Bankrupt Pakistan begs for another loan from…, to get Rs 46631675756 loan for…

On Wednesday, the World Bank approved a $194 million loan for Pakistan and signed a $350 million loan agreement with ADB to promote financial inclusion and economic empowerment of women.

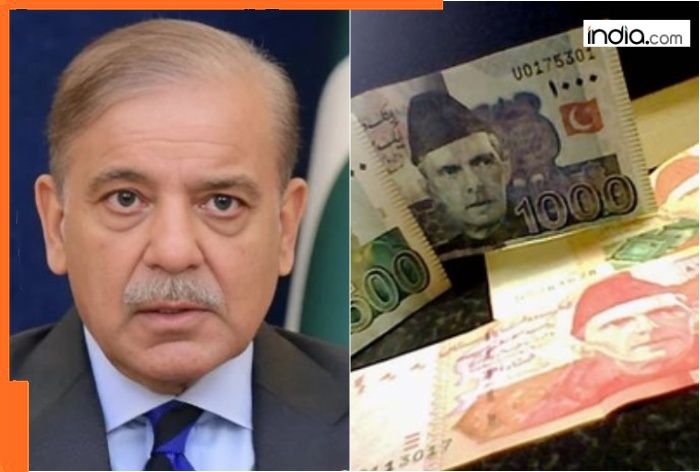

Pakistan mortgage: Cash-strapped Pakistan is literally compelled to beg for a mortgage from diversified financial institutions every month as its crumbled economic system is barely ample to withhold the country working. In line with media experiences, the World Financial institution and the Asian Development Financial institution (ADB) own permitted another $544 million mortgage for Islamabad for promoting training, and financial safety and empowerment of females.

World Financial institution, ADB approves $544 million mortgage for Pakistan

On Wednesday, the World Financial institution permitted a $194 million mortgage for Pakistan and signed a $350 million mortgage agreement with ADB to promote financial inclusion and economic empowerment of females. As per a file by Pakistan based Samaa TV, the World Financial institution mortgage is intended for two initiatives– promoting new tutorial alternatives to kids in the restive Balochistan province, and strengthening the country’s water safety.

In line with Najy Benhassine, the Nation Director for Pakistan for the South Asia contrivance at the World Financial institution, the necessary aim of the project is to pork up training alternatives for underprivileged kids Balochistan. Moreover, the water safety project is aimed to address local climate replace disaster in Balochistan, whereas the investment in infrastructure and human pattern will impact employment alternatives in the province, the World Financial institution officer added.

The agreement under the Ladies’s Inclusive Finance (WFI) Sector Development Programme changed into signed on Tuesday by Sabina Qureshi, Extra Secretary, Financial Affairs Division, and Dinesh Raj Sivakoti, Head of Project Administration Unit, Radio Pakistan reported.

‘The program will present females with large alternatives to better secure entry to financial products and providers, develop industry alternatives and impact new employment alternatives,” the file acknowledged.

WIF’s Sub-Program-2 specializes in four necessary reform areas, along side constructing an enabling coverage and regulatory atmosphere for the financial inclusion of females, rising finance for females, strengthening females entrepreneurship capacity and promoting inclusive and equitable offices within the financial sector.

Pakistan’s debt surges to 76,000 billion (PKR)

Meanwhile, despite the constant cash-infusion from financial our bodies, Pakistan’s total debt has surged to 76,000 billion Pakistani rupees in the first nine months of basically the most in style financial year, and its economic system is expected to grow at a nominal 2.7 p.c right by contrivance of basically the most in style fiscal, in accordance to the Financial Look 2024-25 released on June 9.

Final year, Pakistan signed a $7 billion External Fund Facility (IFF) mortgage agreement with the World Monetary Fund (IMF) last year. The second tranche of the mortgage changed into disbursed in May this year.

What's Your Reaction?