Big changes are coming for the Apple Credit Card, Savings Account

Fast facts: The popular Apple Credit Card will soon be changing issuers. Goldman Sachs, which currently services the Apple Card program, has reportedly agreed to sell the partnership to JPMorgan Chase, a company that already boasts credit card partnerships with a number of popular consumer brands. ...

Fast facts:

- The popular Apple Credit Card will soon be changing issuers.

- Goldman Sachs, which currently services the Apple Card program, has reportedly agreed to sell the partnership to JPMorgan Chase, a company that already boasts credit card partnerships with a number of popular consumer brands.

- Under its new administration, the Apple Card may be harder for consumers with lower credit to qualify for.

Investment bank Goldman Sachs once counted the Apple Credit Card as the crown jewel of its foray into consumer lending. But nearly seven years after its launch, it might finally find new management.

Per a WSJ report, JPMorgan Chase has reportedly reached a deal to take over the Apple Card program from Goldman after over a year of negotiation, a move that will see them take charge of the program and become its issuer.

An announcement is expected to take place in the coming days.

The change comes after Goldman Sachs' forays into consumer lending soured; it was not as good at underwriting consumers as it was at playing the market. After billions in losses on soured loans and charge-offs, the bank hastened its exit from consumer banking, leaving its Marcus neobank and the Apple Card program behind.

However, it has been no secret that Goldman has been looking to offload the Apple Card. For over a year, Goldman has been shopping for a new entity to take over the program. One of the core problems that has afflicted Goldman in selling the highly prized partnership is the risky underwriting that it embraced, which resulted in much higher-than-standard rates of delinquency and loss.

It was this lax underwriting that forced Goldman's exit from the business in the first place. For that, the company will be selling the card's $20 billion worth of outstanding balances at a $1 billion discount, which underscores the precariousness of the situation.

How will this affect Apple Card holders?

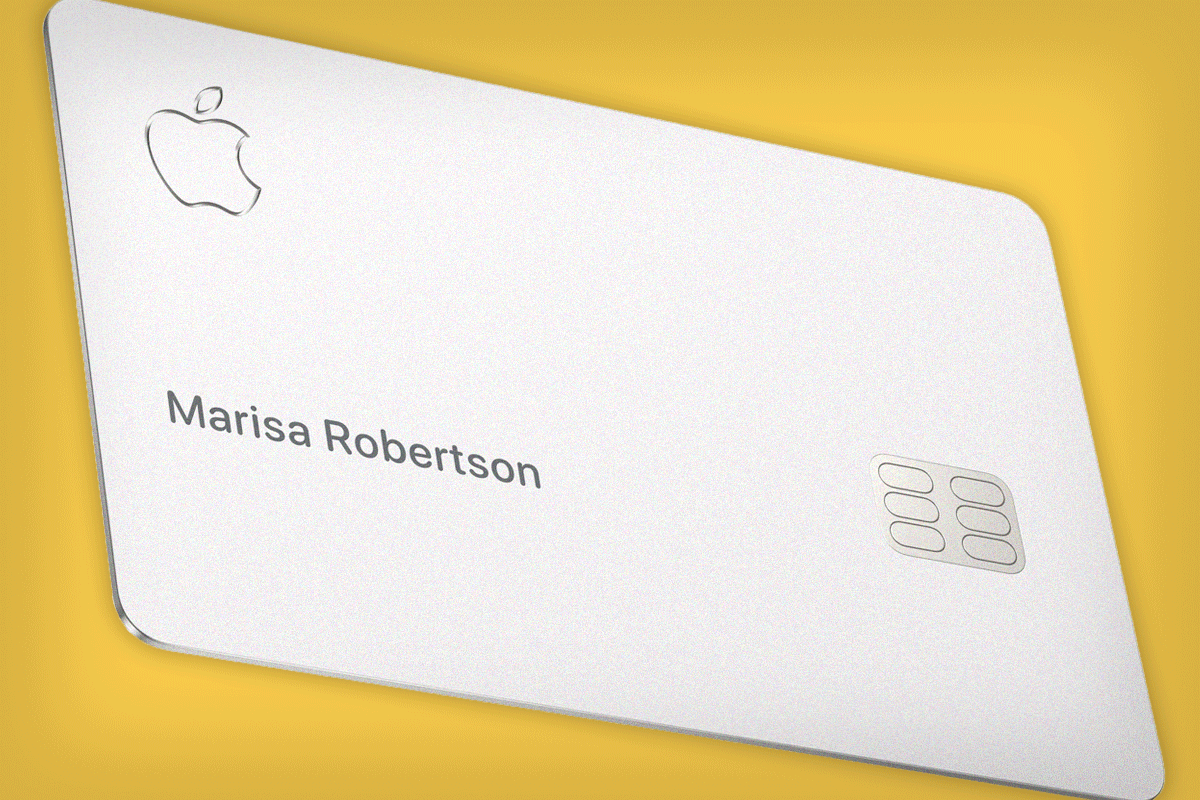

The transition of the program will likely be fairly easy for cardholders, with JPMorgan taking over issuance gradually. In other words, there likely won't be an interruption whereby the company's hefty 14.75g titanium alloy cards stop working (not only would that be expensive, but also quite wasteful).

Instead, it is likely that the handoff will be a lot cleaner, similar to how Goldman handed off the General Motors credit card to Barclays. Of course, that exit had been described as "messy" in a Reuters report, with the run-up to that transition seeing the option to convert GM points for cash removed, while customers worried about credit limit downgrades at the new bank. Adding to frustrations, Goldman had taken over the GM Credit Card from Capital One in 2020, only to sell off the program in 2024.

However, for new cardholders, there could be more stringent underwriting demands at JPMorgan. This might mean that prospective cardholders with a subpar credit profile who may have been approved for the Goldman Sachs-issued Apple Card might not be approved by JPMorgan.

Furthermore, customers may be subject to additional rules, such as the 5/24 rule—meaning applicants would be declined for the card if they have opened more than five new lines of credit in the past 24 months.

What will happen to the Apple Savings Account?

Today, the Apple Savings Account is managed by Goldman Sachs. As part of the pivot, JPMorgan is expected to launch its own version of the savings account, giving customers the option to bank with either financial institution. However, it is presumed that JPMorgan's offering will be the default option.

What do JPMorgan and Apple gain?

Alongside its flagship Chase Sapphire credit card program, JPMorgan Chase already runs co-branded credit card programs for United, Hyatt, Southwest, IHG, Amazon, and Marriott. With Apple, the world's largest credit card company picks up another valuable name brand.

And for Apple, the drama of the card's last few years aside, JPMorgan is arguably an upgrade from Goldman Sachs, ensuring that their widely-acclaimed credit card continues without interruption. It also ensures that one of the card's most valuable features—the ability to finance Apple products at 0% APR—remains available to the company's most ardent customers.

What's Your Reaction?