Cathie Wood buys $46 million of tumbling tech stock

Cathie Wood doesn’t give up on her favorite stocks easily. The head of Ark Investment Management actively manages her tech holdings, and her timing often links to market movements. Sometimes Wood buys her top holdings on the way down, hoping for a bargain. That’s what she just did. It’s been a weak ...

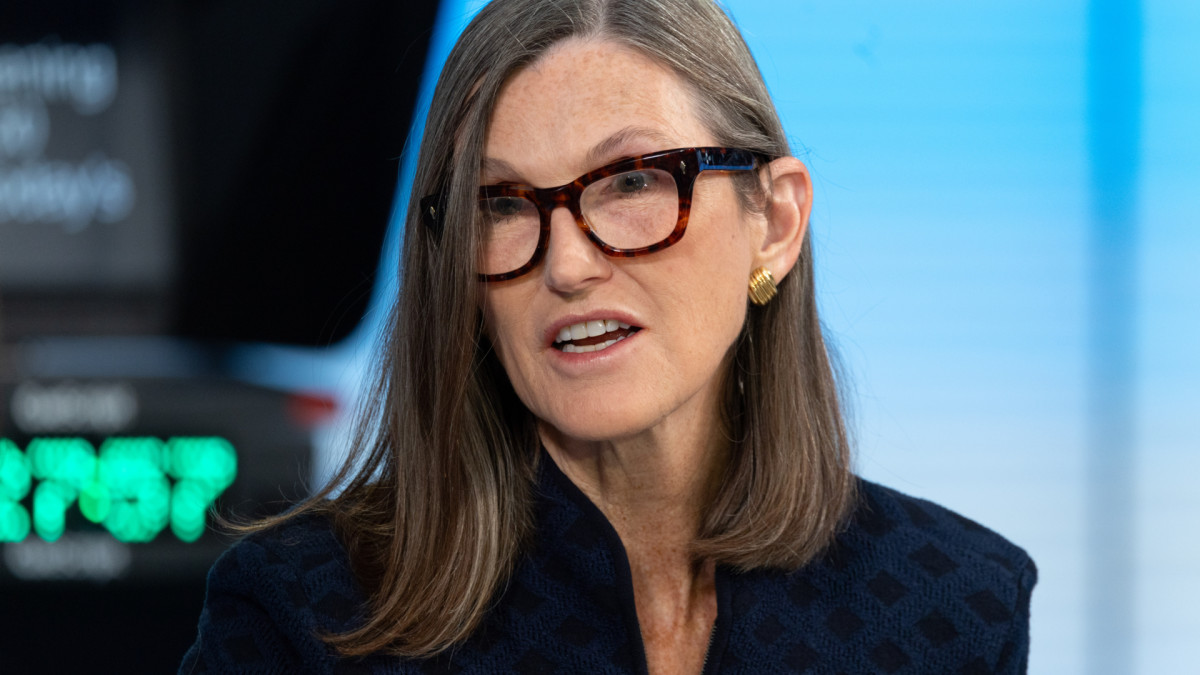

Cathie Wood doesn’t give up on her favorite stocks easily.

The head of Ark Investment Management actively manages her tech holdings, and her timing often links to market movements.

Sometimes Wood buys her top holdings on the way down, hoping for a bargain. That’s what she just did.

It’s been a weak start to the year for Wood. As of Feb. 13, Wood’s flagship Ark Innovation ETF (ARKK) was down 9.79% year to date, while the S&P 500 lost 0.14%, as pressure mounted on growth-focused tech stocks.

Wood gained a reputation after her Ark Innovation ETF delivered a 153% return in 2020. Last year, the flagship Ark Innovation ETF gained 35.49%, far outpacing the S&P 500’s return of 17.88% in the same period.

But Wood's style also brings painful losses in bearish markets, as seen in 2022, when the Ark Innovation ETF tumbled more than 60%.

Those swings have weighed on Wood’s long-term gains. As of Feb. 13, the Ark Innovation ETF has delivered a five-year annualized return of -14.67%, while the S&P 500 has an annualized return of 13.33% over the same period, according to data from Morningstar. Getty Images

Cathie Wood rejects “AI bubble”

Wood focuses on high-tech companies across artificial intelligence, blockchain, biomedical technology, and robotics. She thinks these businesses have great growth potential, though their volatility often causes fluctuations in the Ark’s funds.

From 2014 to 2024, the Ark Innovation ETF wiped out $7 billion in investor wealth, according to an analysis by Morningstar’s analyst Amy Arnott. That made it the third-biggest wealth destroyer among mutual funds and ETFs in Arnott’s ranking. The analyst hasn’t updated the 2025 ranking.

Related: Cathie Wood buys $43 million of megacap tech stock

In a letter published on Jan. 15, Wood says the U.S. economy is storing up energy for a sharp rebound in 2026.

"Despite sustained real gross domestic product growth during the past three years, the underlying US economy has suffered a rolling recession and has evolved into a coiled spring that could bounce back powerfully during the next few years," Wood wrote.

Wood also rejects the “AI bubble” talk, saying it "is years away" and "the most powerful capital spending cycle in history" is coming.

"What once was the cap in spending seems to have become a floor now that the AI, robotics, energy storage, blockchain technology, and multiomics sequencing platforms are ready for prime time," she said.

Not all investors agree with Wood’s optimism. In the 12 months through Feb. 11, the Ark Innovation ETF saw roughly $1.4 billion in net outflows, according to ETF research firm VettaFi.

Cathie Wood buys $46 million of Robinhood stock

On Feb. 11 and 12, Wood’s Ark funds bought a total of 608,483 shares of Robinhood Markets Inc. (HOOD), valued at about $46.2 million, Ark’s daily trade information shows. This was one of her largest recent purchases.

Wood’s move followed Robinhood’s mixed fourth quarter report on Feb. 10.

Related: Cathie Wood sends blunt 3-word message on stock outlook in 2026

The company posted earnings of 66 cents a share, topping the 60-cent consensus estimate, but revenue came in at $1.28 billion, below Wall Street's expectations of $1.34 billion, according to data from Investing.com.

Shares of Robinhood plunged 8.9% and 8.8% on Feb. 11 and 12, respectively.

Robinhood is known for its commission-free trading platform for investors to buy and sell stocks, as well as crypto. It generates revenue through payment for order flow (PFOF), interest earned on customer cash balances, margin lending, and subscription services.

Cryptocurrencies are a key part of Robinhood's revenue, accounting for more than 17% of the total revenue in Q4.

The pullback in Bitcoin over the past several months has weighed on Robinhood’s revenue as well as its stock performance.

Robinhood said in a press release that the Q4 revenue was "partially offset by cryptocurrencies revenue," which dropped 38%.

"There has historically been a strong correlation between the value of Bitcoin and Robinhood's stock performance," David Jagielski wrote for The Motley Fool.

Wood had a strong interest in Robinhood after it went public in 2021. However, she sold roughly 30 million Robinhood shares from Q1 2024 to Q4 2025, according to data from Stockcircle.

As of Feb. 13, Robinhood is the seventh-largest holding of the Ark Innovation ETF, accounting for roughly 4%.

Top 10 holdings of the Ark Innovation ETF as of Feb. 13, 2026:

- Tesla (TSLA) 11.53%

- CRISPR Therapeutics (CRSP) 5.89%

- Tempus AI (TEM) 5.17%

- Roku (ROKU) 4.54%

- Shopify (SHOP) 4.31%

- Advanced Micro Devices (AMD) 4.04%

- Robinhood Markets (HOOD) 3.99%

- Beam Therapeutics (BEAM) 3.78%

- Roblox (RBLX) 3.59%

- Coinbase Global (COIN) 3.26%

Barclays lowered Robinhood's stock price target to $124 from $159 and keeps an overweight rating following the Q4 report, The Fly reported on Feb. 11.

The analyst said Robinhood is still pursuing “ambitious” long-term goals, but warned that a recent slowdown in net new asset growth could pressure the stock. Barclays also linked the weak Q4 results to lower take rates in options and crypto, which reduced transaction revenue.

Robinhood stock closed at $75.97 on Feb. 13 and is down 32.8% year to date.

Related: Veteran trader makes eye-popping call on Palantir amid software slump

What's Your Reaction?