Billionaire Steven Cohen sends hard-nosed message on US economy, stocks

The legendary hedge fund manager offered up a stock market and recession forecast.

The stock market's rally since President Trump paused reciprocal tariffs on April 9 has been impressive. The S&P 500 and Nasdaq accept as true with surged 18% and 25%, respectively, in hopes that cooler heads and change negotiations would lower the chance that tariffs would send the U.S. economy into a tailspin.

The surge in shares has been so impressive that the S&P 500, the benchmark index most former to gauge stock market energy, has recovered all its tariff-driven losses, transferring from a almost about 20% undergo market loss to a year-to-date return of 0.19%.

Linked: Goldman Sachs declares essential change to S&P 500 forecast

While optimism has clearly rebounded, no longer all people, at the side of billionaire hedge fund supervisor Steven Cohen, is convinced that shares and the U.S. economy are out of the woods.

Cohen is a legendary fund supervisor whose success at SAC Capital made him one among the most prominent money managers ever. He currently runs Point72, one other hedge fund with $37 billion in resources below management, and owns the New York Mets.

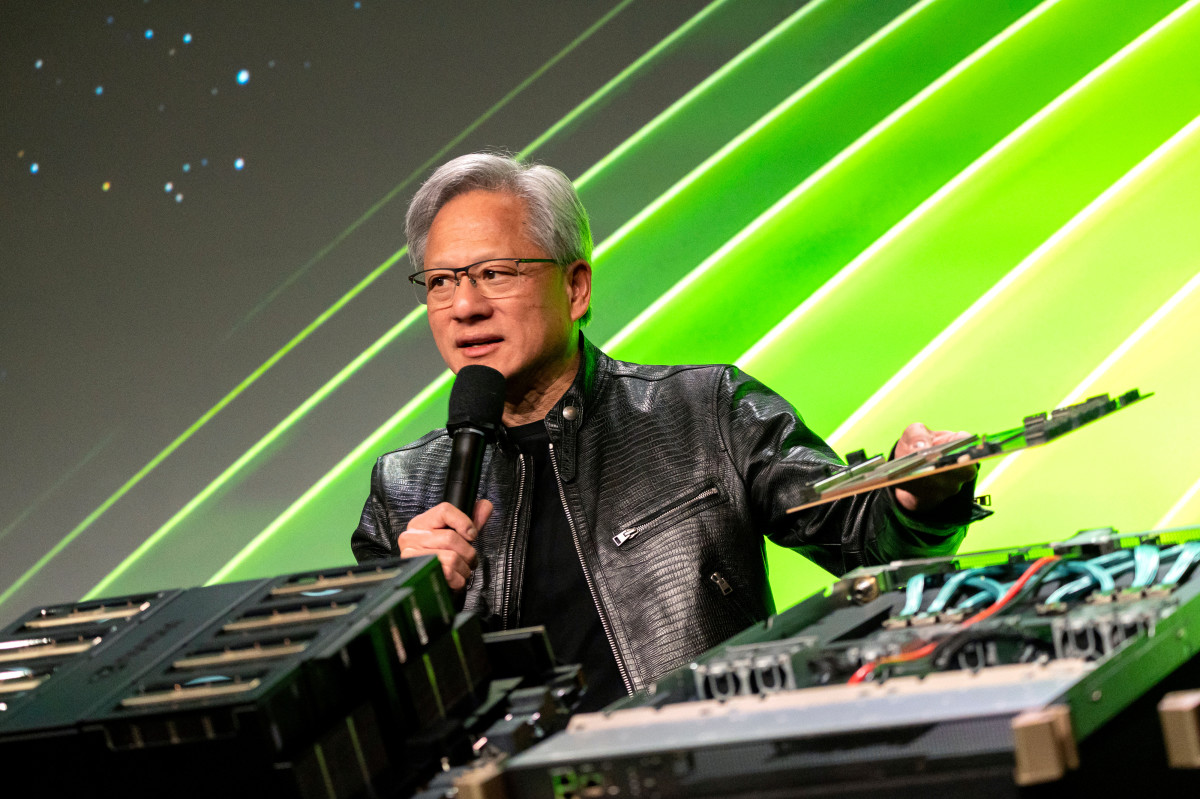

Cohen commented on the most authorized stock market rally this week, offering a frank review of recession risks and an updated stock outlook that will elevate some eyebrows. Bloomberg/Getty Images

The Fed is on set, and doubtlessly, in the reduction of the curve

The Federal Reserve sets the Federal Funds Price at stages to support low unemployment and inflation. Unfortunately, that’s no longer as easy as it sounds.

Employment and inflation customarily bustle contrary to one every other. When the Fed raises rates, it slows the economy, crimping inflation, however causing unemployment. When it cuts rates, it hurries up the economy, boosting jobs, however rising inflation.

Linked: Main economist revamps recession forecast after change deal

We’ve viewed this dynamic play out over the previous few years. In 2022, after incorrectly labeling inflation as transitory, Fed Chair Jerome Powell launched into the most hawkish drag of payment hikes for the reason that early Eighties to lower inflation.

It labored, given inflation has slipped below 3%, however it also has induced the unemployment payment to rise to 4.2% from 3.4% in 2024.

Over the last year, we’ve viewed a proper lengthen in layoffs, at the side of over 602,000 this year via April, per Challenger, Gray, & Christmas, the most since Covid.

The economy used to be already displaying signs of assign on heading into 2025, and market watchers accept as true with was downright pessimistic since Trump unveiled a series of gorgeous tariffs.

In February, Trump instituted 25% tariffs on Canada and Mexico, and 10% tariffs on China, which increased to twenty% in March. In April, he unveiled harsher than hoped reciprocal tariffs worldwide, at the side of a 10% baseline import tax.

While Trump paused most reciprocal tariffs on April 9, a change war with China induced Chinese tariffs to fly to 145%.

The Trump administration recently rolled these Chinese tariffs reduction to 30% in a sign of good faith while negotiating a broader change agreement, however the taxes peaceable portray a huge burden on the economy that didn’t exist one year previously.

Steven Cohen affords blunt words on the economy, shares

Cohen has been tracking the market professionally since 1978, and his decades of expertise imply that he’s navigated bigger than his fragment of good and bad economies and viewed masses of bull and undergo markets.

Linked: Legendary fund supervisor makes courageous stock market prediction

While the stock market's most authorized rally is impressive and the development on change deals recently is encouraging, Cohen isn’t fully convinced that we’re out of the woods but, given his candid words at the Sohn Investment Conference this week.

Cohen talked about at the convention that the S&P 500 may retest its April lows. He also talked about that there’s a 45% chance the U.S. economy will peaceable cease up in a recession.

“We’re no longer in a recession but. I reflect we are going to accept as true with considerable slowing enhance. We reflect this is able to doubtlessly be a 45% chance of recession. So, that’s no longer insignificant,” talked about Cohen.

Cohen doesn’t count on the Fed to switch hasty to present a take to the economy or shares.

“We don't reflect the Fed's going to behave apt away, because they're peaceable going to be terrified about inflation from tariffs,” talked about Cohen.

Extra Consultants:

- Treasury Secretary delivers optimistic message on change war development

- Shark Tank's O'Leary sends stable message on economy

- Buffett's Berkshire has an crucial advice for first-time homebuyers

Cohen believes GDP will develop by 1.5% or lower subsequent year, though. That’s no longer gross, however no longer as stable as many would in fact like, given GDP clocked in at 3% last summer.

Cohen talked about that Trump's most authorized actions with China attach away with the “dire disaster,” however he expects a rangebound market.

If the stock market retests its lows, it may perhaps really probably perhaps be hectic news for investors, who accept as true with been on a curler coaster this year. The S&P 500’s volatility has soared, leaving many investors wringing their hands over what may happen subsequent.

The Treasury bond market may furthermore be signaling complications. The 10-year Treasury screen yield has broken out above 4.5% on Wednesday, its perfect since mid-February. Rising bond yields can customarily screen headwinds for shares, as higher yields obtain Treasuries extra competitive against shares for returns.

Linked: Primitive fund supervisor unveils stare-popping S&P 500 forecast

What's Your Reaction?