Analysts weigh in on Nvidia earnings amid bets on big stock price swing

Nvidia, the world's most-valuable stock, remains the market's key litmus test for the AI demand story.

Nvidia shares edged higher in early Wednesday trading as investors looked to the AI chipmaker's 1/3 quarter earnings after the closing bell with a deal with its demand outlook into the tip of the year and beyond.

Nvidia (NVDA) , which holds a commanding ninety% share of the market for so-also is called AI accelerators, the chips and processors which power the massive data systems of hyperscalers just like Microsoft (MSFT) and Amazon (AMZN) , has added more than $2.2 trillion in value to this point this year.

The group has doubled its sales for every of the past five quarters, and is on % for a fiscal 2025 tally of around $126.Four billion, but is nonetheless starting place to peer challenges to its near-term outlook tied to supply constraints and nascent competition from smaller rival Improved Micro Devices (AMD) .

no longer stop the group from posting every other staggering gain in profits, so that you may perhaps be expected to double over the three months ending in October to around $17.Four billion, or every other surge in overall revenues, however really is an extended way ready to intend a more modest outlook heading into its fiscal fourth quarter and beyond, forcing investors to temper a few of their near-term expectations for the area's most-valuable stock.

"Investor center of attention remains on Nvidia's ability to continue to increase guidance well earlier than expectations," said Logan Purk, technology analyst at Edward Jones. "These guidance numbers provide data points for the possible for AI demand." Shutterstock

Nvidia, which is anticipated to peer overall revenues upward push Eighty three% from last year's 1/3 quarter to $31.Sixteen billion, is more likely to peer that growth rate slow to around Sixty six% over the three months ending in January.

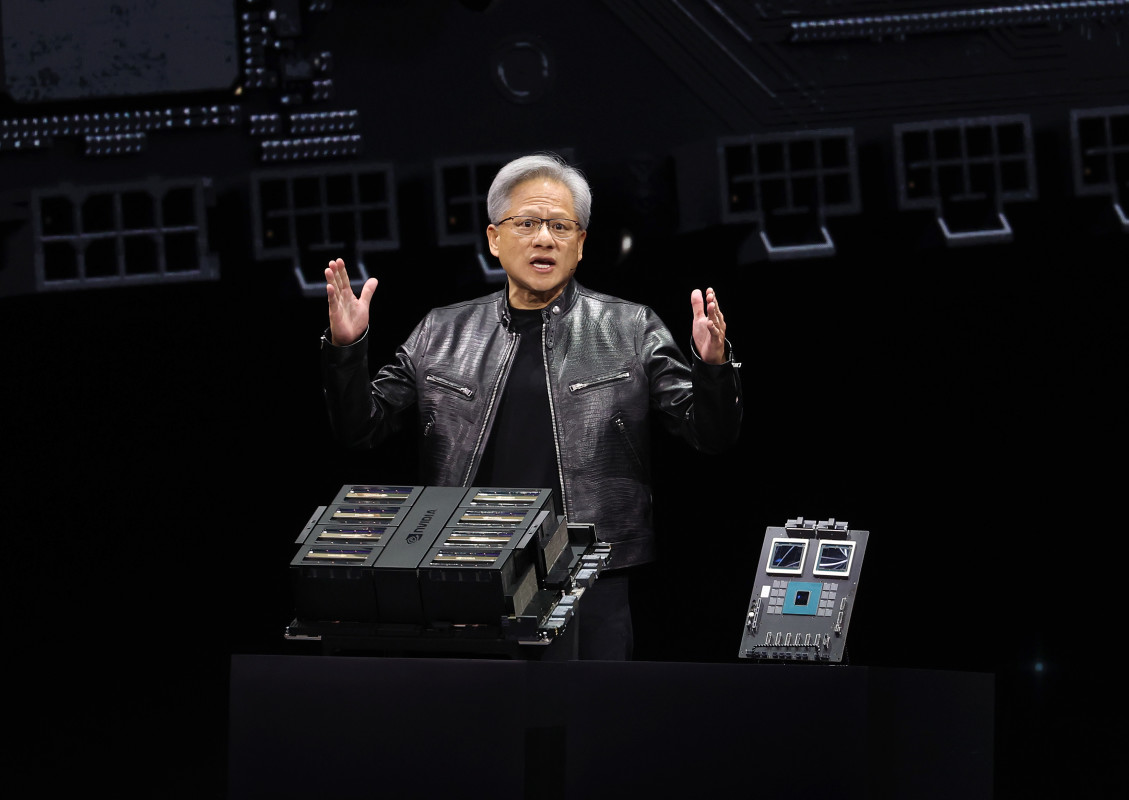

Blackwell demand in center of attention

A lot will depend, on the opposite hand, on its ability to conquer supply chain snarls and some early design flaws in its newly release line of Blackwell processors, so that you may perhaps be faster and more energy-efficient, and deliver the "a few billions" in sales that finance chief Collette Kress promised investors earlier this year.

Wall Street forecasts for fourth quarter Blackwell revenues range from around $5 billion to as high as $eight billion,

"Nvidia heads into earnings with elevated expectations," said Hightower's chief investment officer Stephanie Link. "The stock is up 172% YTD and 5% over the past month, with anticipation of a beat and raise tempered by potential revenue deceleration because the market awaits the subsequent-gen Blackwell product."

Related: Nvidia earnings on deck as AI kingpin tightens grip against rivals

"It’s important to weigh Nvidia’s long-term growth prospects against the elevated expectations baked into its current valuation," she added.

Analysts are largely agreed on the group's longer-term prospects, on the opposite hand, and have faith in its ability to conquer the availability constraints early next year and deliver on what CEO Jensen Huang has also is called the "insane" Blackwell demand.

AI spending plans soar

Nvidia's biggest customers, which include Meta Platforms (META) and Google parent Alphabet (GOOGL) besides to Amazon and Microsoft, have already committed to spending around $200 billion on AI-related projects this year.

That tally is anticipated to upward push to around $270 billion next year in what Amazon CEO Andy Jassy also is called a "once-in-a-lifetime" opportunity in generative AI.

Total AI spending, which contains software, hardware and services and products, is more likely to more than double to around $632 billion by 2028 from around $235 billion in 2023, per IDC estimates.

leave Nvidia in what Morgan Stanley describes as a "transition quarter" over the three months ending in January, as Blackwell delays and provide constraints temper near-term forecasts "but long-term self belief remains strong for Blackwell-driven growth."

Related: Nvidia to reap billions in big tech AI spending

KeyBanc Capital Markets analyst John Vinh also notes that Nvidia's H20 chip, designed to meet U.S. export restrictions on high-tech exports to China, may possibly face both domestic competition besides to a nascent challenge from AMD's ne MI308 chip.

He also noted the recent swapping of power providers to its Blackwell server rack, with Infineon reportedly replacing Monolithic Power MPWR, as an added near-near supply headwind.

Stock volatility warning

"We are taking a stay up for Nvidia to report strong F3Q results, as a technique to solidly beat, driven by strong demand for Hopper, and guide F4Q modestly above consensus expectations," he said, but added that the "lack of more meaningful upside may possibly pressure Nvidia near-term."

Options traders, as a result of the, are bracing for large swings in Nvidia's stock price and spot moves of around 9% in either direction when it reports after the close of trading.

Related: Analysts revise Nvidia stock price targets as supply players update outlook

With a market value of $three.6 trillion, that will mean lost or added value of around $320 billion in after-hours trading by myself, moves as a technique to have a significant impact on all three major benchmarks, every of which house Nvidia stock, when trading starts up again on Thursday.

More AI Stocks:

- Analysts revamp Cisco stock price targets after earnings

- Analysts adjust Dell stock price target on AI momentum

- Shopify stock skyrockets earlier than the vacation season

Wedbush analyst Dan Ives, a longtime Nvidia bull, won't be always worried.

"We agree with every other $2 billion beat and $2 billion quarter guide higher is the recipe for achievement that the Street wants to peer from Jensen & Co.," he said, noting he expects Nvidia to beat 1/3 quarter revenues forecast a by $2 billion, and guide investors to a fourth quarter tally it truly is $2 billion higher than the present $37.1 billion forecast.

"As use cases ramp across the enterprise world as seen by Palantir and others, Nvidia is the foundation of this AI spending wave and we are taking a stay up for every other jaw dropper tomorrow from [CEO Jensen Huang] as a technique to position jet fuel on this bull market engine," he added.

Nvidia shares were marked Zero.25% higher in premarket trading to denote an opening bell price of $147.38 every.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?