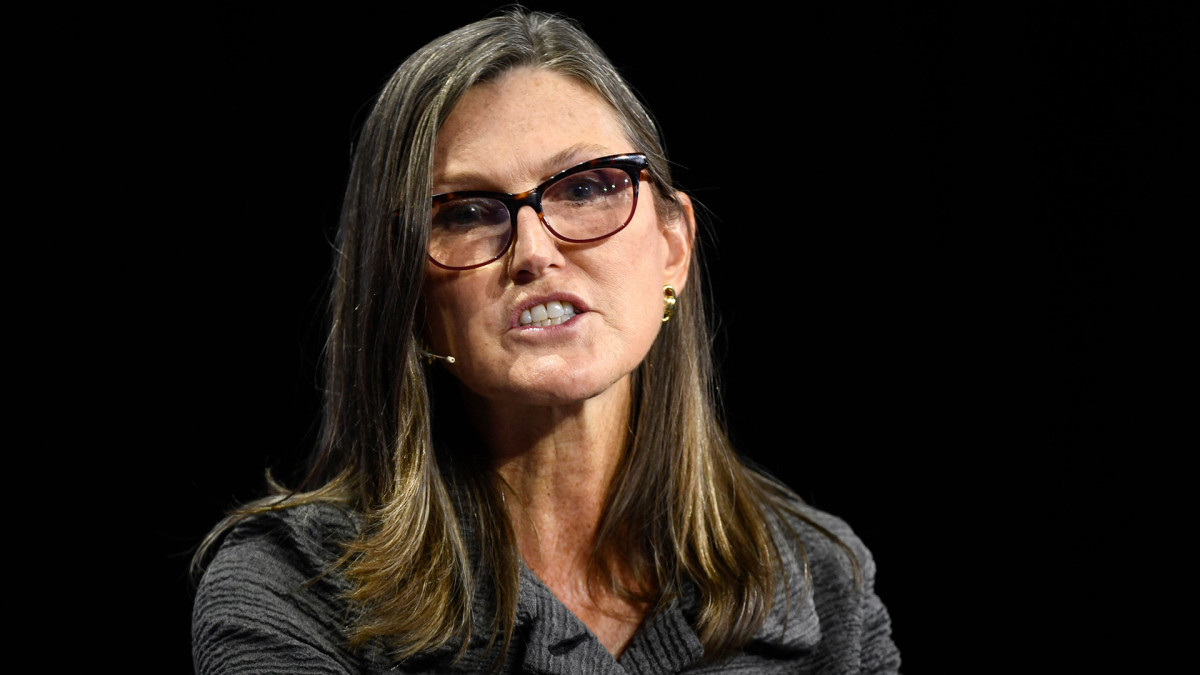

Cathie Wood buys $18.5 million of popular AI stock

Here are Cathie Wood’s latest moves.

Cathie Wood, head of Ark Funding, on the overall buys tech stocks she believes can hang a disruptive impact on the prolonged lumber. Continuously she chases stocks at excessive costs, believing their prolonged-term potential outweighs transient volatility.

Right here's what she dazzling did, including shares of a approved AI stock nearing an all-time excessive on June 16.

Wood’s funds hang experienced a unstable hotfoot this yr, swinging from robust gains to provocative losses and now attend to outperforming the broader market.

In January and February, the Ark funds rallied as investors wager on the Trump administration's potential deregulation that may per chance wait on Wood’s tech bets. But the momentum worn in March and April, with the funds trailing the market as high holdings—in particular Tesla, her biggest role —slid amid rising concerns over the macroeconomy and alternate policies.

Connected: Frail analyst unveils fearless ticket goal for Tempus AI stock

Now, the fund is regaining momentum. As of June 18, the flagship Ark Innovation ETF (ARKK) is up 15.9% yr-to-date, outpacing the S&P 500’s 1.9% derive.

Wood had a outstanding derive of 153% in 2020, which helped derive her reputation and attract precise investors. Her strategy can lead to provocative gains at some level of bull markets, nonetheless moreover painful losses, bask in in 2022 when ARKK dropped more than 60%.

As of June 17, Ark Innovation ETF, with $5.5 billion underneath administration, has delivered a 5-yr annualized return of unfavorable 0.3%. The S&P 500 has an annualized return of 15.7% over the identical duration. Image source: Fallon/AFP through Getty Pictures

Cathie Wood’s investment strategy defined

Wood’s investment strategy is easy: Her Ark ETFs every now and again buy shares in emerging excessive-tech companies in fields equivalent to man made intelligence, blockchain, biomedical skills, and robotics.

Wood says these companies hang the aptitude to reshape industries, nonetheless their volatility results in main fluctuations in Ark funds' values.

Connected: Cathie Wood's win rate: The Ark Invest CEO's wealth & earnings

The Ark Innovation ETF worn out $7 billion in investor wealth over the ten years ending in 2024, per an prognosis by Morningstar’s analyst Amy Arnott. That made it the third-biggest wealth destroyer amongst mutual funds and ETFs in Arnott’s rating.

Wood now not too prolonged ago acknowledged the U.S. is coming out of a three-yr “rolling recession” and heading exact into a productivity-led recovery that may per chance living off a broader bull market.

In a letter to investors published in leisurely April, she disregarded predictions of a recession dragging into 2026, as she expects "more clarity on tariffs, taxes, guidelines, and fervour charges over the next three to 6 months."

"If the most up-to-date tariff turmoil results in freer alternate, as tariffs and non-tariff boundaries attain down in tandem with declines in lots of taxes, guidelines, and fervour charges, then exact GDP declare and productivity should surprise on the excessive side of expectations at some level at some level of the 2d half of of this yr," she wrote.

She moreover struck an optimistic tone for tech stocks.

"All the map throughout the most up-to-date turbulent transition within the US, we contemplate customers and businesses tend to scramble the shift to technologically enabled innovation platforms including man made intelligence, robotics, vitality storage, blockchain skills, and multiomics sequencing," she acknowledged.

Now not all investors fragment this optimism. All the map throughout the final yr, the Ark Innovation ETF saw $2.4 billion in win outflows, with $275 million exiting the fund in dazzling the previous 5 days, per ETF evaluate company VettaFi.

Cathie Wood buys $18.5 million of Nvidia stock

On June 16, Wood’s Ark Innovation ETF bought 128,163 shares of Nvidia (NVDA) . That chunk of stock changed into valued at roughly $18.5 million.

Wood had previously bought all her Nvidia stake in 2022. She began shopping for Nvidia stock in early April amid a brutal promote-off triggered by tariff tensions and tightened export restrictions on stepped forward chips.

Connected: Cathie Wood sells $9.5 million of approved AI stocks after big rally

Since then, Wood has been regularly including Nvidia shares as the stock rebounded after the U.S. and China agreed to temporarily nick tariffs on each and each lots of. Optimism moreover grew after the Trump administration scrapped the Biden-era AI diffusion rule, one more export administration on stepped forward AI chips.

On May 28, Nvidia reported robust fiscal first-quarter results. Adjusted earnings of 96 cents per fragment on $44.06 billion in earnings for its fiscal first quarter surpassed Wall Street’s expectations of 93 cents and $43.31 billion.

Nonetheless, the firm forecasts earnings of $Forty five billion within the July quarter, lacking analysts’ projections by nearly $1 billion. The chipmaker noteworthy that the prefer would were roughly $8 billion increased without the China export curbs.

The warfare of craftsmanship is persevering with. In maintaining with the Wall Street Journal, U.S. Commerce Division officers have an interest by new restrictions on stepped forward skills exports to China, including more limits on chip-making gear gross sales.

China stays a key market for Nvidia, accounting for 13% of its gross sales within the previous monetary yr. If the field’s two biggest economies fail to achieve a alternate deal, it may per chance hit Nvidia’s backside line.

Nvidia's CEO Jensen Huang has prolonged warned that export controls may per chance injure U.S. chipmakers and even threaten the nation’s role as the world leader in skills.

“If we desire the American skills stack to gain all the map throughout the field, then giving up 50% of the field’s AI researchers is now not gleaming," Huang now not too prolonged ago acknowledged on CNBC. "See you later as the complete AI builders are in China, you realize, I contemplate [the] China stack goes to gain.”

Extra Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock may per chance surge after grisly Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

Nvidia closed at $145.forty eight on June 18, up 8.3% yr-to-date and dazzling 2.7% below its all-time excessive of $149.41 posted in January.

In maintaining with TipRanks, Wall Street's sensible ticket goal on Nvidia stock is $173.19, which suggests an upside of 19% as analysts dwell bullish on the firm’s AI-driven declare.

Connected: High analyst sends fearless message on S&P 500

What's Your Reaction?