Medicare Advantage exposed 1.2 trillion dollar rip off

For most Medicare beneficiaries, and especially the 35 million or so individuals enrolled in Medicare Advantage plans, nothing is changing right now. But come 2027, all bets are off. The Trump administration’s push to rein in Medicare Advantage payments could shape premiums, extra benefits, ...

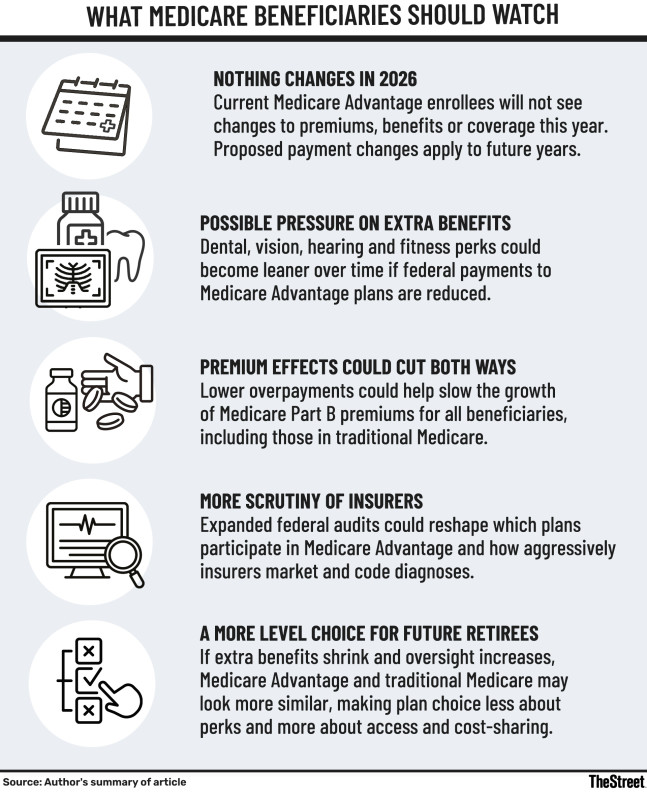

For most Medicare beneficiaries, and especially the 35 million or so individuals enrolled in Medicare Advantage plans, nothing is changing right now.

But come 2027, all bets are off.

The Trump administration’s push to rein in Medicare Advantage payments could shape premiums, extra benefits, and even taxes for years to come.

The administration’s proposals this week arrive as new estimates show Medicare Advantage is costing taxpayers far more than previously understood.

The Committee for a Responsible Federal Budget, citing analysis from the Medicare Payment Advisory Commission, estimates the program will be overpaid by about $76 billion in 2026 alone.

If those excess payments continue, overpayments could total roughly $1.2 trillion through 2035, nearly matching the projected shortfall in Medicare’s Hospital Insurance trust fund.

For current enrollees, the key message is timing. “There is no impact on consumers for 2026,” said Katy Votava, founder of Goodcare.com.

She said policy changes proposed for future years often cause unnecessary worry. “People hear about these announcements and think their plan is going to change tomorrow," she said. "That’s not how Medicare works."

Still, what happens next could matter a great deal to current and future beneficiaries. Author's summary of article

Slower payment growth, tougher oversight

On Jan. 26 and 27, the Trump administration outlined a series of proposals aimed squarely at Medicare Advantage, the private-plan alternative to traditional Medicare. Chief among them was a proposed average rate increase of just 0.09% for 2027, effectively flat funding once health care inflation is taken into account.

President Trump has also signaled a tougher stance on insurer profitability, saying in December that insurance companies “are making so much money, and they have to make less, a lot less.”

Related: UNH stock just did something to the Dow Jones you rarely see

At the same time, CMS Administrator Mehmet Oz said the agency plans to modernize risk adjustment to better reflect beneficiaries’ actual health status and protect taxpayers from unnecessary spending.

That effort includes a major expansion of Risk-Adjustment Data Validation audits. CMS plans to increase its team of medical coders from about 40 to roughly 2,000 and audit every Medicare Advantage contract annually to recover overpayments tied to aggressive coding practices, which is often referred to as upcoding.

Markets reacted quickly. Shares of major insurers, including Humana (HUM), UnitedHealth Group (UNH) and CVS Health (CVS), fell sharply, in some cases by as much as 20%, as investors reassessed the outlook for Medicare Advantage payment growth.

Why beneficiaries could feel the effects

Over the longer term, the impact on beneficiaries is likely to show up in subtler ways.

One potential change is pressure on the extra benefits Medicare Advantage plans offer, such as dental, vision, hearing and fitness programs. According to Kip Piper, president of Health Results Group and CEO of Medonomics, many of those benefits are financed by federal overpayments rather than by lower medical costs. Reducing excess payments could narrow the difference between Medicare Advantage and traditional Medicare and slow the pace of plan expansion.

More Medicare/Medicaid

- AARP raises a red flag on Social Security, Medicare

- If your Medicare plan was canceled, do this now

- AARP explains huge new Medicare change coming soon

- Health care costs are the wild card in year-end tax planning

That does not necessarily mean worse care. Votava said Medicare Advantage already costs substantially more per beneficiary than traditional Medicare while producing no consistently better health outcomes. She pointed to heavy spending on marketing as one visible sign of inefficiency, noting that traditional Medicare does essentially no advertising.

There could also be upside for beneficiaries across the entire Medicare system. Overpayments to Medicare Advantage plans raise Medicare Part B premiums for everyone, including those who stay in traditional Medicare, according to the budget group. Slowing that spending could ease pressure on future premium increases.

Piper said eliminating excess payments would also strengthen Medicare’s finances more broadly. Reducing overpayments would help extend the solvency of the Hospital Insurance trust fund, which finances Medicare Part A services, and reduce the likelihood of future tax increases or additional federal borrowing to support the program.

A more level playing field

The administration’s tougher stance for 2027 follows a more generous payment year already locked in. Final Medicare Advantage rates for 2026, set in April 2025, included a 5.1% increase, translating into roughly $25 billion in additional payments, even as CMS continued phasing in a stricter risk-adjustment model highlighted by MedPAC.

According to the Committee for a Responsible Federal Budget, most projected overpayments stem from two sources:

- MedPAC estimates that higher coding intensity will account for about $470 billion of excess payments through 2035.

- Favorable selection, the tendency for healthier beneficiaries to enroll in Medicare Advantage, will add another $730 billion.

About $520 billion of those overpayments would come directly from the Medicare Hospital Insurance trust fund, the group estimates. Without them, the trust fund could remain solvent for a decade or more. Instead, it is projected to run out of reserves in 2032.

For would-be beneficiaries, the changes could influence how attractive Medicare Advantage looks compared with traditional Medicare.

Piper said fewer extra benefits and greater scrutiny of insurers could create a more level playing field between the two options. Plans that have relied most heavily on aggressive coding practices would face the greatest pressure.

Taken together, the proposals suggest:

- Medicare Advantage plans may look leaner in the years ahead

- Beneficiaries could ultimately benefit from slower premium growth and a more sustainable Medicare program

- Less risk that rising costs will be shifted onto future retirees and taxpayers.

Related: The 10 drugs driving Medicare’s biggest prescription costs

What's Your Reaction?