DeepSeek selloff was more about Nvidia stock than AI

The stock market's rush to dump tech stocks on DeepSeek news could be a prime buying opportunity.

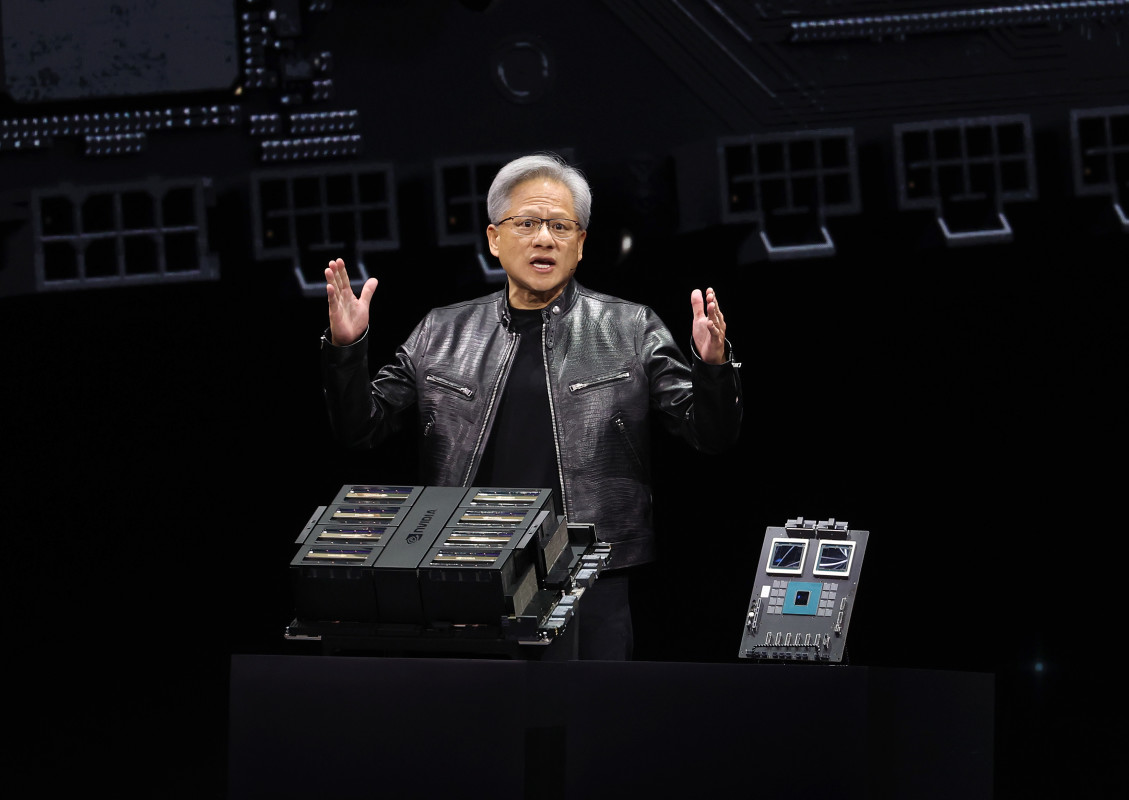

U.S. tech shares tumbled after Chinese language startup DeepSeek unveiled a low-tag AI chatbot, sparking concerns in regards to the sky-high valuations of tech giants cherish Nvidia and Microsoft. Patrick Moorhead, chief analyst at Moor Insights, joined TheStreet to dispute why the market's response used to be overblown.

Linked: These tech shares rallied regardless of DeepSeek drubbing

Paunchy Video Transcript Under:

CONWAY GITTENS: So bid me, you know, we noticed a vast fright in the tech sector after this low tag Chinese language man made intelligence mannequin from DeepSeek tech emerged on the scene. Are you able to fracture down why we noticed such a vast promote off? And why is there such a perceived possibility from DeepSeek tech?

PATRICK MOORHEAD: Yeah so first of all, any perceived possibility into the bull case for Nvidia (NVDA) , given its appreciation of its inventory, is always met with a vast promote off. And that is the reason what that's what we noticed here. And the major thesis, or where there used to be perceived possibility, used to be that a firm of about a 100 of us in China used to be ready to originate what it appeared that others took billions to make investments in, cherish the open eyes of the sphere, and so they spent $5.6 million to make that. So one may raise out that which way that folk don't desire as mighty Nvidia infrastructure, or any firm affiliated or in or round Nvidia, cherish an AMD (AMD) or a Broadcom (AVGO) or a Marvell (MRVL)

CONWAY GITTENS: So is what we noticed an overreaction? I'm good asking that because there is some these which may be questioning whether the validity of what is popping out of DeepSeek. We're already listening to news that Alibaba has an AI mannequin that beats out DeepSeek. Microsoft (MSFT) is weighing in that perchance the system DeepSeek obtained this used to be by an open AI to launch with. So where make you stand on all this?

PATRICK MOORHEAD: So where I stand on it, after striking my team and myself grinding by white papers and talking and doing channel tests is that minute or no has modified. Even as you occur to deem at the wheel of serious language fashions and the improvements that streak into it, there is always a tag reduction effort or a tag reduction cross. I don't mediate that it charges a $5.6 million to to to coach this mannequin. It takes 100 of hundreds and hundreds of bucks to make this. After which you completely salvage to trail the AI, which is lovingly referred to as inference. And that takes a big quantity of cash to stand that up. So our perception is that unless we salvage to AGI at some level in the end, for in relation to every single project that we make, and this can be 5 to 10 years while you occur to develop that to the brink and things cherish robotics. This infrastructure accomplish out will proceed. So and it is furthermore it is it is less about coaching. It is largely about inference. So I make mediate that this used to be a minute little bit of overdone, a lot overdone. However we're silent seeing plot of possibility and fright on the market, which is understandable given the trail up of Nvidia.

CONWAY GITTENS: So then as an funding thesis, this promote off that we noticed in tech, how make you present an explanation for it. Procuring opportunity. Does it cross you into wait and deem mode or make you good double down?

PATRICK MOORHEAD: I mediate it is miles a procuring for opportunity and I have been very consistent for the past two years. Is this this? Nothing stops this accomplish out unless investors are striking stress on the good cap magazine seven to diminish their Capex, and that's the reason no longer going to occur. So I make deem it as a procuring for opportunity. The perchance the unknown procuring for opportunity may very properly be these downstream tickers, apt. The appliance firms, the these that in truth salvage to speak the watch to their firms. All once more, assist to Microsoft, Adobe, ServiceNow, SAP. I we mediate are going to be big beneficiaries downstream. It good hasn't clicked in yet. Of direction it is clicked in for Microsoft, but that used to be more associated to the advantages that they're being ready to fetch from open AI infrastructure and Azure AI versus a companies that their stop clients are procuring for.

Thought Extra Movies:

- This frequent budgeting mistake is that if truth be told costing you cash

- Tariffs likely obtained't lead to better prices, top economist says

- How automation is changing legitimate sports

- Diversification just will not be if truth be told what it extinct to be — How legends make investments

What's Your Reaction?