J.P. Morgan: Cooling inflation sets Fed interest-rate cut bet

Finally, some good news about affordability for Main Street and Wall Street. Underlying inflation rose in December by less than expected, with the core Consumer Price Index increasing 0.2% from November, the Bureau of Labor Statistics reported Jan. 13. The annual core CPI rose 2.6%, matching a ...

Finally, some good news about affordability for Main Street and Wall Street.

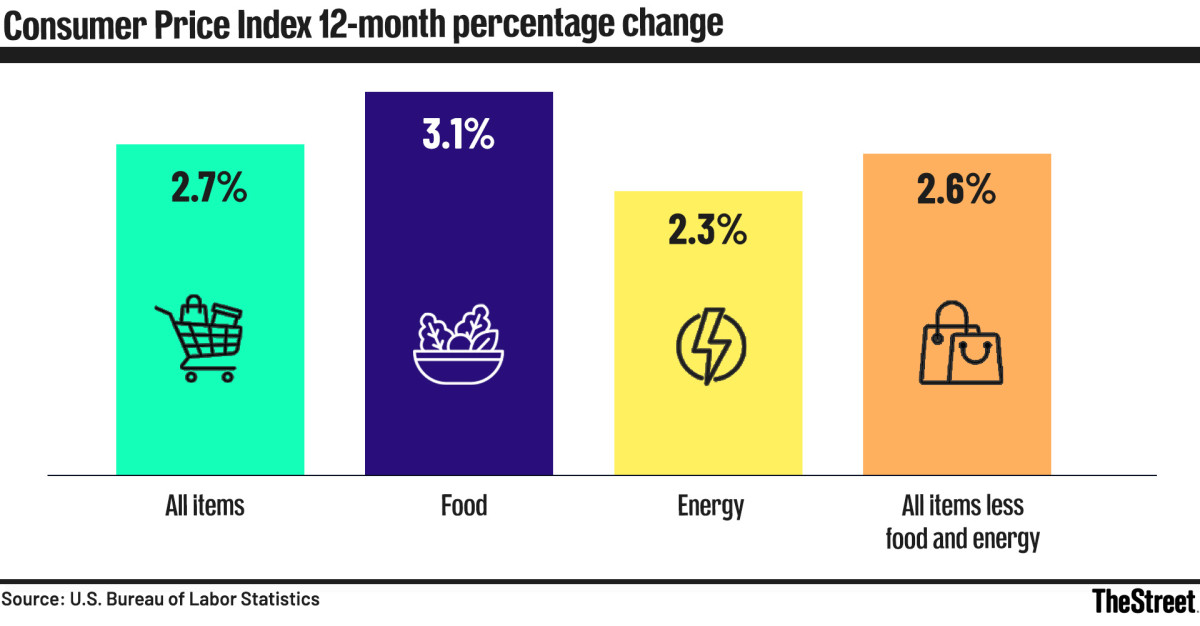

Underlying inflation rose in December by less than expected, with the core Consumer Price Index increasing 0.2% from November, the Bureau of Labor Statistics reported Jan. 13.

The annual core CPI rose 2.6%, matching a four-year low.

Core goods prices stagnated last month, defying expectations for a rebound as post-shutdown data trickles in.

Economists expect inflation to ease gradually over the course of 2026:

- Companies typically adjust their prices early in the year.

- A pending Supreme Court ruling potentially affects global tariffs.

Elyse Ausenbaugh, head of investment strategy at J.P. Morgan Wealth Management, said Jan. 13 that the relatively moderate pace of inflation in labor, housing and energy costs suggests the Fed’s current neutral policy rate is “appropriate.” U.S. Bureau of Labor Statistics/TheStreet

Inflation, jobs fuel interest rates

Maximum employment and price stability are the twin priorities -- the dual mandate from Congress -- of the Federal Reserve.

These goals require a delicate balance:

- Higher interest rates lower inflation but increase job losses.

- Lower interest rates lower unemployment but increase inflation.

The independent central bank uses interest rates as a tool to manage its mandate and execute monetary policy.

The Federal Funds Rate is the price the Fed charges U.S. banks to borrow money overnight.

More Federal Reserve:

- Fed official forecasts bold path for interest rates, GDP in 2026

This, in turn, sets the scene for short-term costs of borrowing money, like credit cards, auto loans, and student loans.

The 10-year Treasury Bond yield is the benchmark for longer-term interest rates like the 30-year fixed mortgage, currently hovering around 6.1%.

White House reacts to new CPI numbers

President Doland Trump and his allies have been escalating demands -- sometimes deploying harsh rhetoric -- at Federal Chair Jerome Powell to support lower rate cuts.

Powell, a Trump appointee, disclosed Jan. 11 that the Department of Justice has launched a criminal probe into him. Trump denied knowledge of the investigation.

Related: Powell pushes back as DOJ probe raises fears for Fed independence

Trump, in a Truth Social post Jan. 13, responded positively to the December CPI report:

“Great (LOW!) inflation numbers for the USA. That means Jerome “Too Late” Powell should cut interest rates.”

FOMC vote determines interest-rate activity

The Federal Open Market Committee, a 12-member policymaking panel, is expected to keep the Federal Funds Rate steady at 3.50% to 3.75% when it meets later this month.

- The Fed’s target inflation rate is 2%.

- As we’ve reported, a very divided FOMC is headed into its Jan. 28 meeting. There's an expected historic streak of dissents as tensions rise within its dual mandate: the cooling labor market and sticky inflation.

- The CME Group’s widely respected FedWatch Tool reports a 2.8% chance of a January rate cut.

- Trump has been calling for rates to be slashed to 1% or lower.

December CPI shows sticky inflation

Shelter, a key element of sticky inflation, increased 0.4%, which was the biggest item for the monthly increase, according to the BLS.

Shelter accounts for more than one-third of the CPI weighting and was up 3.2% on an annual basis.

Other parts of the report also showed inflation persisting.

Food prices rose 0.7% for the month, although egg prices decreased 8.2% and fell nearly 21% from a year ago after having previously soared.

Other areas seeing increases included recreation, airfares and medical care.

J.P. Morgan’s outlook on 2026 interest rates

“With just one more rate cut expected this year, we don’t see inflation as a meaningful threat to the 2026 investment outlook, and an improving economic cycle reduces the need for further cuts,’’ Ausenbaugh said.

Inflation will remain a key topic in political discussions, she added.

“Rising household power bills, groceries and restaurant prices, and healthcare costs will keep affordability concerns in focus as we approach the midterm elections,’’ Ausenbaugh said.

Related: Investors focus on Fed independence as chair decision looms

What's Your Reaction?