Layoff health insurance mistake costs $10,000 yearly

Layoffs are still rippling through the workforce in early 2026: Amazon just announced it's laying off 16,000 workers; UPS is cutting 30,000 workers; Pinterest will lay off 15% of its workforce; and the list goes on. Now, these and other workers who have lost jobs face a decision that can cost them ...

Layoffs are still rippling through the workforce in early 2026: Amazon just announced it's laying off 16,000 workers; UPS is cutting 30,000 workers; Pinterest will lay off 15% of its workforce; and the list goes on.

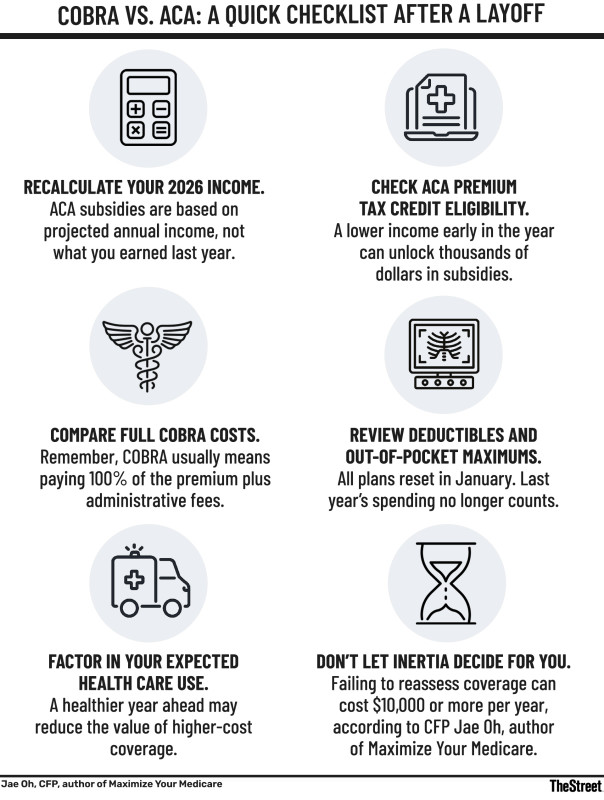

Now, these and other workers who have lost jobs face a decision that can cost them thousands of dollars a year: whether to stay on (or enroll in) COBRA or switch to an Affordable Care Act (ACA) marketplace plan.

The choice is not static.

In a recent interview, Jae Oh, a certified financial planner and author of Maximize Your Medicare, said the calendar alone can dramatically change the math. What made sense in November may no longer make sense in January. And the stakes are big. Make the wrong choice, and it could cost you $10,000.

Below is a transcript of that interview, edited for clarity and brevity.

Robert Powell: Layoffs continue to be a big story as we enter 2026, and many people are wondering what to do about their health insurance. Should they go on COBRA, enroll in an ACA plan, or do nothing? Here to talk about those choices is Jae Oh, author of Maximize Your Medicare. Jae, welcome.

Jae Oh: Thanks for having me, Bob. Jae Oh, CFP, author of Maximize Your Medicare

New Year income reset slashes ACA premiums while COBRA costs climb

Robert Powell: As the new year begins, people who were laid off last year or who may be laid off this year have some important decisions to make when it comes to health insurance.

Jae Oh: Absolutely. The unease around household employment is palpable. It cuts across age and profession, from management to frontline workers. What’s different at the beginning of the year isn’t the regulations themselves, but the decisions households can make.

If you were let go or retired early at the end of a calendar year, your premiums under the Affordable Care Act are benchmarked against your earned, taxable income for that year. By year’s end, you’ve often already earned a substantial amount, which can limit or eliminate eligibility for premium tax credits.

At the beginning of a new year, however, that picture changes. If you’re unemployed in January or February, your estimated income for the year may be much lower. ACA tax credits are based on projected annual income, so decisions made in November can look very different if the same household is evaluating options in February. Simply crossing into a new calendar year can lead to a very different conclusion.

Reassessing COBRA vs. ACA coverage

Robert Powell: So if someone was laid off in 2025 and chose COBRA, it sounds like it’s critical to reassess in January and compare whether staying on COBRA still makes sense versus switching to an ACA plan.

Jae Oh: I think that’s right. With COBRA, unless the former employer is subsidizing coverage, the household pays the full sticker price, plus an administrative charge. That alone makes it worth revisiting.

Also worth reading

- Retirees may want to rebalance as markets broaden, volatility rises

- Why “breaking even” on Social Security is the wrong goal

- The $83,250 secret every solo entrepreneur needs to know for 2026

The comparison can change materially at the start of the year. Some people may be in better health than they were the year before. Deductibles reset. Out-of-pocket maximums reset. Those details matter and should be reviewed carefully when comparing options.

The need for vigilance and a checklist

Robert Powell: It sounds like people really need a checklist to make sure they’re making the right decision.

Jae Oh: Exactly. On my Substack, Jay’s Corner, we’ve spent the past several months digging into these nuances. With dramatic headlines about layoffs and growing concern about early retirement, people are asking whether they can afford to step away from work.

One of the first questions is, how much does life cost? Healthcare is one of the most variable expenses for households. Across surveys, healthcare costs consistently rank near the top for unpredictability. That’s why we try to address this issue right up front.

Why inertia can be costly

Robert Powell: You’ve often reminded me of the importance of staying vigilant. You can’t let inertia take over when it comes to health insurance decisions, because the cost comes straight out of your pocket and may not be in your best interest.

Jae Oh: When I speak to audiences, I tell people to spend their time and energy in priority order. Healthcare deserves a lot of attention because the potential difference in outcomes is so large.

You don’t control where the 10-year Treasury yield will be tomorrow. But you can control these decisions. The difference can easily be five figures a year — $10,000 or more annually — simply because someone didn’t revisit their coverage. I get annoyed when I forget to cancel a $5 monthly subscription. Letting more than $10,000 a year slip by because of inertia is unthinkable.

Related: Medicare mistakes seniors wish they’d known sooner

What's Your Reaction?