Goldman Sachs reboots jobs forecast ahead of looming unemployment report

The Wall Street firm updated its unemployment forecast for August.

The jobs market has been wobbling this year due to cost-cutting pressures, which have boosted layoffs, reduced open jobs, and raised the unemployment rate.

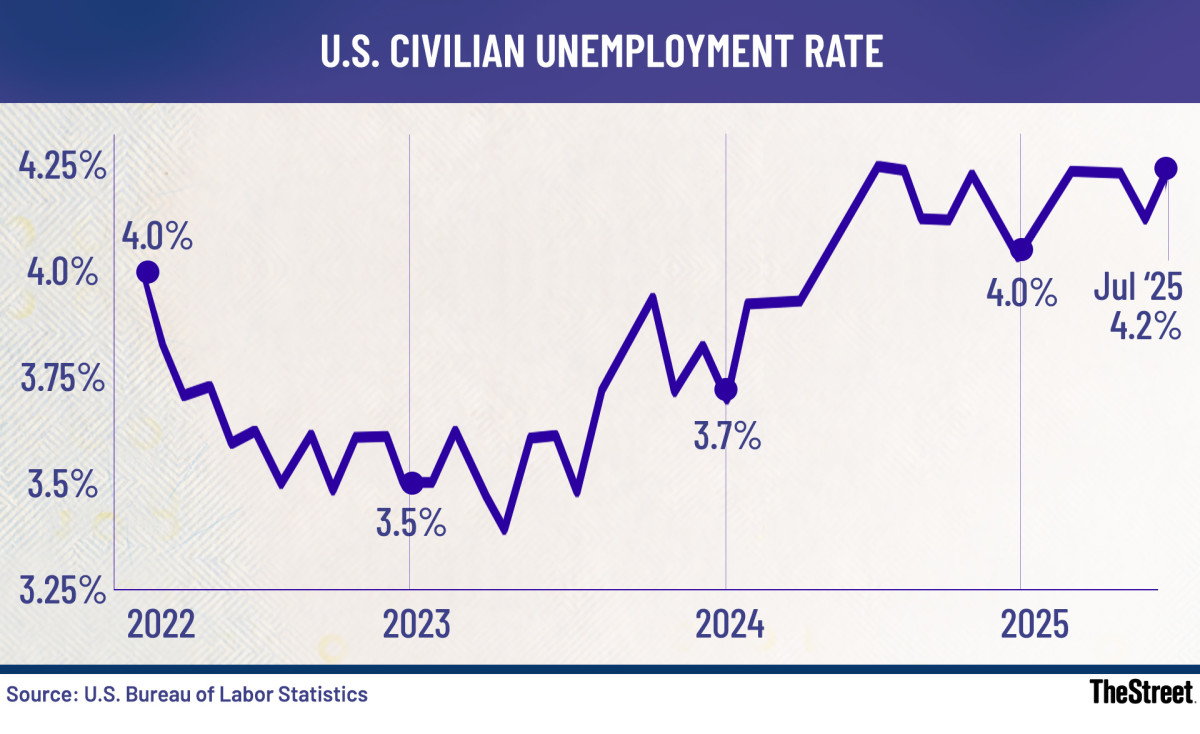

- The unemployment rate has increased to 4.2% from 3.4% in 2023, according to the Bureau of Labor Statistics.

- The number of layoffs year-to-date through August totals 892,362, up 66% year over year, according to Challenger, Gray, & Christmas.

- There were 7.2 milliion open, unfilled jobs in America in July, down from 7.5 million the year before, and over 12 million in 2022.

That's not good news for job-hungry Americans or employed workers hoping for a raise. And it's not great news for the economy, which runs on expectations that wages will outstrip inflation, sparking spending.

The situation isn't lost on Goldman Sachs, which released an update to its jobs outlook on Sept 4, just one day before the big Kahuna of jobs data lands -- the BLS's monthly unemployment report.

Goldman Sachs predicts a new high in the unemployment rate

The U.S. unemployment rate has been largely range bound since summer 2024, vacilating between 4% and 4.2%.

Related: Hiring data show disturbing trend just days before crucial jobs report

On September 5, the BLS will update its unemployment figure to reflect August, and Goldman Sachs expects that the release will show a break out to a new high.

"We estimate that the unemployment rate edged up to 4.3% on a rounded basis," wrote Goldman Sachs analysts in a note to clients. Source: U.S. Bureau of Labor Statistics

The increase is worrisome because it suggests that last year's interest rate cuts by the Federal Reserve didn't do enough to stimulate the economy to support the jobs market.

The World Bank estimates that U.S. GDP will slip to 1.4% in 2025 from 2.8% in 2024 -- the worst showing since Covid-riddled 2020.

"We estimate nonfarm payrolls rose by 60k in August, below consensus of 75k but above the three-month average of +35k," said Goldman Sachs.

An unemployment rate of 4.3% would be the highest since 2021.

Troubling signs for US economy emerging

The million-dollar question is whether the Fed's hesitancy to cut interest rates in 2025 after reducing them by one percentage point last year means it has fallen behind the curve, risking recession or stagflation.

More Economic Analysis:

- Fed official sends bold 5-word message on September rate cuts

- New inflation report may have major impact on your wallet

- Surprising GDP report resets backdrop for stocks

Stagflation, a period of high inflation and low growth, isn't a recipe for a healthy economy. Unfortunately, inflation has climbed in the wake of President Doland Trump's tariffs, increasing since most tariffs were announced in April.

- July: 2.7%

- June: 2.7%

- May: 2.4%

- April: 2.3%

Source: Bureau of Labor Statistics

If inflation takes hold it could put the Federal Reserve into a corner regarding interest rate policy. The Fed is mandated to target low inflation and low unemployment, however, it's easier said than done.

When the Fed raises rates it slows inflation but causes unemployemnt. The opposite happens when it cuts rates. So, if it lowers interest rates at its next meeting on Sept. 17, as expected, it risks fanning inflationary fires to support the labor market even as tariffs impact accelerates.

The big question nobody is asking out loud

The last unemployment rate includes steep downward revisions to May and June jobs creation. So steep, in fact, that President Trump fired the head of the BLS, Commissioner Erika McEntarfer, after the data was reported.

Related: Fresh labor market data fuels chatter about Fed interest rate cuts

A new interim Commissioner, William J. Wiatrowski, who was deputy Commissioner, is on borrowed time, given President Trump has nominated E.J. Antoni to take over for McEntarfer.

Antoni is considered by the White House to be a friendlier face, given he was Chief Economist of the Heritage Foundation, a conservative think tank, who contributed to Project 2025.

Antoni hasn't yet been confirmed by the Senate, but the firing of McEntarfer, and potential appointment of Antoni raises some eyebrows regarding whether jobs data could one day be become politically influenced, making it harder to compare apples to apples and draw conclusions from it.

Related: Here's how stocks react to Fed interest rate cuts

What's Your Reaction?