Influential analyst drops fresh take on Nvidia ahead of key report

Here’s what could be next for Nvidia stock.

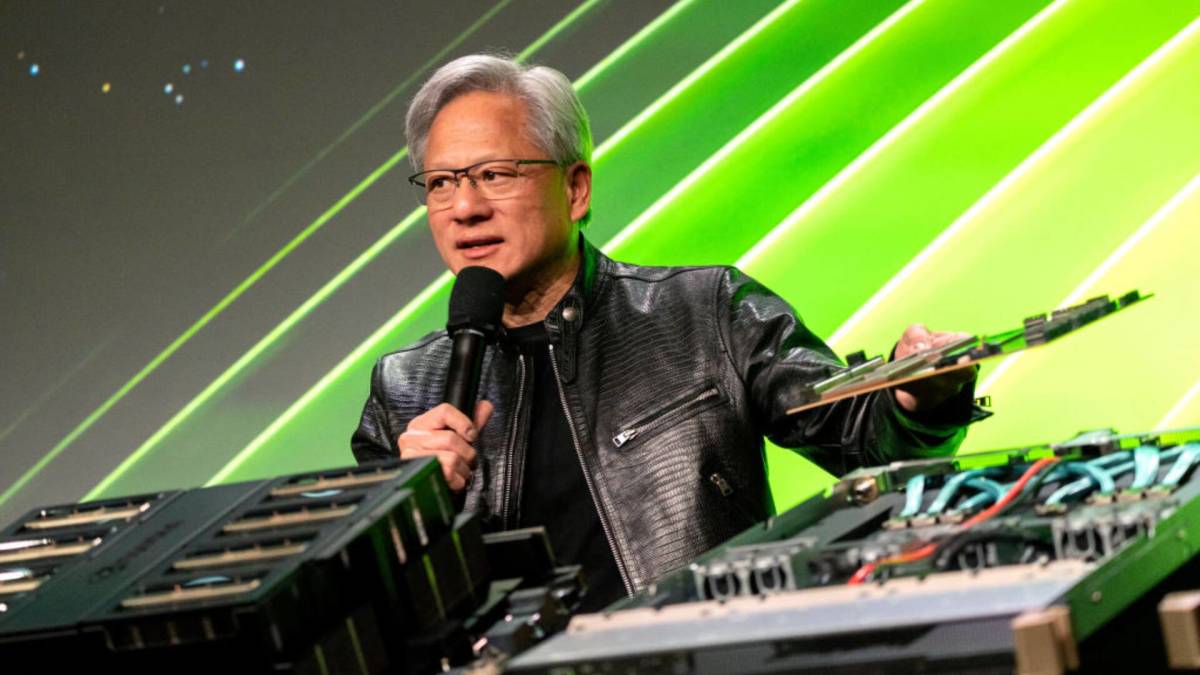

Nvidia doesn't support just artificial intelligence software anymore. The company announced on Aug. 25 that its latest robotics chip module, the Jetson AGX Thor, is now available to the market.

The chips will allow customers to build robots, and the first kits are expected to ship next month, according to the company.

Nvidia's CEO Jensen Huang has said robotics is the company’s largest growth opportunity other than artificial intelligence.

“We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity,” Huang said in June at Nvidia’s annual shareholders meeting.

Still, robotics remains a small business for Nvidia, accounting for about 1% of the company’s total revenue, despite growing fast.

The announcement of Jetson AGX Thor came just ahead of Nvidia’s second-quarter earnings release on Aug. 27, when Wall Street will be looking for fresh signs of momentum in AI and emerging businesses like robotics. Image source: Morris/Bloomberg via Getty Images

Wall Street resets Nvidia stock price target before key earnings

Nvidia (NVDA) has benefited greatly from the generative AI boom after the rollout of ChatGPT. Its stock gained a remarkable 171% in 2024, one of the top stock winners for the year. So far in 2025, the stock is up roughly 34%.

The chipmaker's hyperscaler customers like Microsoft (MSFT) , Alphabet (GOOGL) , and Amazon (AMZN) have all reaffirmed plans to spend billions this year on data centers, which points to strong demand for AI chips and a clear boost ahead for the chipmaker.

Related: $34 billion hedge fund buys more Nvidia stock, sells DoorDash

Investors are also watching for updates on China. Nvidia warned in May that new export curbs could cost up to $8 billion in quarterly revenue, but it and AMD (AMD) struck a deal with the U.S. government earlier this month to resume sales in China in exchange for a 15% fee. This could show up in Nvidia’s guidance.

Analysts are broadly bullish on Nvidia, lifting price targets ahead of earnings.

Evercore ISI analyst Mark Lipacis raised the firm's price target on Nvidia to $214 from $190 and reiterated an outperform rating, TheFly reported. The firm continues to name Nvidia as its top pick, pointing to better near-term visibility and long-term potential.

Baird raised its price target on Nvidia to $225 from $195 with an outperform rating, citing “significant acceleration” in GB200 chip shipments in July. The firm expects that momentum to continue, with xAI-related shipments weighted to fiscal Q4.

TipRanks data collected from 40 Wall Street analysts shows an average price target for Nvidia of $199.94, about 11% above the latest close of $179.81, with the highest estimate at $250 and the lowest at $135.

Gene Munster sends new message on Nvidia stock

Gene Munster, a longtime Wall Street technology analyst, shared his latest thoughts on Nvidia stock ahead of earnings on X, suggesting investors may be overlooking future growth drivers, particularly in robotics.

Munster was previously an analyst at Piper Sandler, where he spent more than 20 years covering big tech companies like Apple, Google, and Amazon. In 2017, he co-founded a Minneapolis-based venture capital firm that invests in tech.

Related: China pushes back after Nvidia deal sparks controversy

"NVDA investors are too focused on next year and missing the bigger picture," Munster said in a post on X, "For the next two years, we're still early in the AI data center buildout."

More Nvidia:

- Nvidia earnings face high bar on data-center demand, China deal

- Nvidia quietly buys more stock in AI infrastructure favorite

- Soros supercharges Nvidia stake, loads up on AI plays

He also gives a glimpse of Nvidia’s next chapter on physical AI, saying it will "pick up where the data center leaves off."

"While robotics represents less than 1% of revenue today, it has the potential to become the data center’s encore and move the growth needle," Munster wrote. “Welcome the new Jetson AGX Thor robotics chip to the lineup.”

Related: Bank of America sounds the alarm on inflation ahead of key report

What's Your Reaction?