Market Wrap: Top Stock Movers- PayPal, Nokia, and Wayfair

Market data as of 4pm ET October 28, 2025 The market closed with yet another record win, once again credited to the increasing investments from companies well-versed in artificial intelligence. The S&P 500 closed 0.2% higher, maintaining its third consecutive day of record gains.The ...

Market data as of 4pm ET October 28, 2025

The market closed with yet another record win, once again credited to the increasing investments from companies well-versed in artificial intelligence.

- The S&P 500 closed 0.2% higher, maintaining its third consecutive day of record gains.

- The Nasdaq Composite was also up 0.8%, with gains in stocks of major tech companies like Nvidia and Intel.

- The Dow Jones Industrial Average was up 0.3%; however, the small-cap Russel 2000 slightly declined 0.6%.

Market sentiment is bullish as it awaits the Federal Reserve's announcement of potential rate cuts tomorrow, October 29. The stronger-than-expected earnings from PayPal, United Parcel Services, and Regeneron Pharmaceuticals kept investors confident, along with the improved prospects on the US-China trade front.

President Doland Trump also signed deals on rare earths and nuclear power reactors with the Japanese Prime Minister Sanae Takaichi, as both countries work to reduce China’s dominance. Berry/AFP via Getty Images

Gold continued to decline for a second consecutive day, down 1.3%, along with Oil and Natural gas, which fell 1.8% and 5.6%, respectively.

Among the most notable performances were those of Nokia, which rose 22.8% following an investment from Nvidia; its stock also increased by 4.9%.

Wayfair and PayPal reported strong performances in their Q3 earnings releases, accompanied by new AI expansions, resulting in stock price increases of 23% and 3.9%, respectively.

Here are the most active stocks today

Five S&P 500 stocks making big moves today are:

- Regeneron Pharmaceuticals: +11.8%

- MSCI Inc: +8.6%

- United Parcel Services: +8%

- Skyworks Solutions: +6.2%

- Sherwin-Williams CO: +5.4%

The worst-performing five S&P 500 stocks today are:

- Alexandria Real Estate Equities: -19.2%

- Zebra Technologies Corp: -11.7%

- Everest Group Ltd: -11.3%

- Royal Caribbean Cruises: -8.5%

- F5 Inc: -7.8%

Stocks also worth noting include:

- Nvidia: +4.9%

- Intel: +5%

- Tesla: +1.8%

- Alphabet A: -0.7%

- Coinbase Global: -1.7%

AI and earnings are pushing PayPal stock up

PayPal announced its Q3 earnings on October 28, along with a new partnership with OpenAI, which contributed to a stock surge for this financial payment services provider, up 6% intraday.

Here is how PayPal's Q3 earnings looked:

- Net revenue rose 7% to $8.4 billion, and GAAP operating income up 9% to $1.5 billion.

- Reported fresh cash flow of $1.7 billion, up 19%.

- GAAP EPS (earnings per share) of $1.30, up 32%, non-GAAP EPS of $1.34.

- Initiated a dividend, a first for the company, of $0.14 per share.

Alex Chriss, President and CEO of PayPal, mentioned profitable growth across branded experiences, PSP, and Venmo, also signaling a profitable future with new Agentic AI services.

More AI Stocks:

- More police agencies adopt AI, raising efficiency — and concern

- How AI Could Monitor Brain Health and Find Dementia Sooner

- ChatGPT latest user perk sparks controversy

- Bezos’s AI bubble warning backed by big names in banking

We are also building for an agentic future, partnering with leaders such as Google, OpenAI, and Perplexity. This is a stronger company today than we were two years ago.

Alex Chriss, CEO of PayPal.

Along with its earnings, PayPal also announced a partnership with OpenAI to integrate its payments into ChatGPT’s “Instant Checkout,” highlighting that this collaboration will make checkout through ChatGPT quicker.

“Hundreds of millions of people turn to ChatGPT each week for help with everyday tasks, including finding products they love, and over 400 million use PayPal to shop.” Alex Chris, CEO of PayPal.

The company also launched Agentic Commerce Services, highlighting its ambition to scale AI-driven shopping experiences, including a catalog management service.

Earlier in October, PayPal also announced PayPal Ads Manager, an AI-powered advertising tool for small businesses, scheduled to roll out in 2026.

Analysts are optimistic about the company’s growth, with RBC Capital raising its price target to $91 from $88, while maintaining an Outperform rating. The firm cites momentum across branded transactions, Venmo, and Buy Now Pay Later volumes as key drivers, according to TheFly.

While BTG noted that the stock surge underlines excitement around AI integration, it is mainly related to the solid fundamentals shown through its robust Q3 report. However, it also cautioned investors that the OpenAI integration will not be exclusive and that they should be wary as other payment methods integrate with ChatGPT, while maintaining a Neutral rating, as noted at TheFly.

Nokia reemerges with Nvidia investment

Once a beloved phone telecommunications provider, known for extremely sturdy phones, Nokia is now back in the conversation, thanks to the AI boom.

The Finnish company reported its Q3 results on October 28, with net sales up 9% year-over-year to €4.83 billion, driven by strong demand for optical networks.

Related: Stock Market Today: Nvidia Rallies 5% On $500 Billion Booking Projection, Lifting Nasdaq and S&P 500 to Fresh Records

But it is the $1 billion equity investment from Nvidia that fueled its stock surge, up 22.%, marking an 80% year-to-date stock gain. This investment will make Nvidia a 2.9% shareholder of Nokia.

While the deal has expanded the semiconductor giant's ever-growing portfolio, it positions Nokia as a key player in the AI-driven connectivity cycle.

This $1B investment will accelerate the development of 5G/6G RAN (Radio Access Network) software optimized for Nvidia architectures. Through this, Nokia will rewrite its network control software to work with Nvidia’s powerful AI and data center chips, utilizing AI to manage traffic, predict demand, and reduce energy consumption.

T-Mobile US will collaborate with Nokia and Nvidia to drive and test AI-RAN technologies, with trials expected to begin in 2026.

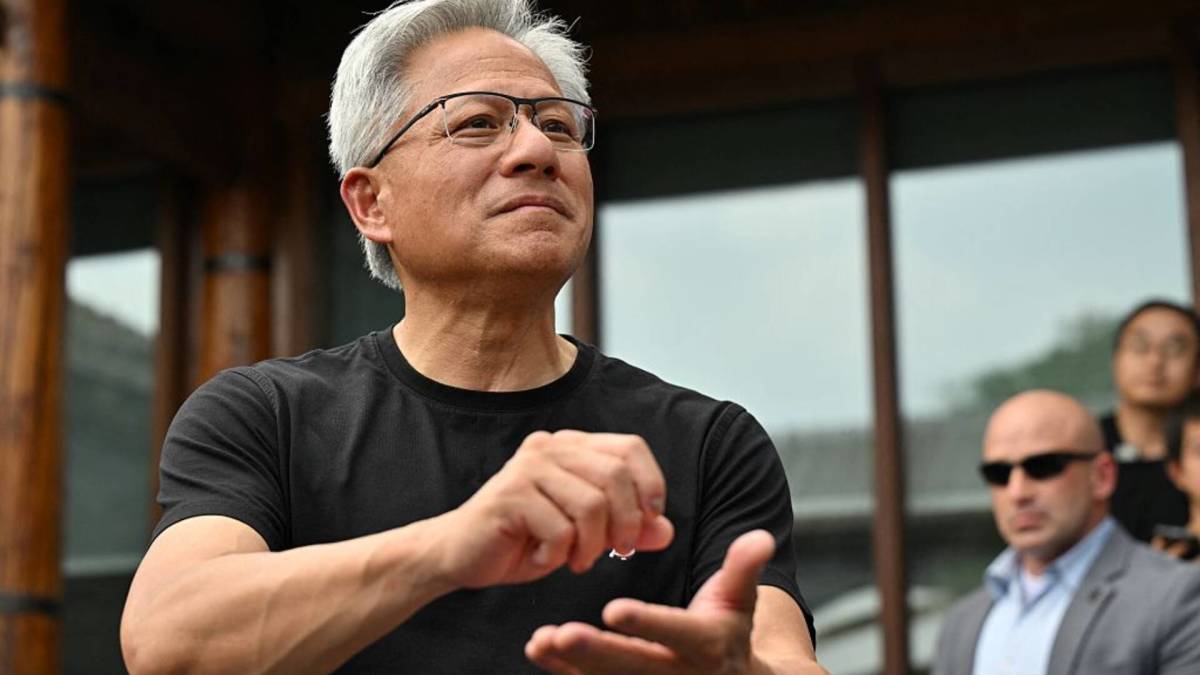

“Telecommunications is a critical national infrastructure – the digital nervous system of our economy and security. Built on NVIDIA CUDA and AI, AI-RAN will revolutionize telecommunications – a generational platform shift that empowers the United States to regain global leadership in this vital infrastructure technology,” said Jensen Huang, Founder and CEO of NVIDIA.

Together with Nokia, and America’s telecom ecosystem, we’re igniting this revolution, equipping operators to build intelligent, adaptive networks that will define the next generation of global connectivity.

Jensen Huang, Founder of NVIDIA.

This deal will help Nokia transition from a legacy telecom company to a technology-driven one that has long inspired trust among consumers.

Increase in consumer spending is helping Wayfair

An increase in consumer spending on home-related goods and services drives Wayfair’s strong Q3 performance.

Related: These classic Halloween candy brands are no longer made

According to the Bureau of Labor Statistics' August CPI (Consumer Price Index) report, household furnishings and operations spending increased 3.9% over the year.

In its Q3 earnings report, Wayfair reported a total revenue of $3.1 billion, up 8.1% year-over-year, as of October 28. Consequently, the stock of the furniture and home goods seller soared 23%, marking an 87% quarterly and an 80% year-to-date increase in stock price.

Here is how the company’s earnings looked:

- Gross Profit was $934 million with a net loss of $99 million.

- Net cash from operating activities was $155 million.

- Non-GAAP free cash flow was $93 million.

“The third quarter was a great success - share gain further accelerated, with revenue growing 9% year-over-year excluding Germany. We saw orders delivered grow by over 5% year-over-year in the quarter, inducing new orders growing mid-single digits for two quarters in a row,” shared Niraj Shah, CEO of Wayfair.

The strong performance resulted in increased confidence from analysts, with Bank of America upgrading its rating to Buy from Neutral and increasing the price target to $130 from $86. BofA noted that Wayfair will continue to capture market share, which sees Loyalty program improvements and increasing Ad penetration as drivers for the Q3 growth.

Truist also raised its price target to $120 from $95, maintaining a Buy rating, citing that Wayfair successfully navigated tariff uncertainty and outperformed the home furnishings segment, which is improving its margins, as noted by TheFly.

Related: McDonald's sees major shift in customer trends

What's Your Reaction?