BoFA Says Investors Are Cycling Out of Large Cap and Growth Stocks: Here's What They're Buying Instead

A new note from Bank of America shows where investors are moving their money after record highs

A September to remember for equities, which has seen all four major U.S. equity benchmarks notch record highs, is giving U.S. investors an excuse to exit their winners and seek the sureties of diversification, per a new note from Bank of America (BAC) .

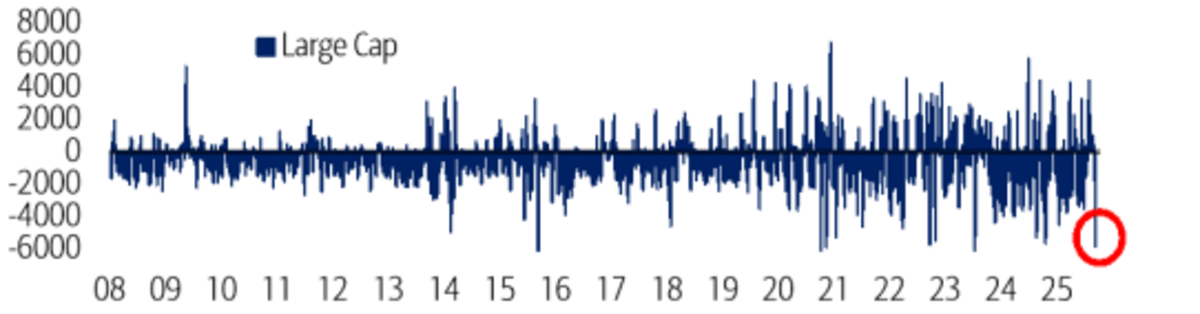

On Wednesday, BofA Securities said that individual large cap stocks saw net outflows of $5.2 billion, the largest weekly outflows since Oct. 2024. Clients of the bank were "net sellers of U.S. equities for the second straight week." Hedge funds, institutional investors, and private client customers were net sellers for their third consecutive week. Bank of America

Much of those individual stock sales seem to have cropped up in more diversified exchange-traded funds, especially sector-specific ones.

Individual tech stocks saw the largest outflows among the 8 of 11 sectors that experienced investor flight. However, tech was the leading sector among nine sectors that experienced ETF inflows.

In other words, investors are taking single stock profits from tech and buying multi-stock exposure through ETFs.

However, there seems to be a larger rotation taking place, aside from simply moving from single stocks to ETFs. Bank of America notes that investors have also been embracing Blend and Value ETFs, as well as Dividend ETFs. They saw the largest inflows after the Federal Reserve's recent 25 basis point cut.

Small caps also continued to draw attention from the Fed cut, now seeing inflows in three or the past four weeks. Deposits into other diversified strategies, including large and broad market ETFs also continued, while mid caps lost ground.

The positioning comes amid an unseasonably strong September for equities. Historically, September is the worst month for U.S. stocks. However, amid mounting optimism around easing interest rates, investors have pounded the table. Over the last month, the NASDAQ Composite has risen more than 4.66%.

It also comes just in time before the market's 'most wonderful time of the year.' The fourth quarter traditionally brings strong returns for stocks. However, investors are grappling with increasingly rich equity valuations, plus worries that Fed-flavored excitement might not live into the historically strong period of the year.

What's Your Reaction?