Goldman Sachs resets PCE inflation target after CPI bombshell

Goldman Sachs just sent a sobering warning to the Federal Reserve. After analyzing a "noisy" January CPI report, the firm’s economists, led by Jan Hatzius, officially reset their forecast for the Fed's favorite inflation gauge. The new target? A 3.05% year-over-year jump in core PCE. This isn't ...

Goldman Sachs just sent a sobering warning to the Federal Reserve. After analyzing a "noisy" January CPI report, the firm’s economists, led by Jan Hatzius, officially reset their forecast for the Fed's favorite inflation gauge.

The new target? A 3.05% year-over-year jump in core PCE.

This isn't just a routine revision—it’s a brutal reality check for investors betting on a pivot. If Goldman is right, the "last mile" of the inflation fight is getting longer, and the window for interest rate cuts in the first half of 2026 is slamming shut.

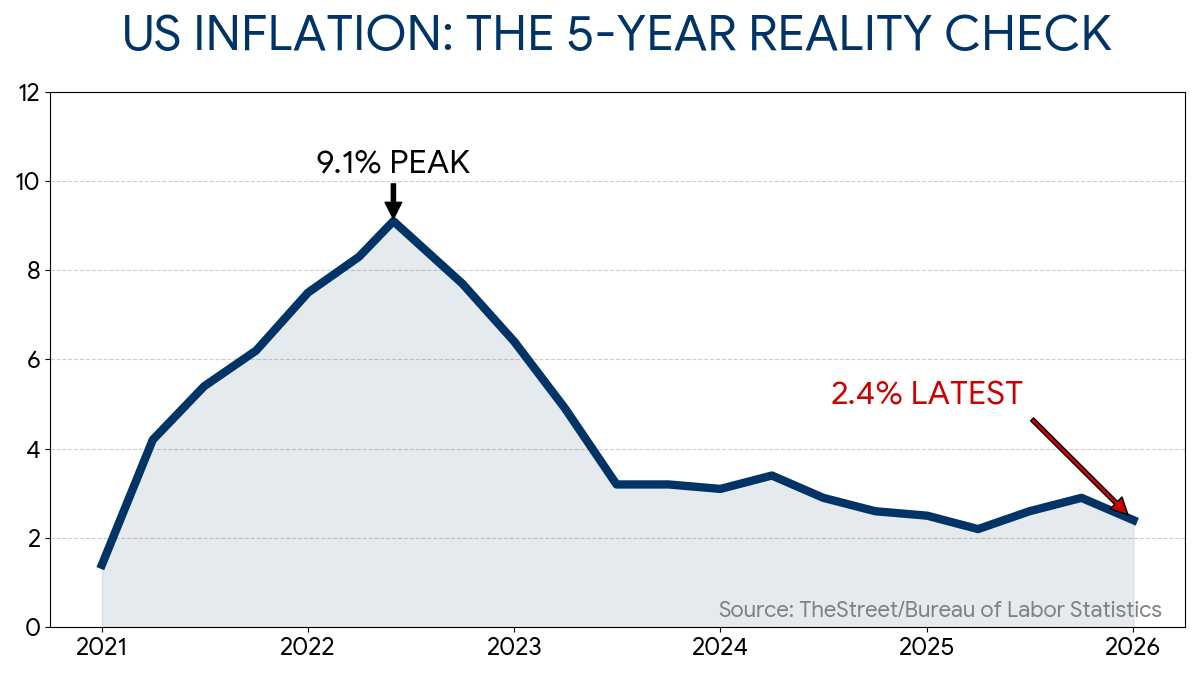

While the latest CPI report showed inflation at 2.4% in January, the lowest rate of price increases since last May, when tariffs began to take effect, a quirk in the data suggests to Goldman Sachs that PCE inflation will be much higher.

That's a problem because the Federal Reserve pays more attention to the Personal Consumption Expenditures (PCE) inflation rate than to the CPI.

CPI by month (past 6 months):

- January 2026: 2.4%

- December 2025: 2.7%

- November 2025: 2.7%

- October 2025: n/a (government shutdown)

- September 2025: 3%

- August 2025: 2.9%

Goldman Sachs' outlook is due to oddities in how PCE measures inflation.

"We estimate that the core PCE price index rose 0.40% [month over month] in January (vs. our expectation of 0.30% prior to today's CPI report)," wrote Goldman Sachs economists.

The Bureau of Economic Analysis, or BEA, will release its December PCE report on February 20 and the January report on March 13. Given the Fed's focus, what the January report says about inflation will impact what happens next to interest rates. TheStreet/Bureau of Labor Statistics

Why PCE inflation won't mirror CPI

In a research note shared with TheStreet, Goldman Sachs said it expects PCE to show an uptick in inflation during January and an inflation rate higher than CPI.

The bank's upwardly revised expectation for 0.40% month-over-month growth is due to consumer electronics and IT commodity prices, which are more heavily weighted in PCE than CPI, rising sharply. CPI also benefited from lower used-car prices, but PCE weights used-car prices less than CPI does, further adding pressure.

Related: Top investor betting on bigger Fed interest-rate cuts and gold

Altogether, Goldman Sachs expects headline PCE to be up 2.81% in January, up slightly from 2.8% in November, the last month for which data is updated (again, we get the December data on Feb. 20).

Their economists' model of core PCE inflation, which excludes volatile oil and food prices, forecasts a 3.05% increase, above the 2.8% rate in November.

Since the Fed's 2% inflation target for setting interest rate policy is based on core PCE, the increase to 3.05% may surprise investors.

Fed hits sidelines on interest rate cuts despite inflation falling

The Federal Reserve sets monetary policy under a dual mandate to promote low unemployment and stable inflation.

Unfortunately, those goals often run counter to one another: higher rates slow inflation but cause job losses, and vice versa.

Last year, the Fed left rates unchanged until September because while unemployment was rising, so too was inflation. As evidence mounted that unemployment was worsening, Fed Chair Powell pivoted, cutting rates at three consecutive meetings to finish out the year.

At the January meeting, however, Powell retreated again to the sidelines to await more evidence that cuts weren't causing inflation and that the job market was solidifying.

So far, data doesn't offer much reason for the Fed to cut rates at its next meeting in March. The unemployment rate fell to 4.3% in January, down from a peak of 4.5% in November. Meanwhile, the January CPI data shows inflation cooling.

On the surface, there's little reason to act, but if PCE inflation comes in higher it may further tilt the odds toward the Fed holding off on cuts.

Currently, the CME FedWatch tool puts odds of a quarter-point cut at the next FOMC meeting on March 18 below 10%, and the probability of a cut at the April meeting at 26%,

Related: Carson Group's Detrick sends blunt message on February slide

What's Your Reaction?