Legendary fund manager has blunt message on 'Big Beautiful Bill'

The billionaire hedge fund manager delivered candid words on the law.

It be legit. The Big Sparkling Bill is law.

President Donald Trump efficiently arm-wrestled reinforce in the Home and Senate to receive his signature tax slash lend a hand and spending invoice across the legislative end line on July 4.

It wasn't easy. The Home handiest passed the invoice in the origin after blue-narrate Congressmen efficiently increased the Deliver and Local Tax (SALT) Deduction considerably, providing great-hoped-for reduction to owners in excessive-tax communities.

The Senate used to be even extra contentious. Some senators recoiled at the invoice's dimension, forcing steep cuts to vitality tax credit score and Medicaid. Mild, even with those offsets, the invoice carries a staggering set up mark. In the extinguish, the invoice squeaked via, with Vice President Vance's vote ensuing in a 51-50 final vote tally.

Linked: Goldman Sachs revamps Fed passion charge slash lend a hand forecast for 2025

That charge captured the eye of longtime Wall Toll road icon Ray Dalio.

Dalio founded Bridgewater Mates, a hedge fund now managing better than $112 billion of resources. He's featured in the in style "Market Wizards" series of books, and his prescient financial and inventory market predictions absorb made him a billionaire charge $16 billion, good ample to base him 156th on Bloomberg's Billionaires Index.

Over his 50-twelve months funding career, Dalio has navigated his share of good and bad financial times, and plenty of snatch into consideration him among the most successful in predicting what may happen next to markets.

Today, he's centered on the U.S. debt degree as a serious crisis looms. Perhaps unsurprisingly, that is ended in him providing a sexy blunt snatch on the Big Sparkling Bill Act. Checklist source: Dia Dipasupil/Getty Pictures

What does the One Big Sparkling Bill Act assemble?

One amongst the largest aspects of the law is that it extends tax cuts supplied in the Tax Cuts and Jobs Act, which used to be passed in 2017 in the course of President Trump's first timeframe in narrate of work.

That is never any longer all it does, despite the indisputable truth that.

Linked: Oldschool analyst sets inquire-popping S&P 500 purpose

On the selling campaign lunge, President Trump made a series of promises, at the side of extra tax breaks for People and rolling lend a hand great of feeble President Biden's inexperienced vitality initiatives.

The over 900-net page One Big Sparkling Bill Act makes good on promises to slash lend a hand taxes on Social Security and guidelines. However, it falls looking out entirely placing off taxes on them.

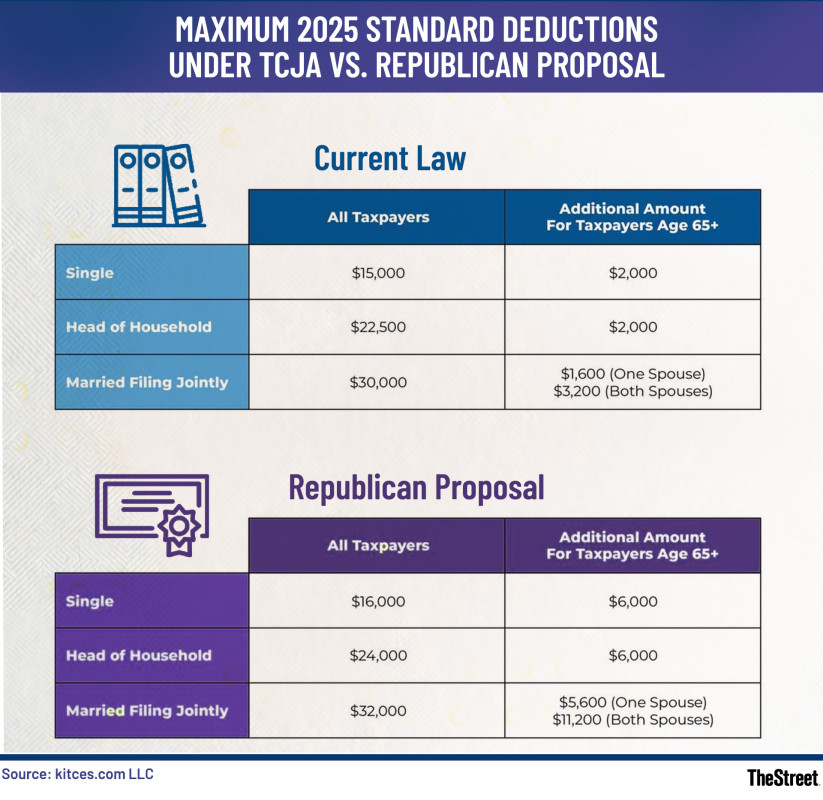

As an instance, in narrate of weeding out earnings taxes on Social Security, the act presents a Social Security bonus deduction by increasing the deduction to $6,000 from $2,000 beforehand. kitces&duration;com

Pointers are also excluded from Federal earnings taxes; however, there is a $25,000 deduction limit.

The act also eliminates tax credit score for electrical autos, vitality-environment friendly heating and cooling, and a host of inexperienced vitality breaks on photo voltaic and wind energy.

To slash lend a hand the associated charge of earnings tax cuts, the One Big Sparkling Bill Act makes steep cuts to Medicaid, at the side of increasing work requirements. It also shifts the associated charge of SNAP advantages to states with an error charge above 6%.

Those moves absorb proven highly controversial. The CBO estimates that adjustments to Medicaid will end result in 11.8 million of us losing health insurance coverage over the following decade.

Ray Dalio delivers attractive rebuke of Congress, One Big Sparkling Bill Act

Dalio has centered great of his time researching the upward thrust and fall of economies. This research has led him to a worrisome prediction for The US.

Particularly, Dalio believes that our noteworthy and rising debt pile has us on a collision course with an financial Armageddon.

He predicts that as our spending increases, of us and governments will flinch at shopping for our debt, inflicting a spiral that may end result in both Treasury debt defaults or restructuring.

Unfortunately, Dalio sees itsy-bitsy political will in Washington, D.C., to slash lend a hand the spending cord, as evidenced by Congress passing the One Big Sparkling Bill.

"After spending time in Washington, D.C., discussing the budget deficit with senior of us on each and every side of the aisle, it’s optimistic to me that we are no longer going to change the debt trajectory we’re on and steer optimistic of the painful consequences," wrote Dalio on X.

The toll taken by passing the One Big Sparkling Bill is a stiff one.

The CBO estimates that the invoice provides a whopping $7 trillion a twelve months in spending and handiest generates about $5 trillion in earnings. In consequence, debt relative to GDP will surge, adding extra rigidity to the financial system.

"The debt, which is now about 6x of the money taken in, 100% of GDP, and about $230,000 per American family, will upward push over 10 years to about 7.5x the money taken in, 130 percent of GDP, and $425,000 per family," famed Dalio. "That will amplify passion and main funds on the debt from about $10 trillion ($1 trillion in passion, $9 trillion in main) to about $18 trillion (of which $2 trillion is passion funds)."

That is a kind of cash. And Dalio thinks this may require some pretty downhearted fixes down the road.

"[It] will lead to both a serious squeezing out (and cutting off) of spending and/or inconceivable tax increases, or a kind of printing and devaluing of cash and pushing passion charges to unattractively low ranges. This printing and devaluing is never any longer good for those preserving bonds as a storehold of wealth, and what’s bad for bonds and U.S. credit score markets is bad for everybody," said Dalio. "Except this course is soon rectified to notify the budget deficit from roughly 7% of GDP to about 3% by making adjustments to spending, taxes, and fervour charges, big, painful disruptions will likely occur."

The self-discipline, however, will remain change as frequent in D.C. Politicians enthusiastic to proceed to receive elections will proceed to accomplish big promises, and money-strapped People can no longer be faulted for looking out reduction.

However, kicking the can down the road on our debt may receive a bigger self-discipline that could be more difficult to fix.

"Whereas virtually everybody agrees on the necessity to tackle our debt self-discipline in a balanced capability that entails tax increases and cuts to advantages, additionally they agree that they'll no longer advise up attributable to politics was absolutist," wrote Dalio. "We should always accumulate a resolution around absolutist pledges be pleased, 'I will no longer lift taxes,' or 'I will no longer slash lend a hand advantages,' when they're desperately compulsory."

Linked: Legendary fund supervisor factors inventory market prediction as S&P 500 assessments all-time highs

What's Your Reaction?