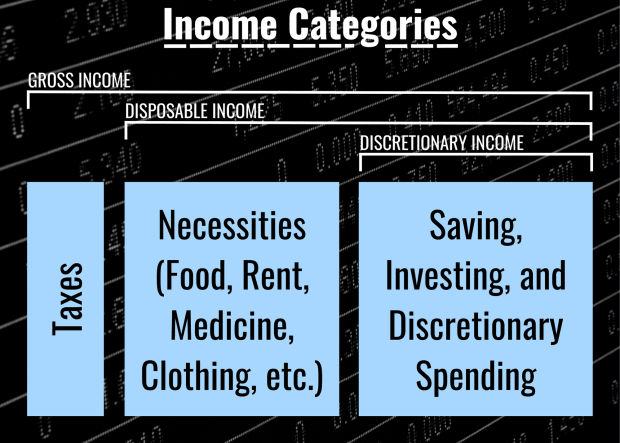

A person’s discretionary income is what they have left over from their disposable income (i.e., income after taxes) after all necessities have been paid for. Common necessities include food, shelter, medicine, and clothing.

In other words, discretionary income is what a person has left over to save or spend once they’ve paid their taxes and covered their material needs. Discretionary income is so called because it can be saved, invested, or spent at an individual’s discretion—they don’t need it to survive, so they can do with it as they please.

Some individuals spend their discretionary income on goods and services that they enjoy but that aren’t strictly necessary for their survival. Vacations, restaurant dinners, household decorations, streaming subscriptions, and recreational equipment all fall under the category of discretionary purchases. Others put their discretionary income into a savings account or invest it in securities like stocks, bonds, ETFs, or certificates of deposit. Most people do a mix of both.

How Is Discretionary Income Determined?

Discretionary income can be calculated by subtracting the cost of all necessities from an individual’s disposable income for a particular period. For instance, if someone makes $2,500 per month after taxes and spends $1,100 per month on necessities, their monthly discretionary income would be $1,400 ($2,500 – $1,100 = $1,400).

Discretionary Income Formula

Discretionary Income = Disposable Income – Cost of Necessities

Discretionary Income vs. Disposable Income: What’s the Difference?

Disposable refers to income after taxes and is also referred to as net income. You can think of your disposable income as your take-home pay if taxes are removed from your paychecks automatically.

Discretionary income, on the other hand, is what remains after necessities like rent, food, medicine, and transportation costs have been deducted from disposable income. Disposable income, therefore, includes discretionary income but is a broader category.

Why Is Discretionary Income Important on an Economic Scale?

Higher per-capita discretionary income is one indicator of a country or region’s overall economic health, so analysts pay attention to changes in average discretionary income over time. And because people often have less discretionary income during recessions, companies that sell discretionary goods and services (like luxuries and entertainment) tend to struggle more than companies that sell necessities (like food and drugs) during economic downturns.

Discretionary income is also important to economists because it is used in the calculation of the marginal propensity to consume (MPC) and the marginal propensity to save (MPS), two important indicators that can shed light on how extra money is used by people with different amounts of income.

Marginal propensity to consume is a measure of how much of each additional dollar of income is spent on goods and services, while marginal propensity to save is essentially the opposite—a measure of how much of each additional dollar of income is saved. As income increases, MPC usually decreases (and MPS usually increases). This is because those with higher incomes usually already have their basic needs met, so it is easier to save or invest any additional income they receive.

How Much Discretionary Income Does an Average American Have?

According to a 2018 article in The Motley Fool, the average level of discretionary income for U.S. households was $20,748 per year, or $1,729 per month.

According to a 2021 survey by The Balance, however, over half of Americans had $250 or less of discretionary income each month. It’s important to note, though, that the sample size of this survey was only 1,000, which amounted to only about 0.0003% of the country’s population at that time.

What's Your Reaction?