Goldman Sachs analyst revisits Palantir Technologies stock price target

Palantir shares are up 20% for the year, but have fallen 27% from their mid-February peak.

Palantir Technologies shares moved lower in early Friday trading amid questions over the tempo of AI funding, tied partly to CoreWeave's shaky IPO, and a designate from Goldman Sachs that questions developments in its core expertise.

Palantir (PLTR) uses its man made intelligence platform, is believed as AIP, to serve customers pull together disparate collections of recordsdata into a single model that they then can keep, put together and deploy of their day-to-day processes.

Palantir additionally touts the advantages of its ontology offering, a framework that helps symbolize and join precise-world entities, knowledge, and processes for its commercial customers.

Final month, the Denver-based group, which used to be based by the tech investors Peter Thiel and Joe Lonsdale, posted stronger-than-expected fourth quarter earnings of 14 cents per fragment, with revenues rising 36% from the 300 and sixty five days-precedent days to $827.5 million, thanks partly to a surge in quiz for AI-related merchandise supplied by its commercial industry.

Palantir forecast 2025 earnings within the diagram of $3.75 billion, firmly forward of the LSEG estimate. Commercial earnings is probably going to rise 54% from 2024 to $1.08 billion. SOPA Photography/Getty Photography

The stock has conducted incredibly neatly as a consequence, rising 143% over the final six months, with a shut to eight-fold keep over the final five years, as investors bustle to early adopters within the AI space.

Its valuation, then every other time, has expanded sharply as neatly, elevating questions over the sustainability of its stock performance given that its trades at a 477x extra than one to forward earnings, when in comparison with around 38x for Nvidia (NVDA) and 32x for Microsoft (MSFT) .

Merchants salvage additionally been spooked by comments from Defense Secretary Peter Hegseth, who has vowed to take around 8%, or $290 billion, out of the Pentagon worth range over the following five years, a switch that will per chance salvage an impact on in actual fact one of Palantir's needed earnings sources.

The U.S. Division of Defense for around 17% of Palantir's overall earnings in 2024, and around 18% in 2023, in step with its annual file.

That is left the stock down almost 27% since its all-time height in mid-February.

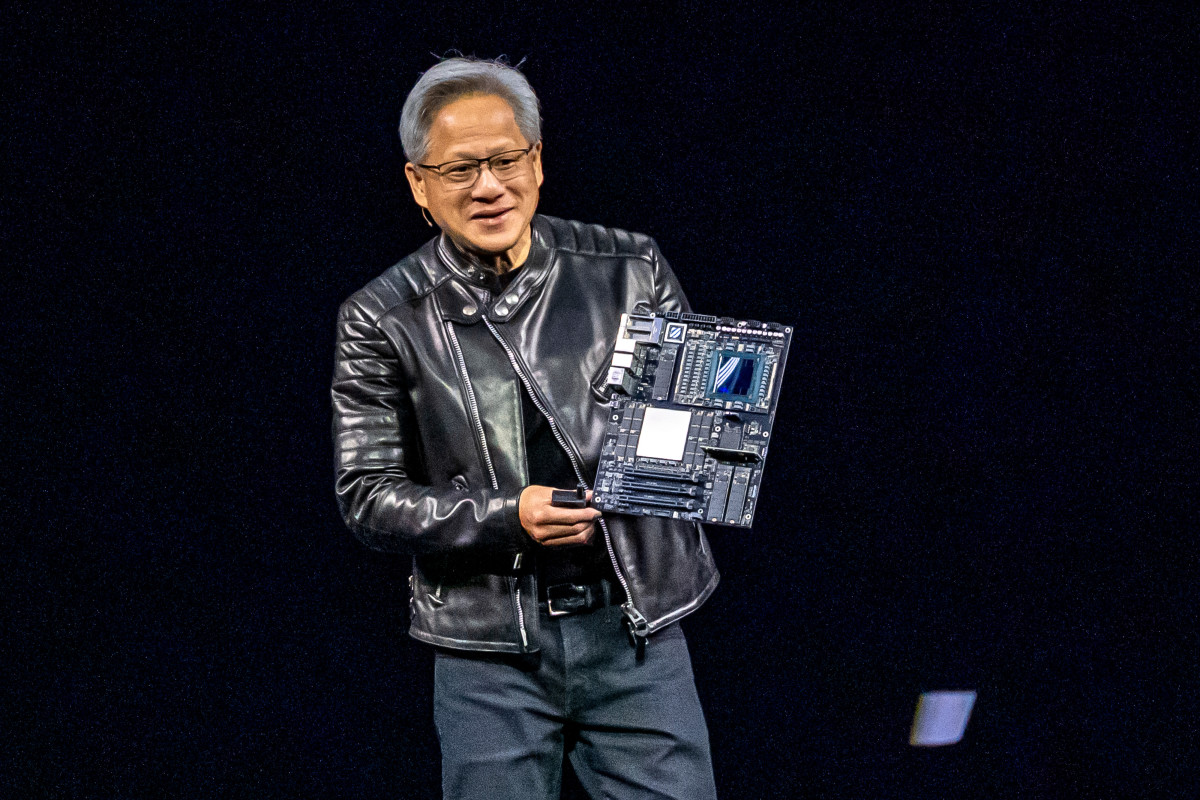

Connected: AI actuality bytes Nvidia-backed CoreWeave IPO

Merchants are additionally tracking developments in CoreWeave's Friday checklist on the Nasdaq, after the Nvidia-backed cloud services and products group slashed its IPO trace and reduced its valuation by around 35%, to $23 billion, amid questions over the tempo of AI quiz.

Goldman Sachs analyst Gabriela Borges neatly-known each and each the heady valuation and the group's ontology offering in reiterating her $180 trace target and 'honest' rating on Palantir in a designate revealed Friday.

In assert to command AI, organizations should construction and contextualize their knowledge in a approach that is lovely and operationally relevant, to enable personalized workflows to cause by plan of key industry questions," Borges acknowledged.

"Palantir’s ontology has enabled knowledge stitching and personalized workflows since its early days, and with increased enterprise focal level on AI, the corporate has emerged as platform capable of handing over rapid time to worth and tangible [return on investment]," she added.

More AI Stocks:

- Analyst revamps Palantir stock trace target after proceed

- Nvidia stakes out aggressive future, no topic investor unease

- Analysts transform Micron stock trace targets after earnings

The analyst neatly-known, then every other time, that 'its core technical competencies salvage no longer fundamentally changed over the final 300 and sixty five days ... pretty, the market has an increasing selection of viewed the cost of an operation-centric knowledge platform as enterprises query to embed AI features."

"Our sure look of Palantir’s differentiated expertise is balanced by our miniature visibility into whether or no longer constructing personalized AI workflows will change into less complicated as the tech ecosystem matures," she added.

Palantir shares had been final marked 0.75% lower in premarket trading to insist a gap bell trace of $89.41 every.

Connected: Passe fund manager unveils query-popping S&P 500 forecast

What's Your Reaction?