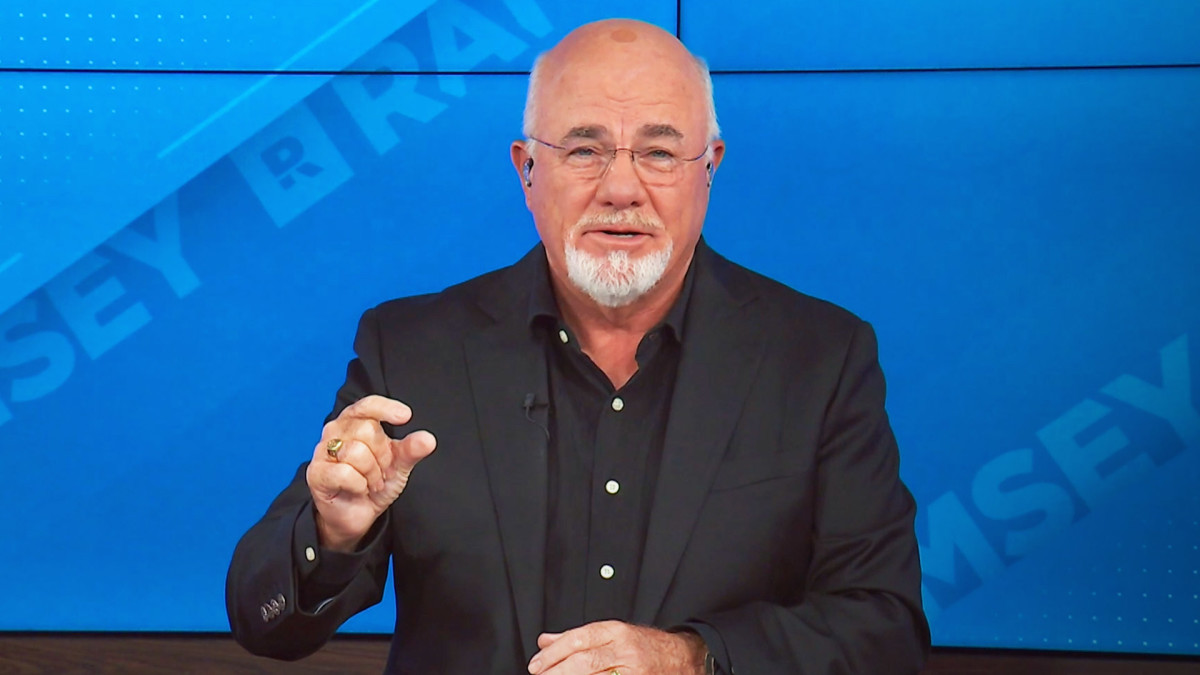

Dave Ramsey sends urgent message on 401(k)s, IRAs

The arrival of Thanksgiving Week signals the beginning of the holiday season that stretches through December and into the new year. As American workers look forward to some much-needed time off and leisure activities with family and friends, many are also considering the financial implications that ...

The arrival of Thanksgiving Week signals the beginning of the holiday season that stretches through December and into the new year.

As American workers look forward to some much-needed time off and leisure activities with family and friends, many are also considering the financial implications that come with the rapidly approaching end of the calendar year.

Personal finance bestselling author Dave Ramsey wants his readers and followers to know about some important details that people with 401(k) plans and Individual Retirement Accounts (IRAs) would be wise to recognize.

Related: Dave Ramsey warns Americans on wrong way to buy a car

For one, 401(k) contributions must be made through an employer's payroll by Dec. 31, 2025 to count for the 2025 tax year, according to the Internal Revenue Service (IRS).

People have until April 15, 2026 (Tax Day) to add to their IRAs for those contributions to count for the 2025 tax year, the IRS explains.

For 2025, people can contribute up to $23,500 to their 401(k) — and if they’re age 50 or older, they’re allowed an additional $7,500 catch-up contribution.

For IRAs, the limit is $7,000, with a $1,000 catch-up contribution available if one is 50 or older.

Dave Ramsey explains traditional 401(k) vs. Roth 401(k)

Contributions to a traditional 401(k) are made on a pre-tax basis, meaning they reduce taxable income in the year they are made and are not subject to income tax at that time, Ramsey explains.

The tax benefit occurs when filing a return because the contributions lower the overall taxable income for the year.

However, withdrawals from a traditional 401(k) in retirement are treated as ordinary income, and taxes are owed on the amounts withdrawn, including contributions, employer contributions, and any investment earnings.

"You get the tax break now, but you’ll have to pay the tax man somewhere down the line," Ramsey wrote.

More on personal finance:

- Dave Ramsey warns Americans on critical Medicare mistake to avoid

- Finance author sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

A Roth 401(k) is funded with after-tax dollars, meaning contributions are taxed before they enter the account.

Unlike a traditional 401(k), these contributions do not reduce taxable income in the year they are made. However, qualified withdrawals in retirement, including both contributions and investment earnings, are tax-free.

"Both types of tax advantages are great, but if your employer offers a Roth 401(k), we always recommend taking that option," Ramsey wrote. "Allowing your money to grow tax-free for decades and then not having to worry about taxes when you’re living out your retirement dreams? Sign us up!"

Dave Ramsey's advice on IRAs

An IRA is a type of savings account designed for retirement that provides tax benefits, Ramsey explains.

Depending on the type of IRA, a person may receive a tax deduction on contributions with tax-deferred growth, or they may benefit from tax-free growth and withdrawals later.

But it’s important to note that an IRA is not an investment itself, Ramsey clarifies.

"It’s the account that holds your investments and determines how they’re taxed by the government," he wrote.

Traditional IRA facts

- Traditional IRAs are funded with pretax dollars, meaning contributions can be deducted from taxable income in the year they are made, according to the IRS.

- Taxes are deferred until retirement, when withdrawals are subject to ordinary income tax on both contributions and investment earnings.

- There are no income limits for opening or contributing to a traditional IRA, as long as the individual has taxable income.

- Required minimum distributions (RMDs) must begin after age 73, ensuring that taxes are eventually paid on the funds in the account.

Roth IRA facts

- Roth IRAs are funded with after-tax dollars, meaning contributions are taxed before entering the account, according to the IRS.

- Qualified withdrawals in retirement, including contributions and investment earnings, are not subject to income tax.

- Eligibility to contribute depends on income; for 2025, the limit is $165,000 for single filers and $246,000 for married couples filing jointly.

- Roth IRAs do not require minimum distributions, allowing funds to remain in the account indefinitely.

- Individuals with income above the contribution limits may use a backdoor Roth IRA strategy, which involves contributing to a traditional IRA and then converting those funds to a Roth IRA.

Related: Dave Ramsey sends strong message on buying and selling homes

What's Your Reaction?