Interest-rate cuts may fade for 2026 borrowers: Fed official

If you’re planning to borrow money for a new auto loan, another student loan, or extra credit card in 2026, you should sit up, put down your screen and listen to Minneapolis Fed President Neel Kashkari. He told CNBC Jan. 5 that he thinks the central bank is close to the point where it should stop ...

If you’re planning to borrow money for a new auto loan, another student loan, or extra credit card in 2026, you should sit up, put down your screen and listen to Minneapolis Fed President Neel Kashkari.

He told CNBC Jan. 5 that he thinks the central bank is close to the point where it should stop lowering interest rates.

Kashkari will rotate as a voting member of the Federal Open Market Committee this year.

“My guess is we’re pretty close to neutral right now,” Kashkari said.

Calibrating "neutral" is critical for Fed policymakers as they decide whether to continue the streak of three consecutive rate cuts implemented in the latter part of 2025.

“We just need to get more data to see which is the bigger force. Is it inflation or is it the labor market? And then we can move from a neutral stance, whatever direction is necessary,” Kashkari said. Board of Governors of the Federal Reserve System

What a "neutral" interest rate means

The Federal Funds Rate approaching neutral means the Federal Reserve’s benchmark interest rate neither stimulates nor restrains economic growth.

In short, it’s the “Goldilocks Zone” of monetary policy because it’s "just right."

Economists define the neutral rate, or r-star (r*), as the interest rate that keeps the economy at full employment while maintaining stable inflation around the Fed’s 2% target.

When rates hit this level, monetary policy is neither pressing the gas pedal nor pumping the brakes on economic activity.

It’s important to note that the neutral rate isn’t a fixed rate.

The neutral rate fluctuates according to productivity growth, demographic trends, and global capital flows.

Here’s how Fed officials estimate a neutral rate

Most Fed officials currently estimate that the long-run neutral rate falls between 2.5% and 3%, but roughly 4.5% to 5% when accounting for inflation.

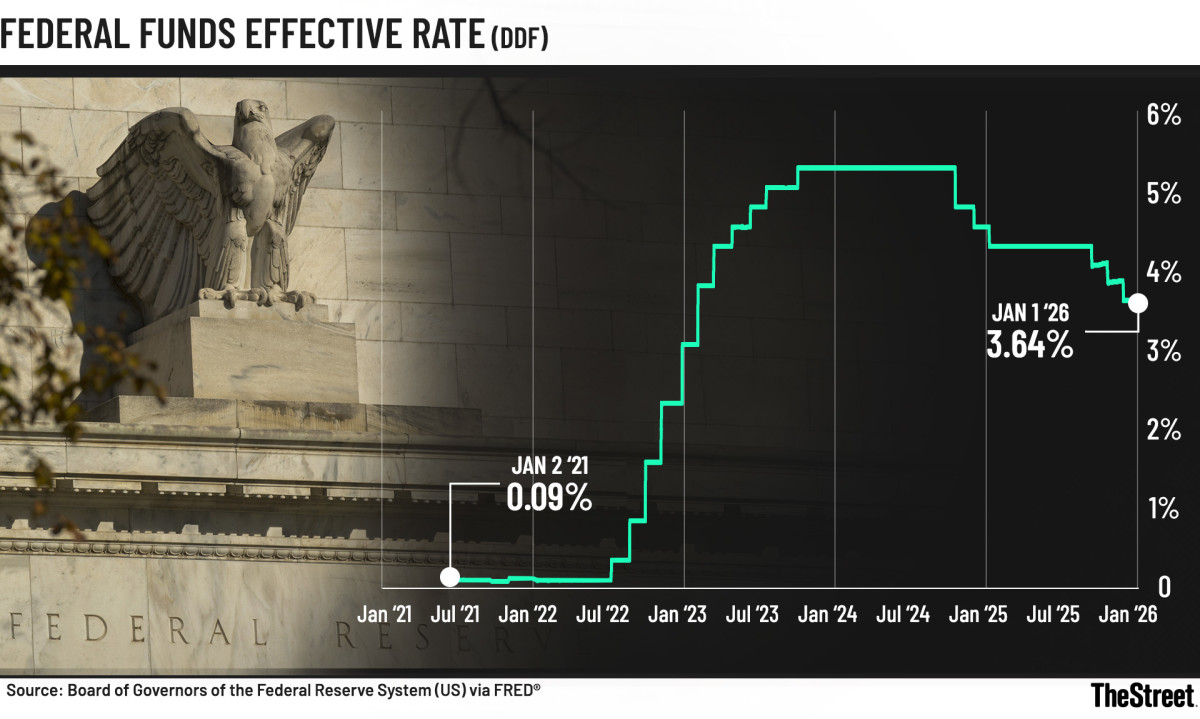

The current Federal Funds Rate is 3.50% to 3.75%.

The Federal Open Market Committee, the central bank’s policymaking panel, cut the funds rate three times for a total of 0.75 of a percentage point in 2025.

After the December rate cut, Fed Chair Jerome Powell said the lowering of rates brought monetary policy “within a broad range of neutral.”

Related: Fed faces 2026 upheaval as economy shifts, Powell exits

Looking ahead to 2026, the Fed’s own median projection or “dot plot” suggested there would be only one additional quarter-point cut. This would move the rate to about 3.25% to 3.50% by year's end.

The markets have a different idea. Market expectations are slightly more dovish, calling for two rate cuts, which would push rates closer to 3%.

President Doland Trump has spent the past year blasting Powell and the FOMC for not lowering rates to around 1%. The White House maintains this will stimulate the stagnant housing market and reduce the amount of interest on the nation’s debt, which currently hovers between approximately $38.4 trillion and $38.5 trillion.

Impact on inflation, jobs, and economic growth

Understanding neutral helps policymakers at the independent central bank determine whether current monetary policy is restrictive or accommodative.

If the Federal Funds Rate exceeds the neutral rate, borrowing becomes more expensive. As inflation cools, it potentially slows economic growth.

Below neutral, cheaper credit encourages spending and investment but potentially slows growth.

So here’s the challenge: Nobody knows the exact neutral rate in real time.

Yep — it’s like an educated game of Whack-a-Mole.

Thus, Fed officials are making data-driven decisions about employment figures, inflation metrics, and GDP growth to determine if they’re landing near the critical milestone that neutral represents.

At stake is a delicate and tricky balanced approach that sustains economic expansion without triggering price spikes.

Kashkari describes U.S. economy as "resilient"

The next FOMC meeting is Jan. 27-28, and CME Group’s widely watched FedWatch Tool estimates a 16.1% chance of a quarter-percentage-point cut.

“I think inflation is still too high. And the big question in my mind is, how tight is monetary policy?” Kashkari said.

“Over the last couple of years, we kept thinking the economy is going to slow down, and the economy has proven to be far more resilient than I had expected. That tells me, well, monetary policy must not be putting that much downward pressure on the economy.”

Even though he said he is concerned about the labor market, Kashkari indicated that the FOMC is close to done with rate cuts.

The unemployment rate has drifted higher to 4.6% this year. Meanwhile, the Fed’s preferred core inflation measure was most recently at 2.8%, albeit according to data whose accuracy, CNBC noted, has been questioned due to impacts from the government shutdown.

“Inflation risk is one of persistence, that these tariff effects take multiple years to work their way all the way through the system, whereas I do think there’s a risk that the unemployment rate could pop from here,” Kashkari said.

Related: Next Fed chair faces ‘no-win’ test as White House pushes rate cuts

What's Your Reaction?