Exxon, Chevron have more than earnings to talk about this week

A funny thing happened on Dec. 16, 2025, aside from it being the 81st anniversary of the start of the Battle of the Bulge in 1944. On that date, shares of ExxonMobil and Chevron, two heavyweights of the U.S. energy industry, both hit lows. As of the close on Jan. 28, 2026, Exxon ...

A funny thing happened on Dec. 16, 2025, aside from it being the 81st anniversary of the start of the Battle of the Bulge in 1944.

On that date, shares of ExxonMobil and Chevron, two heavyweights of the U.S. energy industry, both hit lows. As of the close on Jan. 28, 2026, Exxon is up 14.3% since Dec. 16. Chevron is up 11.3%. The S&P 500 Energy Sector is up 15.6%.

Alphabet, the best-performing Magnificent 7 tech stock since Dec. 16, is up just 9.3%.

For now, energy is having a moment

Suddenly, a piece of the stock market largely ignored in the last few years — because its components are not peddling artificial intelligence or hyper-fast semiconductors — is getting a look.

If it seems a mystery, we might get a better understanding of the causes of the moves early Friday, Jan. 30, before U.S. markets open. That's when ExxonMobil and Chevron release their first-quarter earnings, and executives will hold their earnings calls with analysts.

To be sure, the earnings aren't expected to blow people away.

Exxon Mobil is expected to earn around $1.68 per share on revenue of $81.1 billion. EPS would be up 0.6% from a year ago, with revenue down 2.8%.

Chevron's EPS are estimated at $1.51, down 26.7%, and revenue of $50.1 billion is expected, down 4% from the fourth quarter of 2025.

Both companies' shares did not generate much wow in 2025. Exxon Mobil was up 11.9%. Chevron was up 5.2%. (Google-parent Alphabet soared 67%.)

These oil businesses go way back

The oil business is not yet dead, much as environmentalists might dream. These giants, born in the 19th century by John D. Rockefeller and others, may seem like dinosaurs. But remember, Exxon was the largest company in the world by market cap in 2013, back when Apple had a really bad quarter, and Nvidia was making chips for gamers.

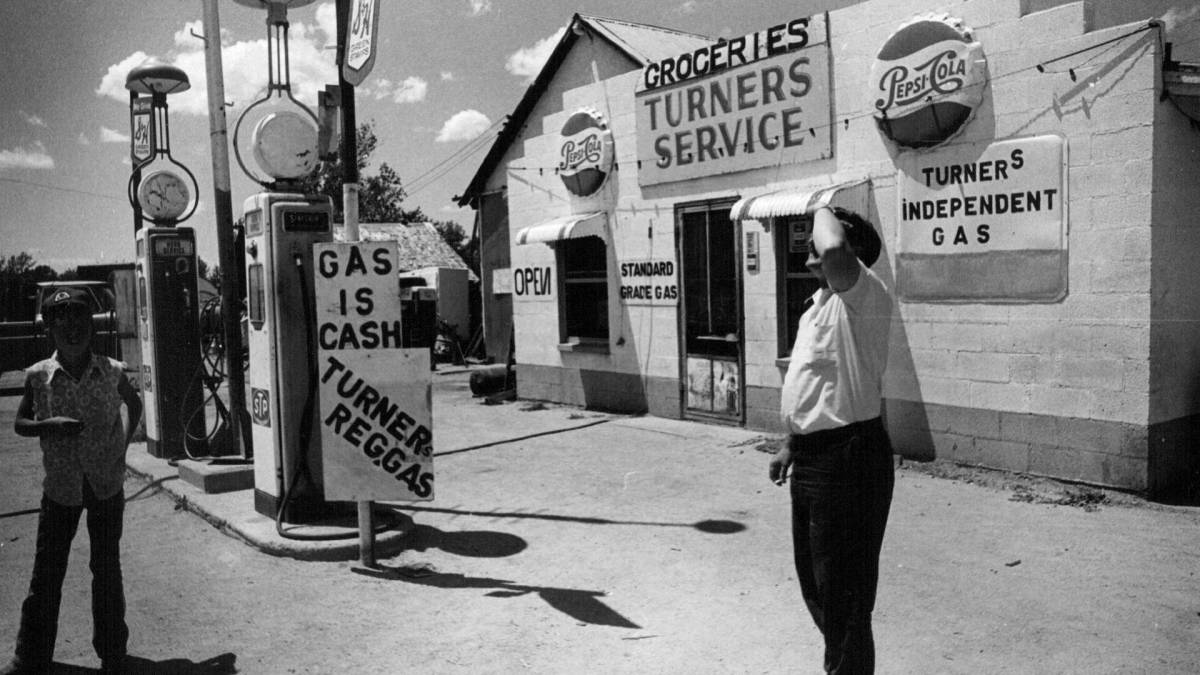

But there are people who want or need motor fuels and need them in remote locations, like the rural American West.

They have been global almost from the start, and Exxon and Chevron were members of the Dow Jones Industrial Average starting in 1928 and 1930, respectively. Exxon was taken out in 2020, replaced by... Apple.

Sometimes, the efforts work out. Chevron runs a big position in Kazakhstan. It also has a small operation in Venezuela — a country Exxon CEO Darren Woods told President Trump was "uninvestible".

In part, that's because the late Venezuelan President Hugo Chavez nationalized Exxon's interests and never paid a dime for them.

Big oil shareholders matter

Exxon Mobil and Chevron are profitable, and they make shareholders who want income happy with dividends alongside stock-price growth. The biggest shareholders in both companies are global money managers. Exxon's dividend yield is about 3% (at $4.12 a share). Chevron's $6.84 dividend yields 4.3%.

Related: Chevron, oil execs send strong message on Venezuela

Both companies are really, really stubborn about protecting those dividends and have been known to borrow the cash to pay them.

They also buy back large numbers of shares every year, protecting the stock price against the volatile nature of oil and natural gas prices.

Just how volatile can oil prices get?

Very. And this is what makes oil and gas different from Tech.

You get years like 2022, as the pandemic was easing. West Texas intermediate, the benchmark U.S. crude, jumped 60.4% between the start of the year and a peak of $121.94 per 42-gallon barrel on June 8, according to Energy Information Administration data. The average retail price of gasoline hit $5.016 a gallon, according to AAA.

And the Consumer Price Index soared that summer to an 8.5% gain for the year by July.

Chevron's revenue jumped 51% in 2022 to $236.4 billion.

More Oil and Gas:

- White House clashes with major oil company over Venezuela deal

- Venezuela oil claim could rewrite what you pay at the pump

- Venezuela oil debate reveals big mystery

But oil prices fell 60% between that 2022 peak and the end of 2025. Profits have been squeezed. Jobs have been cut, including in the Permian Basinof Texas and New Mexico, one of the largest oil-producing regions in history.

This year, crude oil is up 10%. Typically, prices fall from fall into the next year and rise when summer driving starts to pick up and gasoline is reformulated. That may shift may have started already and may explain their stock gains.

Exploration is the critical sauce

But both companies still spend big — and must spend big — on exploration and production. That's the lifeblood of the energy business. One always needs to develop new fields because existing fields get played out. It's like a clothing store that always needs to restock its shelves.

They invest billions in computing power to analyze what resources may lurk thousands of feet underground or deep in the ocean. They spend billions more to drill and extract it and billions more on top of that to refine and transport gasoline, diesel and other products to customers.

Exxon's cap-ex budget is estimated at $26 billion to $27 billion this year and $28 billion to $32 billion a year through 2030 and is expected to be concentrated in the Permian Basin and the gigantic fields found offshore Guyana in northern South America.

Chevron's 2026 cap-ex budget is $18 to $21 billion.

The earnings reports and analyst calls should include updates on those plans

Yes, it's often a horribly messy and destructive endeavor. The oil companies make enemies, and they spend millions more on lawyers.

What happens next with spending depends at least in part on what ExxonMobil and Chevron say about Venezuela. And what they decide about uncorking Venezuela's 303 billion barrels in reserves will decide what happens next to their stock prices, making this week's upcoming earnings calls critical for investors.

Related: Venezuela oil debate reveals big mystery

What's Your Reaction?