Elizabeth Warren slams Paramount's hostile Warner Bros. bid

Antitrust laws, in theory, are designed to preserve competition, ensuring markets remain open to innovation and preventing dominance from stifling consumer choice. It's no wonder, then, that soon after Netflix (NFLX) announced Dec. 5 that it would buy Warner Bros. Discovery (WBD) for $72 billion — ...

Antitrust laws, in theory, are designed to preserve competition, ensuring markets remain open to innovation and preventing dominance from stifling consumer choice.

It's no wonder, then, that soon after Netflix (NFLX) announced Dec. 5 that it would buy Warner Bros. Discovery (WBD) for $72 billion — and Paramount Skydance (PSKY) followed up Dec. 8 with a hostile offer made directly to Warner shareholders for $74.4 billion (about $30 billion in cash) — concerns about any resulting combined market share were quickly raised.

On Dec. 7, President Trump was asked about whether the scope of the proposed deal between Netflix and Warner Bros. might be a problem.

"There's no question about it," Trump said, according to the Associated Press.

Related: Netflix quietly drops Warner Bros. Discovery cable channels in sale

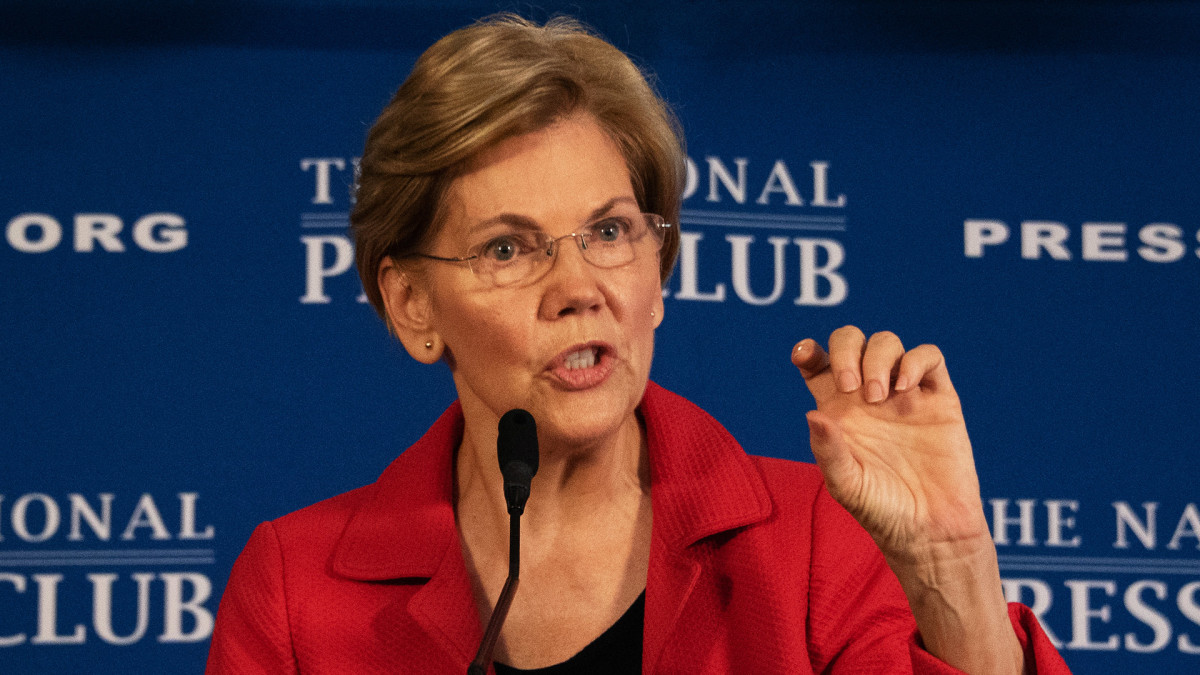

In response to the news that Paramount was pursuing a hostile bid for Warner Bros., Sen. Elizabeth Warren (D-Mass.) wasted no time explaining her view on the developments.

“A Paramount Skydance-Warner Bros. merger would be a five-alarm antitrust fire and exactly what our anti-monopoly laws are written to prevent," Warren said in a statement.

Elizabeth Warren calls out Paramount's Trump ties

Warren, who has a demonstrated history of raising concerns about political favoritism and antitrust matters — particularly regarding the Trump administration — explained what she sees as ties between the current White House and Paramount.

"Paramount Skydance’s new hostile bid is backed by a who's who of Trump buddies, from Jared Kushner’s private equity firm to the Ellison family to money flowing from the Middle East — raising serious questions about influence-peddling, political favoritism, and national security risks," Warren said.

"The Department of Justice and the Committee on Foreign Investment in the United States must review any Warner Bros. deal based on the law and facts, not who sucked up the most to Doland Trump,” she added.

Senator Warren bluntly speaks on media mergers

Media mergers have been high on Warren's agenda for some time, particularly in relation to concerns about monopolies. Her Senate office released the following timeline:

- Dec. 5: Senator Warren reacted to Netflix securing Warner Bros., describing the outcome as an “anti-monopoly nightmare.”

- Nov. 21: During an appearance on The Late Show with Stephen Colbert, Warren criticized Paramount Skydance CEO David Ellison directly on his own network.

- Nov. 19: Warren, joined by Senators Bernie Sanders (I‑Vt.) and Richard Blumenthal (D‑Conn.), wrote to DOJ Antitrust Division head Abigail Slater, cautioning that a Warner Bros. deal could be compromised by favoritism and corruption.

- August 1: Warren issued a statement after receiving replies from Paramount and Skydance to her inquiries, labeling the responses “dodgy” and demanding an independent investigation into possible criminal conduct tied to their multi‑billion‑dollar merger.

- July 24: Warren criticized the Trump administration’s approval of the Paramount Skydance merger, declaring, “Bribery is illegal no matter who is president.”

- Feb. 20: Warren urged the DOJ to thoroughly examine the proposed Disney‑Fubo merger, warning it could drive up costs for television viewers.

Netflix, Paramount deals with Warner Bros. seen by some as healthy

Another opinion contends that a hostile takeover battle is evidence of a dynamic market.

Antitrust regulators often look for signs of rivalry, such as the existence of multiple suitors fighting for the same asset.

"If Warner Bros. fell under the Netflix umbrella, it would arguably become one of the most significant forces in the industry," wrote Collier Jennings for Collider.

"The Paramount deal challenges that, and in the process raises the idea of an even more powerful force," Jennings continued. "While Hollywood used to be defined by a collection of studios, mega-mergers are increasing certain studios' power."

Collider makes another point about the two potential deals.

"Lost in all the hubbub over the Warner Bros./Netflix/Paramount kerfuffle is the fact that Netflix would only acquire Warner Bros.'s film library if its merger went through," Jennings wrote.

"Paramount, on the other hand, wants Warner Bros. in its entirety. That means its movie library and TV networks, including TNT, CNN, HGTV, the Food Network and Discovery," Jennings continued.

"On top of that, Paramount would also potentially acquire HBO and HBO Max, which would deal Netflix another major blow as it wouldn't be the biggest streaming game in town."

Related: White House demands have unexpected impact on Warner Bros. sale

What's Your Reaction?