Dave Ramsey, AARP sound alarm on 401(k)s, IRAs

In my 30-plus years reporting and publishing financial journalism, I've observed one major piece of advice on which personal finance authors and experts agree: Don't rely on Social Security alone for retirement income. The average Social Security monthly paycheck frequently changes. "For example, ...

In my 30-plus years reporting and publishing financial journalism, I've observed one major piece of advice on which personal finance authors and experts agree: Don't rely on Social Security alone for retirement income.

The average Social Security monthly paycheck frequently changes.

"For example, the estimated average monthly Social Security retirement benefit for January 2026 is $2,071," explained the Social Security Administration (SSA).

Related: AARP, SSA warn retirees about new benefit reductions

I took that number and multiplied it by 12 to calculate an annual total of $24,852 in Social Security income.

The poverty level in the U.S. for a 2-person household is $21,640, according to the Department of Health and Human Services. So the average Social Security annual benefit is only $3,212 (about 12.9%) above the poverty line.

As they realize that Social Security is not going to provide them with the retirement lifestyle of their dreams, American workers often look at saving and investing options that will help them achieve a retirement income that makes Social Security just a small piece of their post-career finances.

"Making Social Security the main ingredient of your retirement plan? That’s a recipe for disaster," personal finance bestselling author Dave Ramsey wrote.

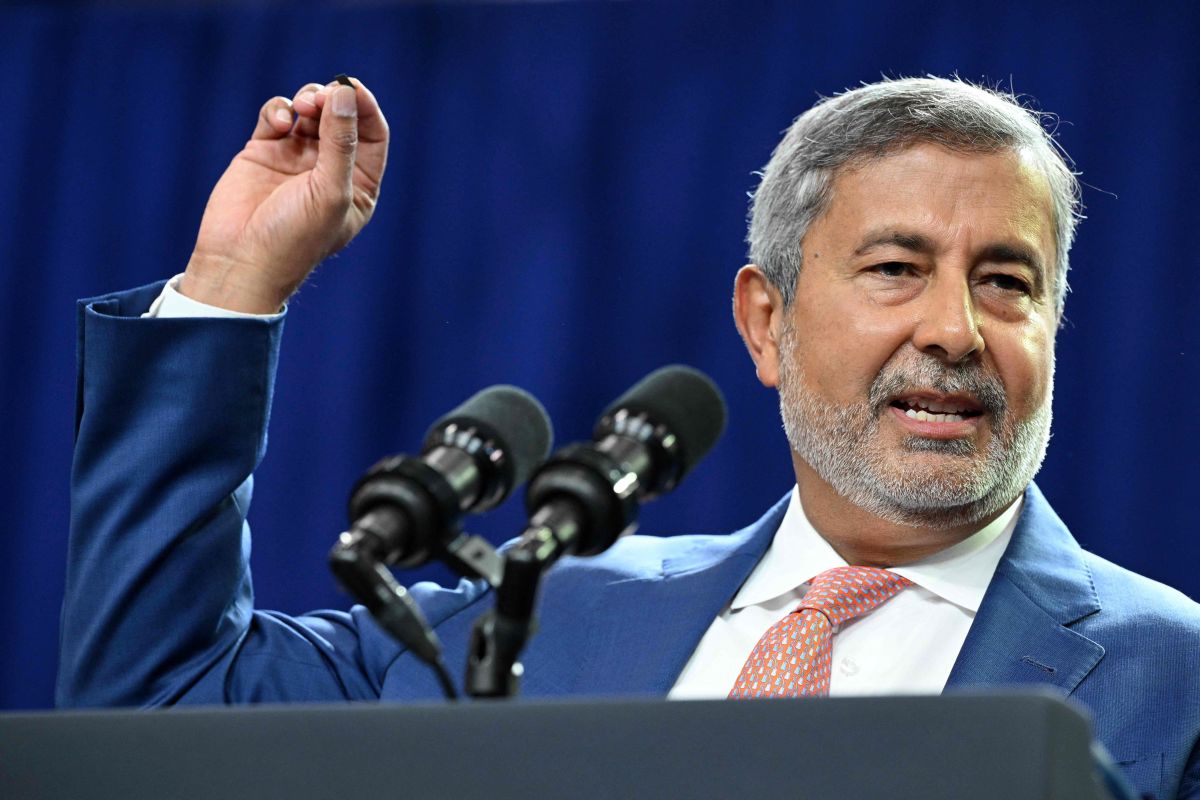

Ramsey and AARP — the advocacy group for older Americans — explain important details about the popular and often successful strategy of using 401(k) plans and Individual Retirement Accounts (IRAs) to retire comfortably. Shutterstock

Dave Ramsey recommends 401(k) plans

A 401(k) is an employer-sponsored program designed to help workers build a nest egg for the future.

You choose how much of your paycheck you want to contribute — either a set dollar amount or a percentage of your salary — and that portion is automatically deducted and placed into your retirement account.

"According to The National Study of Millionaires, 8 out of 10 millionaires built their wealth through their company’s 401(k)," Ramsey wrote. "If all those people used a boring old 401(k) to get to millionaire status, you can too!"

Advantages of using a 401(k)

- Contribution limits rise in 2026, allowing up to $24,500 in annual contributions to a 401(k). Individuals aged 50 and older can contribute an extra $8,000, bringing their total possible contribution to $32,500. (Source: Internal Revenue Service)

- Many employers offer matching contributions, which can effectively double the portion you contribute up to the match limit. Matching is optional for employers, but when it’s available, it provides an immediate and significant boost to your savings. (Source: Ramsey Solutions)

- Traditional 401(k) contributions are made with pretax dollars, which reduces your taxable income for the year and can lower the amount you owe when filing taxes. (Source:Internal Revenue Service)

- All funds you contribute to your 401(k) belong to you, and you can move your balance to an IRA if you change jobs or if your employer closes. (Source: Ramsey Solutions)

AARP explains advantages of a Roth IRA

Many advisers favor Roth IRAs because they offer the benefit of tax‑free withdrawals in retirement. It’s an appealing perk.

Still, if you’ve accumulated substantial savings in a traditional 401(k), it’s worth pausing before shifting that money into a Roth. The future tax break comes with an immediate cost — you may face a significant tax bill at the time of conversion.

"That doesn’t necessarily mean you should abandon a Roth conversion. Just be sure you understand the pitfalls and can navigate around them," AARP wrote.

More on personal finance:

- Zillow forecasts big mortgage change for U.S. housing market

- AARP sounds alarm on major Social Security problem

- Dave Ramsey bluntly warns Americans on 401(k)s

A Roth IRA uses money you’ve already paid taxes on, so when you take funds out later in life, those withdrawals come out free of both taxes and penalties as long as you’re at least 59-and-a-half and the account has been open for five years.

Unlike a traditional IRA, there’s no requirement to begin taking minimum distributions at 73, which lets the balance keep growing without interruption.

"And if you leave the asset to your children, they can take tax-free withdrawals as long as they deplete the account in 10 years," AARP wrote.

AARP clarifies 401(k)-to-Roth-IRA conversion drawbacks

- You must pay income taxes on any pretax dollars you convert to a Roth account, which can make the strategy costly.

- Paying the tax bill with funds from outside your 401(k) is generally preferable because using money from the account itself reduces the balance available for future tax‑free growth.

- A large conversion can raise your taxable income enough to push you into a higher tax bracket, increasing the tax rate applied to your other earnings.

- Converting to a Roth increases your adjusted gross income (AGI), which may trigger higher Medicare Part B premiums.

- In 2026, the standard monthly Medicare Part B premium is $202.90, but individuals with AGI above $109,000 and couples above $218,000 may pay between $284.10 and $689.90 per month.

- Medicare’s high‑income surcharge is usually based on your tax return from two years earlier, meaning a conversion today could raise your premiums in a future year without much warning.

- A higher AGI from a Roth conversion also raises the chance that part of your Social Security benefits will be taxed.

- The IRS determines Social Security taxation using “provisional income,” which includes your AGI, any tax‑exempt interest, and half of your Social Security benefits.

- If provisional income falls between $25,000 and $34,000 for single filers or $32,000 and $44,000 for joint filers, up to 50 percent of benefits may be taxable.

- If provisional income exceeds $34,000 for individuals or $44,000 for couples, as much as 85 percent of benefits may be taxable.

- Withdrawals from a 401(k) used in a Roth conversion count toward these income thresholds and can increase the taxable portion of your benefits.

(Source:AARP)

Related: Dave Ramsey bluntly warns Americans on 401(k)s

What's Your Reaction?