AMD sees big demand for 'Nvidia killer' chips but issues unexpected forecast

AMD is ramping production of its new 'Nvidia killer' AI chip, the MI300, to meet "accelerating demand."

Updated at 5:13 PM EST

Advanced Micro Devices (AMD) - Get Free Report posted fourth-quarter earnings that were largely in-line with analysts' forecasts Tuesday. However, it predicted a "strong product ramp" for its new AI chips into the coming year even as it issued a mute near-term sales forecast.

AMD's new MI300X, a graphics-processing unit designed to support generative artificial intelligence technologies, is expected to produce around $2 billion in sales over the coming year as the group leverages its new launch against Nvidia's ability to meet the global surge in demand.

AMD said non-GAAP earnings for the three months ending in December came in at 77 cents per share, an 11.5% increase from the same period in 2022 that matched Street forecasts. Group revenues, AMD said, rose 10.1% to $6.168 billion, just ahead of analysts' forecasts of a $6.12 billion tally.

Data center revenues, including the group's suite of new AI-focused chips, rose 38% to $2.3 billion.

Gaming sector revenue was down 17% from a year ago to $1.4 billion, while data center was flat at $1.6 billion. The client segment, which includes personal computing, saw a 62% revenue surge to $1.5 billion, while embedded segment revenues fell 5% to $1.2 billion.

In the coming year, AMD said it sees first-quarter revenue in the region of $5.4 billion, plus or minus $300 million, with gross margins of around 52%. LSEG forecasts had the third quarter revenue forecast at $5.7 billion.

When compared to the previous quarter, AMD said data center revenues to be flat, with a "seasonal decline in server sales offset by a strong Data Center GPU ramp."

'Accelerating' demand for new AI chips

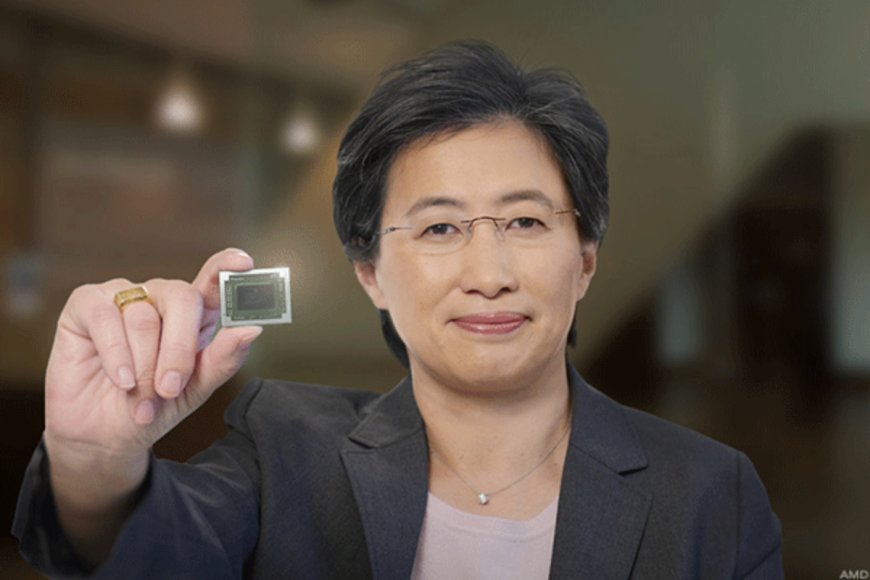

“We finished 2023 strong, with sequential and year-over-year revenue and earnings growth driven by record quarterly AMD Instinct GPU and EPYC CPU sales and higher AMD Ryzen processor sales,” said CEO Lisa Su. “Demand for our high-performance data center product portfolio continues to accelerate, positioning us well to deliver strong annual growth in what is an incredibly exciting time as AI re-shapes virtually every part of the computing market.”

AMD shares were marked 5.6% lower in after-hours trading immediately following the earnings release to indicate a Wednesday opening bell price of $162.50 each.

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it's not Nvidia!)

AMD's new MI300X chip, the new AI-focused GPU that looks to challenge Nvidia's (NVDA) - Get Free Report market dominance, as well as the broader family of MI300 semis, are expected to see sales of more than $2 billion over the whole of 2024.

Tech analysts say AMD's MI300X carries more memory with speed than Nvidia's top-selling H100.

Nvidia's massive order backlog could also give AMD an advantage in early sales, as it can meet client needs in the near term, while Nvidia is focused on producing and delivering chips purchased last year.

“AMD executed well in 2023 despite a mixed demand environment,” said CFO Jean Hu. “We drove year-over-year revenue growth in our Data Center and Embedded segments and successfully launched our AMD Instinct MI300 GPUs, positioning us for a strong product ramp in 2024.”

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?