Goldman Sachs analyst revisits AMD stock price target as slump extends

AMD shares have lost nearly $80 billion in market value over the past three months.

Evolved Micro Devices shares moved decrease over again Friday following a imprint purpose and rankings exchange from a high Wall Avenue analyst tied partly to a new venture for the AI chipmaker heading into 2025.

Evolved Micro Devices (AMD) , while currently working a particular and much away second to Nvidia NVDA within the worldwide for AI-powering chips and processors, is furthermore seeing a new and accelerating venture available within the market for personal computer programs and servers.

Softbank-owned Arm Holdings, which went public in boring 2023 with a $5 billion IPO that valued the neighborhood at around $55 billion, collects licensing charges from its chip designs and extra royalties from individual sales.

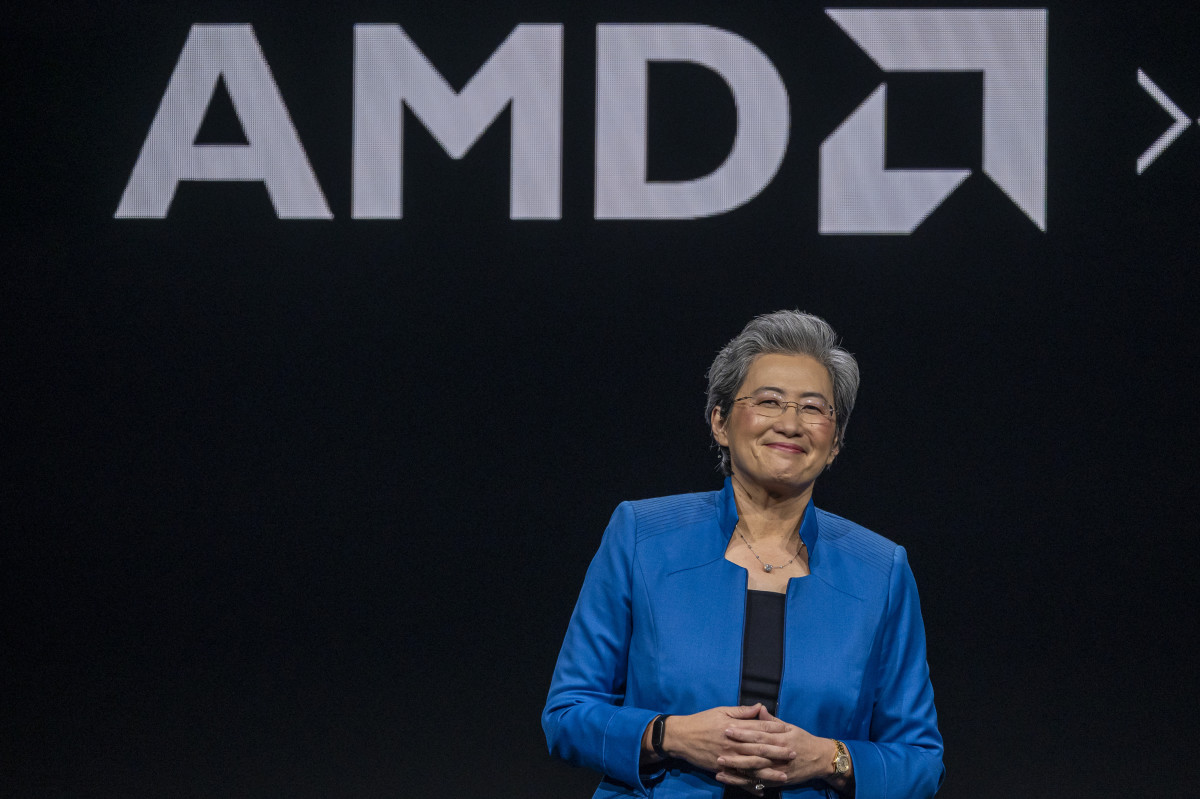

It be furthermore taking a elevated fragment of the worldwide PC market, a secondary division for AMD at the wait on of its AI-focused files middle section, with CEO Rene Haas predicting a commanding 50% fragment of the Windows PC market market 2029. TheStreet/Shutterstock/David Becker/Stringer/Getty Photographs

Goldman Sachs analyst Toshiya Hari infamous the neighborhood's fresh advances in a present that lowered each and each its ranking and price purpose for AMD heading into its fourth quarter earnings file later this month.

AMD fragment imprint underperformance

Having added the stock to his 'aquire' checklist in November of 2020, Hari infamous that the shares bask in underperformed the S&P 500 over that time, rising 50% when put next to the benchmark's 72% manufacture.

The shares viewed fresh weak point, as successfully, falling more than 33% for the duration of the last six months, successfully south of the 9.4% decline for the PHLX Semiconductor Sector benchmark and bask in shed around $65 billion in imprint since its disappointing sales and earnings outlook in boring October.

Associated: Analyst overhauls AMD stock imprint purpose as gap with Nvidia widens

"Even supposing we reside positive on AMD's capacity to take fragment from Intel in x86-based compute for the duration of PCs and venerable servers, we're an increasing selection of alive to [over] the upward thrust of Arm-based customized CPUs and heightened competitors in accelerated computing," Hari and his team wrote.

Hari talked about Arm's upward thrust will weigh on its earnings enhance prospects, add to running expenses and weigh on the stock's imprint to earnings multiple.

He downgraded the stock to 'honest' from 'aquire' and lowered his imprint purpose on the neighborhood by $46 to $129 per fragment.

AMD needs to win market self assurance

"We predict about this underperformance stems from weak point in PC and venerable conclude-attach apart a query to, as successfully as slower-than-expected enhance in Info Heart GPUs," Hari talked about. "We now seek files from the stock to reside fluctuate-sure except the market regains self assurance in AMD's future enhance and margin trajectory.

AMD, which is slated to file its fourth quarter earnings on Jan. 28, told traders in October that MI300 sales may upward thrust to more than $5 billion this yr, with overall earnings within the gap of $7.5 billion.

Extra AI Shares:

- Faded fund supervisor finds startling AI shares forecast for 2025

- Meta’s new vision may exchange each and each AI and social media

- Analysts picture AI stock picks for 2025, together with Palantir

Analysts are looking out for out a base line of $1.08 per fragment with files middle earnings of $4.15 billion, client earnings of $1.95 billion and gaming and embedded earnings totaling around $1.4 billion.

AMD shares were marked 1.92% decrease in premarket trading to notify an opening bell imprint of $119.50 each and each.

Associated: Faded fund supervisor components dire S&P 500 warning for 2025

What's Your Reaction?