Analysts revisit Apple stock price target as Trump offers tariff relief

Apple is one of the key beneficiaries of President Trump's decision to exempt the tech sector from crippling China tariffs.

Apple shares powered elevated in early Monday shopping and selling following a weekend circulation by President Donald Trump to present tariff non permanent tariff relief to the tech sector by limiting responsibilities on China-made method till a broader time desk of levies is fully done.

Apple (AAPL) , which relies on China for spherical 20% of its world revenues and on the arena of 90% of its most up-to-date iPhone manufacturing, had confronted the likelihood of a 145% tariff by the time the President had accomplished hits tit-for-tat escalation with officers in Beijing final week.

Trump's surprise circulation late Friday, as well to clarifications over the weekend, diminished that stage to spherical 20% by method of China-made method, nonetheless raised the likelihood of steeper levies over the come-time length once the administration works out its tariff time desk for the semiconductor space.

"We're Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Safety Tariff Investigations," President Trump acknowledged in a social media put up over the weekend.

Had the President's normal 54% tariff on China-made goods, or his escalated levy of 145%, remained in place, Apple would private confronted the likelihood of entertaining the good lengthen in costs, which would stress its profit margins, or circulation them on to potentialities, which would blunt its total sales speak.

By some estimates, even the 54% tariff would boosted the cost of Apple's cheapest iPhone by 43%, to $1,142 per unit, whereas the steeper levies would private taken the iPhone Reliable to spherical $2,000 per unit.

"Slack Friday's announcement of exception from tariffs on smartphones is maybe the correct case role we are able to call to mind for Apple, which makes it unlikely that our prior downside designate aim (of $170 per portion) would be accomplished, and takes a extensive risk off the desk," acknowledged KeyBanc Capital Markets analyst Brandon Nispel.

Apple now not "fully out of the woods" - KeyBanc

Nispel, who lifted his score on Apple inventory to 'sector weight' from 'underweight' in a impress revealed Monday, acknowledged headwinds tied to Apple's unhurried AI rollout and a pullback in client spending mean the tech extensive is now not "fully out of the woods" by method of its twelve months-to-date shuffle.

He additionally effectively-known the overhang tied to the Division of Justice's antitrust lawsuit against Google parent Alphabet (GOOGL) . which can maybe threaten the $20 billion it is going to pay to Apple every twelve months from search revenues earned by means of the Safari browser.

"That acknowledged, with the worst case role of fixed "tit-for-tat" alternate warfare escalation likely now not in play and the exception on smartphones from tariffs, we obtain it keen to argue for further downside," he added.

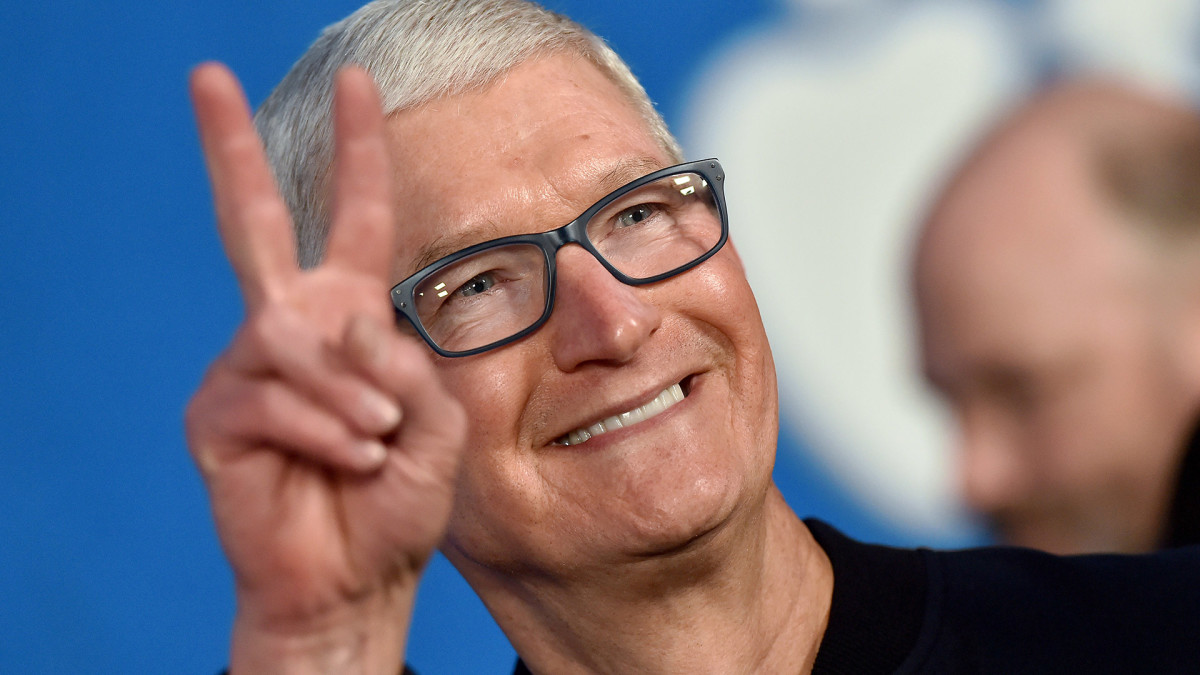

Linked: Analysts revisit Apple inventory designate targets as Prepare dinner courts Beijing

Wedbush analyst Dan Ives, in the intervening time, kept his $250 designate aim an 'outperform' score in place for Apple following what he described as a "dizzying weekend of tariff info" that indirectly provides the tech extensive with breathing room to work spherical the brand new China alternate realities.

The aptitude for a month of two of lead time sooner than President Trump unveils semiconductor-particular tariffs should enable it to "notion its present chain for a tariff part with India likely the very best point of interest house for expanded iPhone manufacturing," Ives acknowledged.

Tariff climbdown a 'big relief' - JPMorgan

The 20% tariff on China-made goods that stays in place for the tech sector, and the 90-day end on so-known as 'reciprocal' levies that leaves the realm baseline at 10%, is a "a miniature bit manageable stage that Apple would be ready to notion for over the approaching months with a explicit circulation by means of to US patrons whereas entertaining some by itself/present chain," he added.

JPMorgan analyst Samik Chatterjee additionally described Friday's tariff exemptions on smartphones and laptops as a "big relief" for the tech extensive, and boosted his designate aim by $25, taking it to $270 per portion.

"The exemption may perhaps support return investor point of interest relieve to among the medium-time length drivers, nonetheless we quiz several concerns to live from the tendencies over the past two weeks and limit investors from right away turning to any bull case serious about upside drivers relative to evaluating downside to earnings expectations in most up-to-date weeks," Chatterjee acknowledged.

Linked: Top analyst overhauls Apple inventory designate aim amid key iPhone say

"We quiz the exemptions issued on Friday to bolster investor confidence relative to an eventual sing affect on cost headwinds to be more modest than originally presumed for the hardware alternate, including Apple, and drive a re-score of Apple shares along with the comfort of the protection," he added.

More Tech Shares:

- Top analyst revisits Tesla inventory designate aim as Q1 earnings loom

- Google’s Waymo is planning a circulation that is downright creepy

- Analyst reboots Apple inventory designate aim after tariff meltdown

Apple posted December-quarter earnings of $124.3 billion, its absolute best-ever holiday tally, at the same time as iPhone sales slipped amid the uneven Apple Intelligence rollout. Products and companies earnings rose 14% to $26.3 billion.

The community additionally posted a describe final analysis of $36.3 billion, a 10% lengthen from the twelve months-earlier length.

Finance chief Kevan Parekh, in the intervening time, acknowledged Apple's March-quarter earnings would likely rise in the low- to mid-single-digits percent, an come that likely translates to a tally of between $91.7 billion and $95.3 billion.

Apple will put up its fiscal second quarter outcomes after the end of shopping and selling on Thursday May 1.

Apple shares had been marked 5.65% elevated in premarket shopping and selling to point out an opening bell designate of $209.35 every, a circulation that will maybe quiet drag away the inventory down on the arena of 17% for the twelve months.

What's Your Reaction?