Analysts focus on Nvidia ahead of key tech event

Here's what could happen next to Nvidia shares.

You can should wonder what Bob Galvin would possess considered Jetson Thor.

Galvin used to be the CEO of Motorola and attend in 1967, he used to be the kickoff speaker on the most famous Consumer Electronics Demonstrate in New York Metropolis.

Connected: Veteran fund manager delivers alarming S&P 500 forecast

The event used to be a by-product of the Chicago Track Demonstrate, which had been serving because the principle event for exhibiting user electronics.

The fundamental CES had 17,500 attenders and over 100 exhibitors on the Hilton and Americana resorts.

Pocket radios and TVs with built-in circuits had been among the many items on prove, as well to a flood of electronics from Eastern producers.

The event moved to Las Vegas in 1978 and has persisted to develop, with final Twelve months's CES pulling in over 138,000 attendees and bigger than 4,300 exhibitors.

CES 2025 is determined to spin from Jan. 7-10, with pre-prove events starting a day earlier.

"This is the place producers procure enterprise completed, meet new companions and the place the industry’s sharpest minds take the stage to unveil their most up-to-date releases and boldest leap forward," in accordance to the event's online web page. "Do now not be left in the past as we shape the lengthy spin." Shutterstock

Company sees tech shares surging in 2025

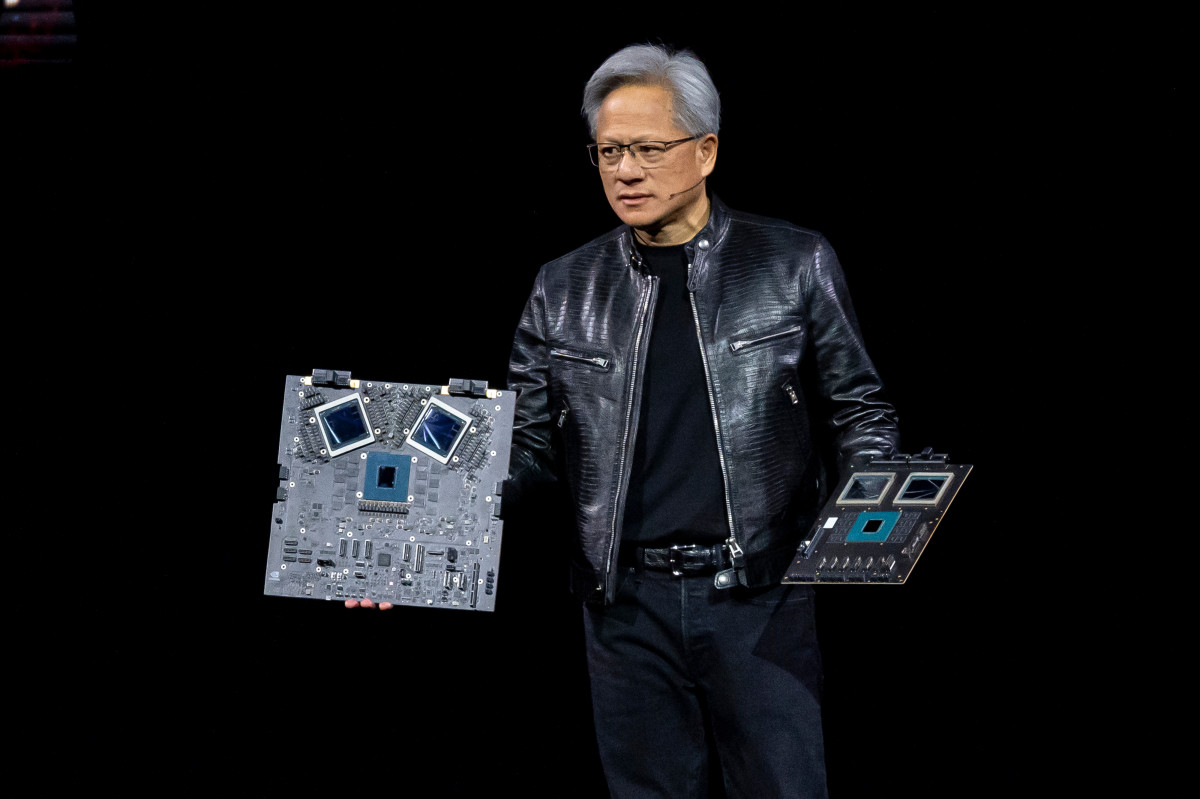

Jensen Huang, co-founder and CEO of man-made intelligence chipmaking Godzilla Nvidia (NVDA) is determined to present the gap keynote take care of on Jan. 6.

Nvidia used to be fingers down the greatest thing in tech in 2024.

More shares’ performance in 2024

- The 5 best performing shares on the Dow Jones Industrial Moderate in 2024

- The 5 worst-performing shares on the Dow Jones Industrial Moderate in 2024

- The 5 best performing shares on the Nasdaq 100 in 2024

- The 5 worst performing shares on the Nasdaq 100 in 2024

- The 5 best performing shares on the S&P 500 in 2024

- The 5 worst performing shares on the S&P 500 in 2024

The Santa Clara, Calif., company joined the Dow Jones Industrial Moderate on Nov. 8, replacing Intel (INTC) and used to be the Dow's top performer for the Twelve months, with shares rising 171%.

Nvidia reached a $3 trillion market cap and rapidly surpassed Apple (AAPL) as essentially the most priceless company on Earth before settling into the No. 2 residing.

Wedbush analysts no longer too lengthy in the past named Nvidia as one among its High 10 Tech Winners for the "AI Revolution" in 2025, alongside with Palantir (PLTR) , Tesla (TSLA) , Salesforce (CRM) , and Apple to name a pair of.

The firm said it believes tech shares will be tough in 2025 on the shoulders of the AI Revolution and $2 trillion-plus of incremental AI capital expenditures over the following three years, in accordance to The Cruise.

Wedbush expects tech shares to be up 25% in 2025 as Wall Boulevard extra digests a less regulatory spider web below incoming President Donald Trump and the times of Federal Alternate Rate Chair Lina Khan are in the rear-explore mirror.

Tech may also be boosted by stronger AI initiatives inside of the Beltway on the formulation, and a “goldilocks foundation” for Big Tech and Tesla attempting into 2025 and past, the firm said.

Put an impart to "some white-knuckle moments" in 2025 alongside the formulation on the heels of Fed worries, China tariff poker game, and stretched valuation chorus moments, Wedbush said.

Nonetheless, analysts maintain this may perchance procure the alternatives to dangle the tech theme and key names which has been its core investing tech playbook the final two years

Bank of The usa Securities analysts reiterated their aquire ranking on “sector top opt” Nvidia before CES.

Whereas stating that “the huge topics possess already been mentioned in the media before the event,” the firm serene sees CES as a particular catalyst that can re-pronounce Nvidia's "platform dominance" and opportunity in excessive-train markets, the firm said in a learn prove.

Analysts attempting to search out updates from Nvidia

At the event, the firm is attempting to search out updates on the company's robotics approach with Jetson Thor – a specialized laptop designed for powering refined humanoid robots – from silicon to gadget and emergence of a "bodily AI" theme.

Nvidia is anticipated to originate Jetson Thor in the most famous half of of 2025, and The Financial Events reported that "Nvidia is making a bet on robotics as its next big train driver, because the enviornment’s most priceless semiconductor company faces increasing opponents in its core synthetic intelligence chipmaking enterprise."

Connected: Nvidia stock faces new threat after China change

BofA, which has a $190 stock label arrangement on Nvidia, said it used to be also attempting to search out updates on the originate of RTX 50xx, Blackwell variants of PC gaming cards with enhanced "neural rendering" and sooner GDDR7 reminiscence.

Besides, the firm desires to hear more about a doable entry into AI PCs, which is seemingly by partnership or a "small: probability of a standalone PC CPU"; and an change on files middle including recent-gen Blackwell, upgraded variants and a teaser on next-gen Rubin AI chip platform due in calendar Twelve months 2026.

"We count on Nvidia to manufacture an spectacular push into robotics leveraging its kill-kill capabilities in silicon (Jetson processor chips) to gadget (former to simulate, disclose and spin AI models, Isaac robotics working gadget)," Wedbush said.

"On floor the leveraging of AI from the computing/effectivity (chatbots, co-pilots) to the bodily (sensors, robots) realm looks love the following logical step."

Nonetheless, the firm said that it sees a topic in making the products legitimate ample, cheap ample, and pervasive ample to spawn credible enterprise models.

"From that point of view, robotics may presumably remain one other cool but niche opportunity corresponding to metaverse or self ample vehicles," Wedbush said.

"So, while we develop no longer doubt Nvidia's capabilities, we're doubtful as to when and how immediate they can impact Nvidia's financials," the firm added.

Connected: Veteran fund manager delivers alarming S&P 500 forecast

What's Your Reaction?