Analyst resets Nvidia stock price target before earnings

Nvidia’s earnings report next week will be the weather vane of the AI industry.

Nvidia stock (NVDA) investors saw a roller-coaster ride upfront of its Q2 cash liberate in August. Its share rate dropped below $100 on August 5, rebounded, and went up for six consecutive days from the twelfth to the 19th. Nvidia traded at around $128 on August 21.

Nvidia’s early-month plunge became partly ensuing from world market turmoil after the yen-carry alternate and a manageable chip transport prolong ensuing from a design flaw within the Blackwell constitution.

The chip genuinely significant stays the AI industrial chief, with an Eighty% market share in AI processors. In spite of competitors like AMD are making a selection on up the percent.

On August 19, AMD launched a 5 billion acquisition of ZT Programs to beef up its GPU earnings. Nvidia stock lost 2% on the next trading day. GPUs are hardware specialised in performing the matrix calculations required by AI processing.

Great: Analysts reset AMD stock outlooks after AI acquisition

Nvidia will put up its fiscal Q2 cash on August 28. No matter the effects, they're going to mark a key weather vane for the AI and the semiconductor industrial. The cash reports from its peer chip makers may functional be an even reference for cash prediction and future stock rate movements.

The No. 2 market participant, AMD, delivered sturdy Q2 cash on July 30, exceeding analysts' expectations for every earnings and earnings. Cash rose 9% to $5.eighty four billion, whereas cash elevated by 19% to sixty 9 cents a share. It additionally sees amazing AI demand upfront.

In spite of Intel tumbled on an cash miss. On August 1, the industrial company urged a net loss of $1.sixty a thousand million, when compared with a net earnings of $1.48 billion a yr in the course of the past. Cash and cash had been additionally reduce than analysts’ forecasts.

Intel attributed the loss to a resolution to increased impulsively produce Core Absolutely PC chips that should specialise in AI workloads, per CEO Pat Gelsinger. Bloomberg/Getty %

What to count on after a report Q1 earnings

Nvidia urged report quarterly earnings of $26.zero billion for fiscal Q1 2025, up 18% from Q4 and 262% from a yr ago.

The AI genuinely significant anticipates Q2 FY25 earnings of $28 billion, with GAAP and non-GAAP gross margins projected at Seventy four.Eight% and Seventy five.5%, respectively. In distinction, Q2 FY24 urged earnings of $13.Fifty a thousand million, with GAAP and non-GAAP gross margins of 70.1% and seventy one.2%.

Great: Analysts reset targets for key Nvidia service supplier after cash

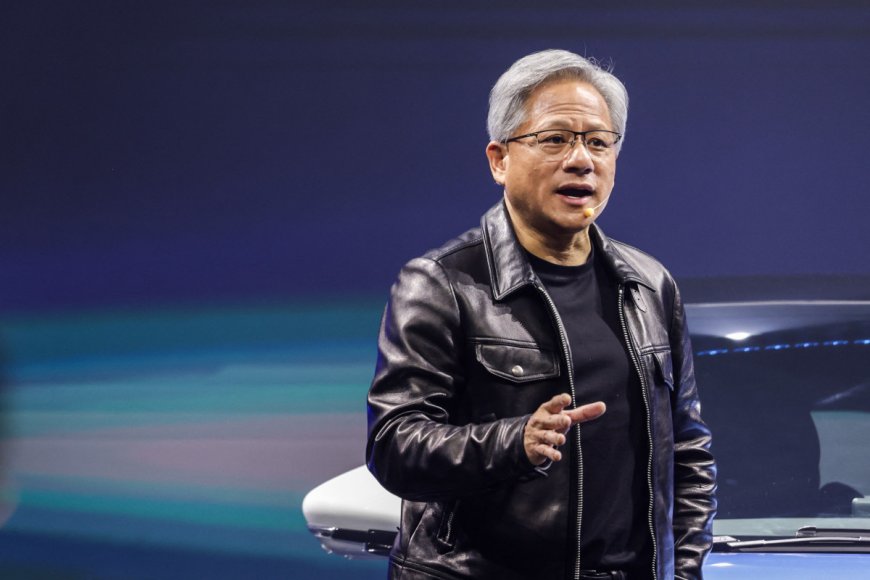

“The subsequent industrial revolution has begun — organizations and international locations are partnering with NVIDIA to shift the trillion-dollar general small print capabilities to accelerated computing and construct a new diversity of small print midsection — AI factories — to supply a new commodity: synthetic intelligence,” observed CEO Jensen Huang in Q1’s cash liberate, “We are poised for our subsequent wave of development.”

HSBC analyst raises Nvidia stock rate target beforehand cash

On August 21, HSBC analyst Frank Lee raised Nvidia’s rate target to $a hundred forty five from $135 and saved a buy order ranking.

The analyst sees persisted vigour for Nvidia pushed by underlying AI GPU demand, with “constrained impact on cash from any product roadmap prolong.”

“The 2025 AI hyperscaler capex type stays intact, together with underlying AI demand,” the analyst observed.

HSBC expects Nvidia’s Q2 earnings to be $30 billion, beating the industrial company’s e e-book and consensus estimates of $28 billion and $28.6 billion, respectively.

Extra AI Shares:

- Nvidia stock tumbles in tech slump amid questions over key chip

- Microsoft exec warns of an ongoing place

- Apple cash pinnacle forecasts, iPhone earnings slip upfront of AI launch

TheStreet additionally urged on August 19 that Goldman Sachs analyst Toshiya Hari reiterated a buy order ranking on Nvidia with a $135 target beforehand cash, citing sturdy demand and Nvidia's "amazing" competitive target.

“Even as the urged prolong in Blackwell should trigger off some on the subject of about-term volatility in fundamentals, management commentary, coupled with furnish chain small print add-ons over the coming weeks, should trigger off increased conviction in Nvidia's cash electrical energy in 2025,” the analyst observed in a glance for take into accout.

Great: Veteran fund manager sees world of suffering coming for stocks

What's Your Reaction?