Dave Ramsey has blunt advice on 401(k)s and Roth IRAs

Millions of American workers planning for retirement understand that Social Security paychecks are not enough money on which to depend for income when their careers are over. As 2025 comes to a close, the average monthly Social Security benefit is around $2,000, according to the Social Security ...

Millions of American workers planning for retirement understand that Social Security paychecks are not enough money on which to depend for income when their careers are over.

As 2025 comes to a close, the average monthly Social Security benefit is around $2,000, according to the Social Security Administration (SSA). This only works out to about $24,000 annually — barely above the poverty level of $21,150 for a two-person household, the U.S. Department of Health and Human Services writes.

Related: AARP raises a red flag on Social Security, Medicare

Workers identify employer-sponsored 401(k) plans and Individual Retirement Accounts (IRAs) as sources of retirement income well-worth saving for.

"A traditional IRA is a tax-advantaged personal savings plan where contributions may be tax deductible," according to the Internal Revenue Service (IRS). "A Roth IRA is a tax-advantaged personal savings plan where contributions are not deductible but qualified distributions may be tax free."

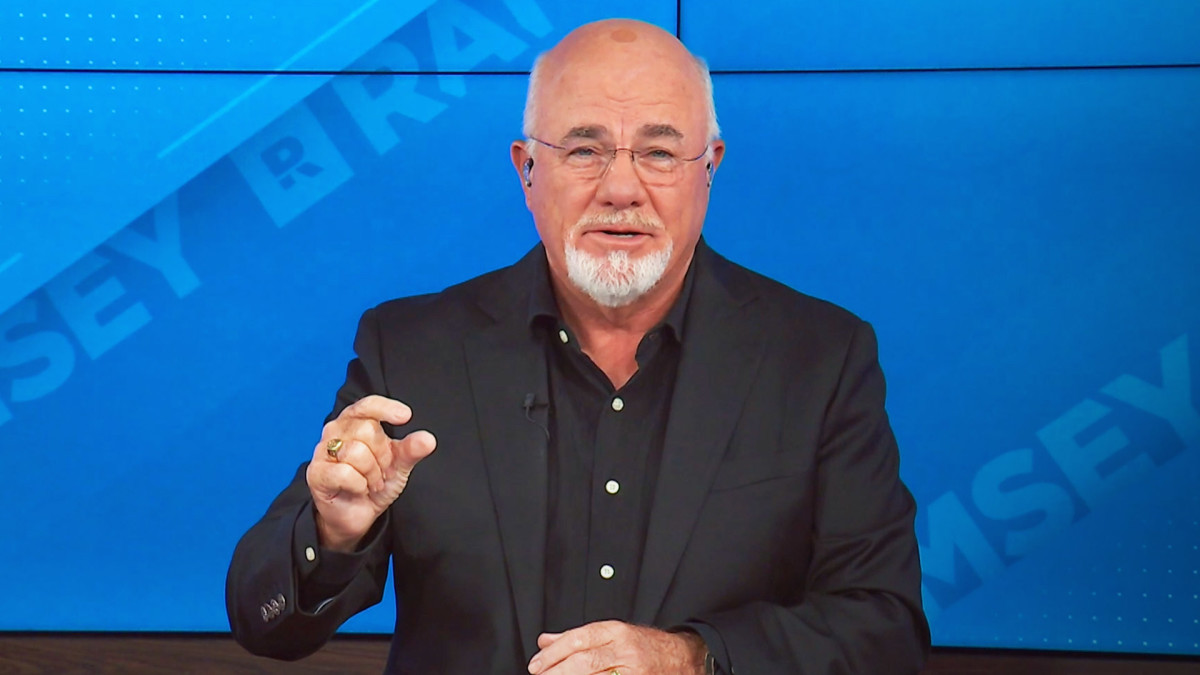

Bestselling personal finance author Dave Ramsey discusses both 401(k)s and IRAs to help Americans understand important things to know about them.

"Your 401(k) and Roth IRA are two of the most powerful tools you can use to save for retirement," Ramsey wrote.

Dave Ramsey explains 401(k), Roth IRA basics

Both retirement savings tools are effective ways of preparing for life after work.

"A Roth IRA is an account that allows you to save a certain amount each year for retirement. But what makes a Roth IRA one of the best retirement savings options is that it includes tax-free growth and tax-free withdrawals once you retire," according to Ramsey.

More on personal finance:

- Dave Ramsey warns Americans on critical Medicare mistake to avoid

- Finance author sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

"A 401(k) is a retirement savings plan that’s sponsored by an employer. With a traditional 401(k), employees decide how much of their paychecks to invest automatically in their account," he continues. "The money you put in is tax-deferred, meaning you won’t pay income taxes on that money . . . yet."

"But years from now, when you retire and start pulling from your 401(k) savings, those withdrawals will be taxed at whatever the income tax rate is when you take it out."

Dave Ramsey outlines Roth IRA benefits

- Broader investment choices: A Roth IRA isn’t restricted by an employer or plan administrator, giving you access to thousands of mutual funds. More flexibility means greater control over how you invest, Ramsey emphasized.

- Independent of your job: You can open a Roth IRA whenever you choose, regardless of where you work. Your account stays with you, eliminating the hassle of managing multiple old workplace plans.

- Ongoing contributions: You can make contributions to your Roth IRA after you reach age 70-and-a-half, according to the IRS.

- No mandatory withdrawals: Roth IRAs don’t require you to take distributions at a certain age, allowing your savings to continue growing for as long as you keep the account.

- Option for a spousal IRA: Married couples can fund a Roth IRA for a spouse who doesn’t earn income. The working spouse can contribute to both accounts, unlike a 401(k), which only allows contributions from the employee participating in the plan.

Dave Ramsey explains 401(k)s for retirement savings

- If your employer matches your contributions (and most do), you get an instant 100% return on part of the money you invest in your 401(k). "That’s free money. Take it!" Ramsey wrote.

- Tax-deferred growth means your money grows faster.

- Pretax contributions lower your taxable income, which makes it easier to invest more.

- You can invest up to $24,500 in 2026 (and if your spouse has a 401(k), they can also invest that amount). If you’re 50 or older, the contribution limit increases to $32,500 per year to help you catch up, according to the IRS.

Ramsey clarifies 401(k) rollovers to IRAs

A 401(k) rollover lets you move the money from a former employer’s 401(k) into an IRA or into the retirement plan at your new workplace.

Because rollover funds aren’t treated as IRA contributions, the amount you transfer doesn’t count toward your yearly IRA contribution cap. You can roll over any balance, and you can complete as many 401(k) rollovers in a year as you choose.

"So if you have thousands of dollars just sitting inside a dozen (or more) 401(k) accounts from old jobs, you could turn around and roll over every single penny from each of those accounts into an IRA without a problem!" Ramsey explained.

Related: Dave Ramsey warns Americans on Social Security, 401(k)s

What's Your Reaction?