Fed split deepens as Miran calls for 1.5-point rate cut

Federal Reserve officials entered the new year divided over how much to lower interest rates after cutting them during their last three meetings of 2025. A growing number, mainly the presidents of the regional Federal Reserve banks, have come out in favor of holding rates steady, at least until ...

Federal Reserve officials entered the new year divided over how much to lower interest rates after cutting them during their last three meetings of 2025.

A growing number, mainly the presidents of the regional Federal Reserve banks, have come out in favor of holding rates steady, at least until they have more data on inflation and jobs from post-shutdown monthly reports.

Not Fed Governor Stephen Miran.

The temporary appointee of President Doland Trump said he wanted to see rates slashed by at least 100 basis points (one percentage point) this year.

Then on Jan. 8, Miran told Bloomberg Television he is looking for 150 basis points of interest-rate cuts this year to boost the cooling labor market.

Describing monetary policy as restrictive, Miran said underlying inflation is likely running at 2.3%, which means Fed officials have room to cut further.

“I’m looking for about a point and a half of cuts. A lot of that is driven by my view of inflation,” Miran said. Board of Governors of the Federal Reserve System

Miran ratchets up call for jumbo multiple cuts

Miran has been pushing aggressive cuts to the benchmark Federal Funds Rate since he was appointed to a temporary position on the board in September by President Doland Trump.

The president and his allies took office last January demanding the independent central bank drastically lower short-term interest rates to reduce the risk of stagflation and recession.

“There’s about a million Americans who don’t have jobs, who could have jobs without causing unwanted inflation,” Miran said.

Fed officials estimate a single interest-rate cut in 2026

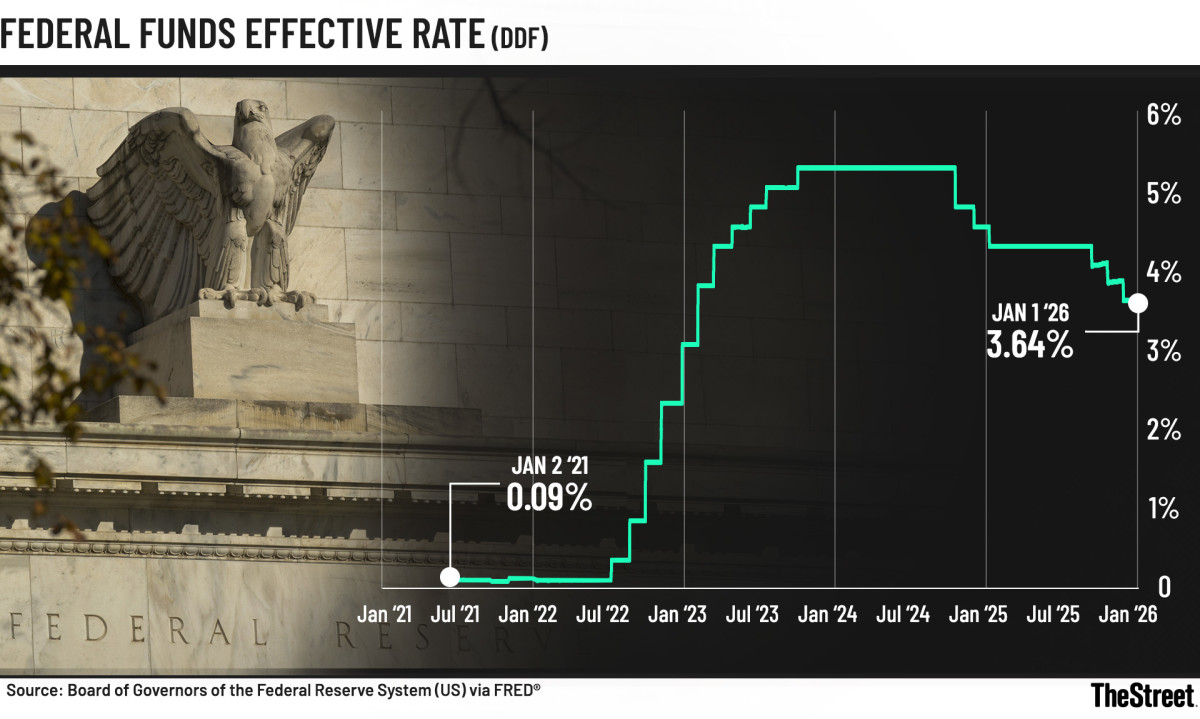

- The current Federal Funds Rate is 3.50% to 3.75%.

- The rate sets the pace for short-term borrowing including auto loans, credit cards, and home-equity loans.

- The Federal Open Market Committee, the central bank’s policymaking panel, cut the funds rate three times for a total of 75 basis points (three-quarters of a point) in 2025.

- After the December rate cut, Fed Chair Jerome Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.”

How economists measure the neutral rate

Most Fed officials currently estimate that the long-run neutral rate falls between 2.5% and 3% but roughly 4.5% to 5% when accounting for inflation.

More Federal Reserve:

- Fed official forecasts bold path for interest rates, GDP in 2026

Economists define the neutral rate, or r-star (r*), as the interest rate that keeps the economy at full employment while maintaining stable inflation around the Fed’s 2% target.

- When rates hit this level, monetary policy is neither pressing the gas pedal nor pumping the brakes on economic activity.

- It’s important to note that the neutral rate isn’t a fixed rate.

- The neutral rate fluctuates according to productivity growth, demographic trends, and global capital flows.

Markets are expecting a more dovish approach

Looking ahead to 2026, the Fed’s latest median projection or “dot plot” suggested there would be only one additional quarter-point cut. This would move the rate to around 3.25% to 3.50% by year's end.

Market expectations are slightly more dovish, calling for two rate cuts, which would push rates down closer to 3%.

President Trump has spent the past year blasting Powell and the FOMC for not lowering rates to around 1%.

The White House maintains this will stimulate the stagnant housing market and reduce the amount of interest on the nation’s debt, which currently hovers between approximately $38.4 trillion and $38.5 trillion.

FOMC meets later this month to discuss interest-rate cuts

The next FOMC meeting is Jan. 27-28, and CME Group’s widely watched FedWatch Tool dipped this week to an 11.6% chance of a quarter-percentage-point cut then.

Miran has been seeking multiple jumbo rate cuts since September, when he went on leave from his post as chair of the White House Council of Economic Advisers to fill a Fed governor term that ends this month.

Related: Interest-rate cuts may fade for 2026 borrowers: Fed official

The controversial appointment had global central bank watchers concerned for the Fed’s independence.

The White House has been on an extremely public search to replace Powell, with the president saying the final candidate to lead the independent central bank must show "loyalty" to Trump’s monetary policy demands.

Miran: Interest rates are unnecessarily high

Miran’s repeated his argument that the current stance of policy remains well above his estimate for neutral, the level at which rates neither stimulate nor restrain the economy.

But his policy prescription for 2026 would lower rates even below that.

Asked about that stance, Miran said it was appropriate because the Fed has for so long been holding rates unnecessarily high.

“If we hadn’t been keeping policy, in my view, too tight over the last year or so, it wouldn’t be necessary to provide that kind of accommodation,” he said.

“The danger in cutting that quickly is that the Fed would be acting on a very narrow interpretation of inflation progress,” said Sarah House, senior economist at Wells Fargo. “Core price pressures have eased but they’re not convincingly at target, and the labor market hasn’t weakened enough to justify jumbo cuts unless growth deteriorates sharply.”

Other Fed officials urge a wait-and-see approach to rate cuts

Richmond Fed President Tom Barkinsaid on Jan. 6 the current level of rates were “within the range of its estimates of neutral,” referring to the “dot plot” projections published in December.

Last year’s 75 basis points of policy easing means interest rates are now within the range of estimates for the so-called neutral rate, Barkin said, which he likened to taking out insurance, according to Bloomberg.

“But going forward, policy will require finely tuned judgments balancing progress on each side of our mandate,” Barkin said.

- Minneapolis Fed chief Neel Kashkari on Jan. 5 said his guess was that “we’re pretty close to neutral right now.”

- Like Kashkari, Philadelphia Fed President Anna Paulson is a voting member of the rate-setting Federal Open Market Committee this year. She said on Jan. 3, according to Reuters, that "some modest further adjustments to the policy rate would likely be appropriate later in the year" if her economic expectations are realized.

Miran’s term ends Jan. 31, but…

Miran said it remains unclear whether he might remain at the central bank after his term expires at the end of this month.

Many Fed watchers expect Trump will use Miran’s current seat to place his selection for the next chair on the Board of Governors. But another seat may open if Powell departs the Fed after his tenure as chair ends in May.

Related: Next Fed chair faces ‘no-win’ test as White House pushes rate cuts

What's Your Reaction?