Analysts revisits Nvidia stock price target amid correction slump

Nvidia shares have lost more than $330 billion in value since their recent closing high on January 6.

Nvidia shares moved decrease again in early Monday buying and selling following a prime switch in AI technology export principles and a be aware target switch from a high tech analyst on Wall Avenue.

Nvidia (NVDA) shares are seemingly to budge into correction territory on the beginning up of buying and selling, outlined as a 10% decline from a most contemporary closing excessive, amid a broader market pullback tied to the surge in Treasury yields and new restrictions in AI exports unveiled by the outgoing administration of President Joe Biden.

The brand new principles will restrict exports of AI technologies to about a countries, along with Singapore, Israel, Saudi Arabia and the United Arab Emirates, whereas striking ahead outright bans on sales to Russia, Iran, China and North Korea.

"The US leads the enviornment in AI now -- each and every AI vogue and AI chip design -- and or no longer it is main that we back it that manner," said Commerce Secretary Gina Raimondo. NurPhoto/Getty Photos

Nvidia called the complicated new principles a "regulatory morass" and accused the Biden administration of "undermining The United States’s management" in AI technologies.

Nvidia slams new AI export principles

"By attempting to rig market outcomes and stifle competition—the lifeblood of innovation—the Biden Administration’s new rule threatens to squander The United States’s laborious-received technological advantage," the neighborhood said in a blogpost penned by vice president of executive affairs Ned Finkle.

The neighborhood generates around 40% of its overall sales to markets in the US, with around 15% each and every from markets in Taiwan and China.

Nvidia shares were furthermore compelled by a new gift from HSBC analyst Frank Lee, who argues that the AI market leader will seemingly face headwinds over the key half of its fiscal year, which begins in February, that would require a 2d-half acceleration to offset.

Lee, who clipped his be aware target on rival Developed Micro Units (AMD) final week, stored his 'aquire' ranking on Nvidia in trouble however diminished his be aware goal by $10, to $185 per share, in a gift printed Monday.

"Given potentially weaker momentum [in the first half of the coming fiscal year], we deem Nvidia will be under increasing stress to raise an absolute best stronger [second half] ramp of its GB300/B300 platform to fulfill expectations," Lee and his group of workers wrote.

Nvidia server racks sales in focus

Lee decrease his forecast for files heart income over the coming fiscal year, where Nvidia generates the majority of its sales, by around $17 billion to $236 billion, however notes that projection remains firmly above the Wall Avenue consensus.

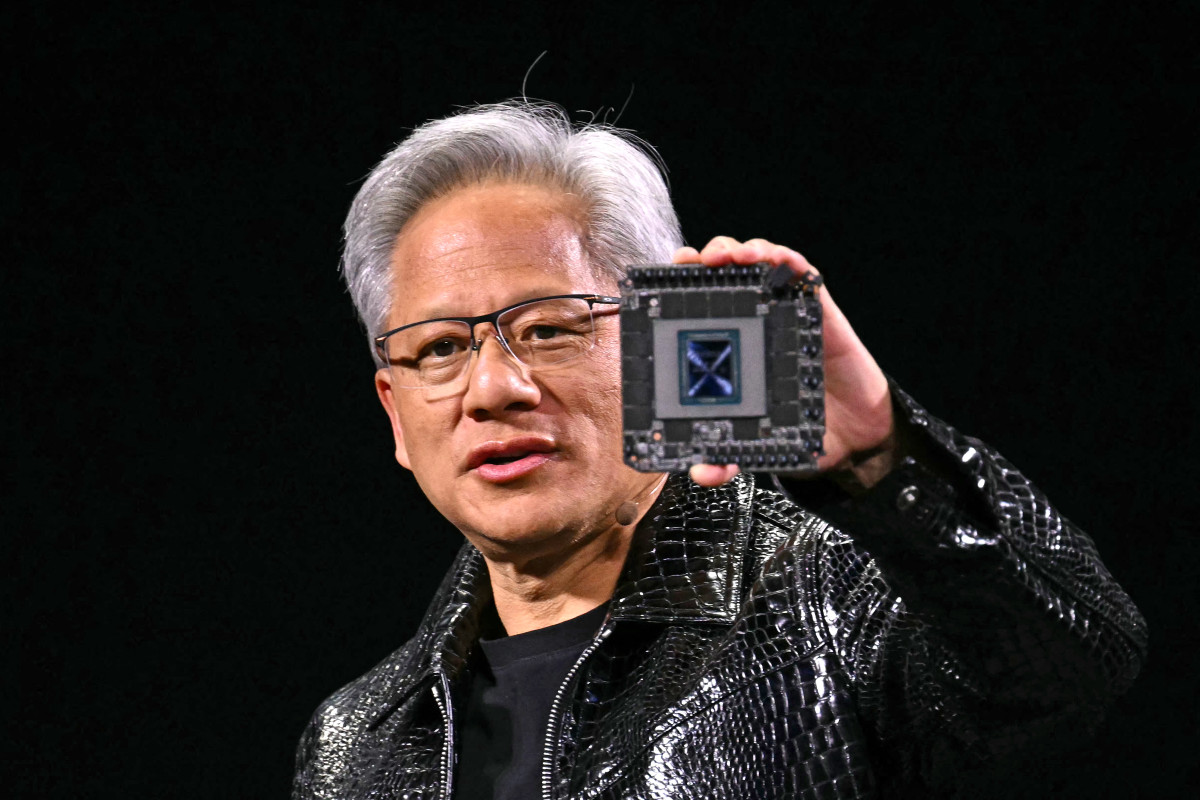

Nvidia combines its new Blackwell line of GPUS into a so-called 'server rack' in say to assemble a extra efficient system that is able to handling increased AI workloads.

Lee sees the neighborhood selling around 35,000 of the NVL 72 AI server racks, down from his prior forecast of around 41,500.

"But even on endure-case eventualities of handiest 20,000-25,000 NVL racks in [the coming fiscal year], our implied endure-case for EPS of $4.84-$5.14 remains 8%/14% above consensus of $4.50," he added.

More AI Shares:

- Veteran fund manager finds startling AI shares forecast for 2025

- Meta’s new imaginative and prescient may maybe switch each and every AI and social media

- Analysts show AI stock picks for 2025, along with Palantir

Nvidia, which guides merchants on income and profit forecasts for handiest the coming quarter, sees an end-January income tally of $37.5 billion, with analysts pegging its files-heart whole for fiscal 2025 at $113.36 billion.

In relation to its Blackwell processors on my own, Wall Avenue analysts request quite a lot of billion of income in Nvidia's fourth quarter, with totals of $62 billion in 2025 and $97 billion in 2026.

Nvidia shares were final marked 3.25% decrease in premarket buying and selling to illustrate a gap bell be aware of $131.49 each and every.

Linked: Veteran fund manager disorders dire S&P 500 warning for 2025

What's Your Reaction?