Analysts reset Nvidia stock forecast ahead of major conference

Here's what could happen next to Nvidia shares.

Or no longer it's miles a should-should wonder what Bob Galvin would hang idea to be Jetson Thor.

Galvin used to be the CEO of Motorola and encourage in 1967, he used to be the kickoff speaker at the major User Electronics Sing in New York Metropolis.

Connected: Frail fund manager delivers alarming S&P 500 forecast

The tournament used to be a derivative of the Chicago Music Sing, which had been serving as the major tournament for exhibiting particular person electronics.

The first CES had 17,500 attendees and over 100 exhibitors at the Hilton and Americana hotels.

Pocket radios and TVs with built-in circuits had been among the many items on display veil, in addition to a flood of electronics from Japanese producers.

The tournament moved to Las Vegas in 1978 and has persisted to develop, with remaining 12 months's CES pulling in over 138,000 attendees and better than 4,300 exhibitors.

CES 2025 is blueprint to plug from Jan. 7-10, with pre-demonstrate events starting a day earlier.

"That is the build brands salvage commercial done, meet new partners and the build the alternate’s sharpest minds rob the stage to unveil their most modern releases and boldest leap forward," in response to the tournament's web blueprint. "Don't be left within the past as we form the future." Shutterstock

Company sees tech stocks surging in 2025

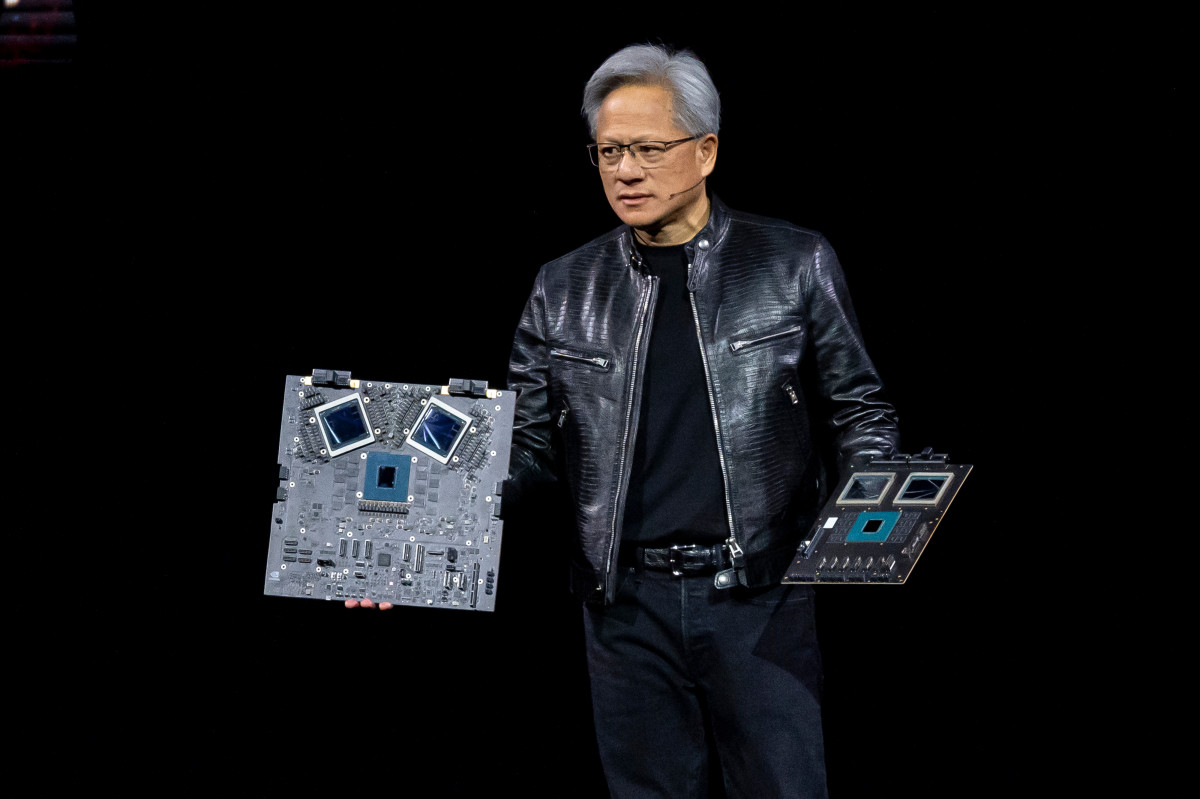

Jensen Huang, co-founder and CEO of synthetic intelligence chipmaking Godzilla Nvidia (NVDA) is blueprint to present the outlet keynote tackle on Jan. 6.

Nvidia used to be fingers down the smartest thing in tech in 2024.

Extra stocks’ efficiency in 2024

- The 5 best performing stocks on the Dow Jones Industrial Average in 2024

- The 5 worst-performing stocks on the Dow Jones Industrial Average in 2024

- The 5 best performing stocks on the Nasdaq 100 in 2024

- The 5 worst performing stocks on the Nasdaq 100 in 2024

- The 5 best performing stocks on the S&P 500 in 2024

- The 5 worst performing stocks on the S&P 500 in 2024

The Santa Clara, Calif., company joined the Dow Jones Industrial Average on Nov. 8, replacing Intel (INTC) and used to be the Dow's prime performer for the 12 months, with shares rising 171%.

Nvidia reached a $3 trillion market cap and temporarily surpassed Apple (AAPL) as the most beneficial company on Earth sooner than settling into the No. 2 dilemma.

Wedbush analysts no longer too long within the past named Nvidia one of its High 10 Tech Winners for the "AI Revolution" in 2025, alongside with Palantir (PLTR) , Tesla (TSLA) , Salesforce (CRM) , and Apple to name a couple of.

The company stated it believes tech stocks will be robust in 2025 on the shoulders of the AI Revolution and $2 trillion-plus of incremental AI capital expenditures over the subsequent three years, in response to The Soar.

Wedbush expects tech stocks to be up 25% in 2025 as Wall Avenue additional digests a less regulatory spider web below incoming President Donald Trump and the days of Federal Alternate Payment Chair Lina Khan are within the rear-look replicate.

Connected: Frail trader who as it will be picked Palantir as prime stock in 2024 reveals best stock for 2025

Tech may also be boosted by stronger AI initiatives for the interval of the Beltway on the manner, and a “goldilocks foundation” for Big Tech and Tesla having a spy into 2025 and beyond, the company stated.

Quiz "some white-knuckle moments" in 2025 alongside the manner on the heels of Fed worries, China tariff poker sport, and stretched valuation chorus moments, Wedbush stated.

On the opposite hand, analysts think this can make alternatives to own the tech theme and key names, which has been its core investing tech playbook for the rest two years

Bank of The United States Securities analysts reiterated their aquire ranking on “sector prime select” Nvidia prior to CES.

While citing that “the huge topics hang already been mentioned within the media prior to the tournament,” the company aloof sees CES as a obvious catalyst that can re-converse Nvidia's "platform dominance" and opportunity in excessive-growth markets, the company stated in a analysis display veil.

Analysts shopping for updates from Nvidia

At the tournament, the company is shopping for updates on the company's robotics strategy with Jetson Thor – a no doubt expert pc designed for powering sophisticated humanoid robots – from silicon to instrument and emergence of a "bodily AI" theme.

Nvidia is anticipated to originate Jetson Thor within the major half of 2025, and The Monetary Times reported that "Nvidia is having a guess on robotics as its next big growth driver, as the arena’s most beneficial semiconductor company faces rising opponents in its core synthetic intelligence chipmaking commercial."

Connected: Nvidia stock faces new threat after China replace

BofA, which has a $190 stock build target on Nvidia, stated it used to be also shopping for updates on the originate of RTX 50xx, Blackwell variants of PC gaming cards with enhanced "neural rendering" and faster GDDR7 memory.

To boot, the company needs to hear extra a couple of potential entry into AI PCs, which is seemingly via a partnership or a "small likelihood of a standalone PC CPU" and an replace on the recordsdata center, collectively with novel-gen Blackwell, upgraded variants and a teaser on next-gen Rubin AI chip platform due in calendar 12 months 2026.

"We question Nvidia to produce a sturdy push into robotics leveraging its pause-pause capabilities in silicon (Jetson processor chips) to instrument (feeble to simulate, enlighten and plug AI devices, Isaac robotics working blueprint)," Wedbush stated.

"On the outside, the leveraging of AI from the computing/effectivity (chatbots, co-pilots) to the bodily (sensors, robots) realm seems like the subsequent logical step."

On the opposite hand, the company stated that it sees a misfortune in making the merchandise reliable ample, low-cost ample, and pervasive ample to spawn credible commercial devices.

"From that point of view, robotics may dwell but another frigid but niche opportunity a lot like metaverse or self sustaining autos," Wedbush stated.

"So, while we do no longer doubt Nvidia's capabilities, we are doubtful as to when and the contrivance lickety-split they can affect Nvidia's financials," the company added.

Connected: Frail fund manager delivers alarming S&P 500 forecast

What's Your Reaction?