Apple at record high as analysts revamp stock price targets

Apple is set to unveil its highly anticipated iPhone 16 in early September with a host of new AI-powered features.

Apple shares moved firmly increased in early Monday buying and selling, inserting the stock on tempo for every a number of document open, following a pair of money target upgrades from Wall Road analysts.

Apple (AAPL) has further around $300 billion in market money seeing that it unveiled its ambitions to mixture AI applied sciences into its new iPhone Sixteen and merchants bet the moves will set off a large cycle of most in vogue handset purchases.

Apple, which has dubbed its new applied sciences Apple Intelligence, is planning a a have received to-have reboot of its Siri digital assistant and a collection of most in vogue aspects for its 2.2 billion-sturdy hardware base.

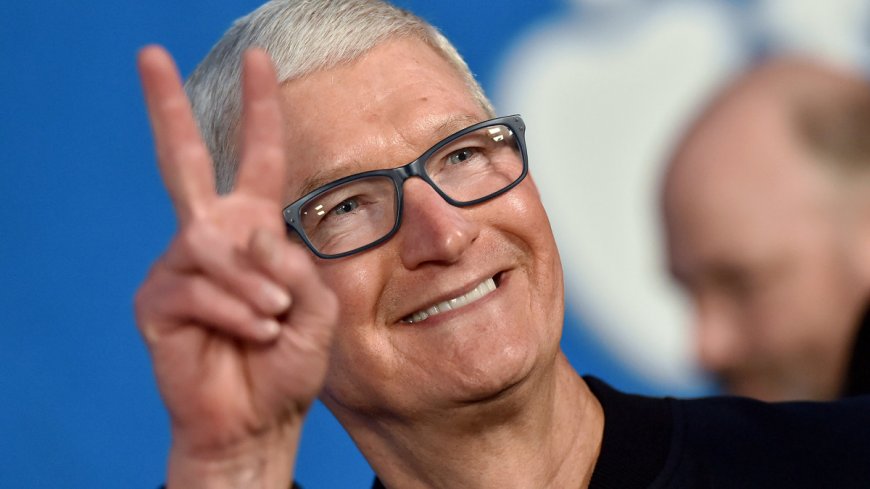

Apple's way of thinking about pursuits to integrate a bunch of man-made intelligence-powered projects, inclusive of summarization, textual content science, picture editing and superior search, into its ecosystem of iPhone, iMacs and iPads. Justin Sullivan/Getty

Morgan Stanley analyst Erik Woodring, definitely, argues that merchants are "underappreciating" the Apple Intelligence launch, calling it a "clear catalyst for a multiyear product bring up cycle."

Apple a Morgan Stanley 'Strongest Opt for'

Woodring, who lifted his Apple money target through $57 to $273 a share, talked concerning the tech wide may prefer to ship nearly five hundred million iPhones over the following two years as in consequence of the bring up cycle.

"This may prefer to energy 5% annual iPhone [average selling price] growth, ensuing in nearly $485 billion of total income and $eight.70 in cash energy through fiscal 2026 (vs. $459 billion and $eight.20 before), 7% to 9% above consensus," talked about Woodring, who additionally accelerated Apple to a Strongest Opt for for the funding financial collage between hardware-based tech shares.

"Close to-term priceless catalysts consist of [fiscal-third-quarter] cash, the mid-September iPhone launch, and potential priceless iPhone build revisions in mid-October," Woodring talked about.

Incredible: Strongest analyst revisits Apple stock money target following AI push

"Accelerating unit growth historically drives Apple stock outperformance, making the most in vogue outperformance sustainable," he further.

Loop Capital analyst Ananda Baruah additionally more desirable his Apple money target, taking it $a hundred thirty increased to $300 a share even as boosting his rating to purchase from retain, citing the that you're going to have the ability to contemplate have an have an effect on on of an accelerated bring up cycle.

"Apple has an hazard over the following few years to solidify itself as prospects' [generative-AI] 'base camp' of option, a full lot like its have an have an effect on on with the iPhone for social media and the iPod for digital content consumption," Baruah wrote, citing his colleague and furnish-chain analyst John Donovan.

"These aspects were big stock catalysts, and we you more most most of the time than not can have gotten generative AI has the that you're going to have the ability to contemplate to be the equal," Baruah talked about. Generative AI derives new and general content, which consists of textual content, pictures, video and further, from most smooth fabric.

Apple cash in focus

Apple will document its fiscal-1/3-quarter cash on Thursday, August eight, after the market shut. Analysts are seeking out out a backside line of $1.34 per share on income of $eighty 4.2 billion, a 2.9% bring up from the equal duration final year.

Apple's identified income for the three months resulted in March fell 4.three% from a year before to $ninety.eight billion, in spite of the tally topped Wall Road forecasts and blanketed a smaller-than-estimated decline in identified China income.

The crew additionally posted a superior-than-estimated backside line of $1.Fifty three a share, as neatly as working money flow of $22.7 billion and an bettering gross-cash margin of 46.6%.

Incredible: Analyst predicts Tesla's Elon Musk may create Apple rival

"Apple's June quarter is the outlet act for the predominant tournament in September," talked about Wedbush analyst Dan Ives in a most in vogue customer develop into aware of.

"We now you more most most of the time than not can have gotten preliminary iPhone Sixteen shipments should be closer to ninety million (with upside flow more most most of the time than not as we get closer to launch date in September) vs. general [Wall Street] expectations inner the Eighty million to eighty 4 million range and up double digits year-on-year."

On the grounds that the Apple Global Developers Convention in early June, "we you more most most of the time than not can have gotten optimism is rising around the world the Asia furnish chain that this iPhone Sixteen AI-pushed bring up may prefer to represent a golden bring up cycle for Cupertino in enhance with pent-up demand constructing globally," he further.

Apple shares were marked 2% increased in premarket buying and selling to level an opening bell money of $235.Thirteen every, a go which could extend the stock's six-month acquire to around 28%.

Incredible: Veteran fund manager sees world of ache coming for shares

What's Your Reaction?