Morgan Stanley revamps Nvidia's price target ahead of big Q3

AI poster-child Nvidia (NVDA) is again at the core of Wall Street’s attention as the chipmaker heads into its most important earnings report of the year. With Q3 results expected to hit on November 19, analysts are weighing in, without being shy about where they stand. Morgan Stanley’s Joseph ...

AI poster-child Nvidia (NVDA) is again at the core of Wall Street’s attention as the chipmaker heads into its most important earnings report of the year.

With Q3 results expected to hit on November 19, analysts are weighing in, without being shy about where they stand.

Morgan Stanley’s Joseph Moore just bumped his price target on Nvidia stock to $220 (a 15.8% increase from current prices), calling the AI behemoth to post its strongest quarter in some time.

Throw in Mr. Market’s expectations for top-and-bottom-line numbers to surge over 50% year over year, and the setup looks remarkably optimistic.

For more color, Wall Street expects GAAP EPS to land at $1.20, along with $54.97 billion in revenues for Q3.

More importantly, Nvidia’s recent underperformance hasn’t done much to cool the market’s enthusiasm heading into the big report.

Wall Street turns up the heat ahead of Nvidia’s Q3 earnings

The market’s attention is locked firmly onto Nvidia as analysts pile fresh optimism ahead of the upcoming quarterly report.

Morgan Stanley’s Joseph Moore price target bump only adds fuel to the momentum, especially on the back of explosive revenue and earnings growth expectations. Also, with AI stocks cooling off, Nvidia’s report might be the moment when investors refocus on the industry’s powerhouse.

Morgan Stanley’s call signals stronger confidence

Ahead of Nvidia’s hotly anticipated Q3 report, Moore states that industry checks point to a “material acceleration” in demand, the kind that tends to show up in Nvidia’s numbers a quarter or two later.

A big part of that is Blackwell, which has moved into full production, with customers treating it as the default choice for training and inference at scale.

Perhaps what’s even more enticing for investors is that Vera Rubin, the platform designed as Blackwell’s successor, is already showing “very strong” demand before it officially launches.

Related: Bank of America resets Nvidia stock forecast before earnings

Moore also makes the case that Nvidia’s recent lag behind some of its AI peers won’t last. With customer and supplier feedback highlighting quicker growth than Wall Street models predict, he believes the stock’s cooling-off period is temporary.

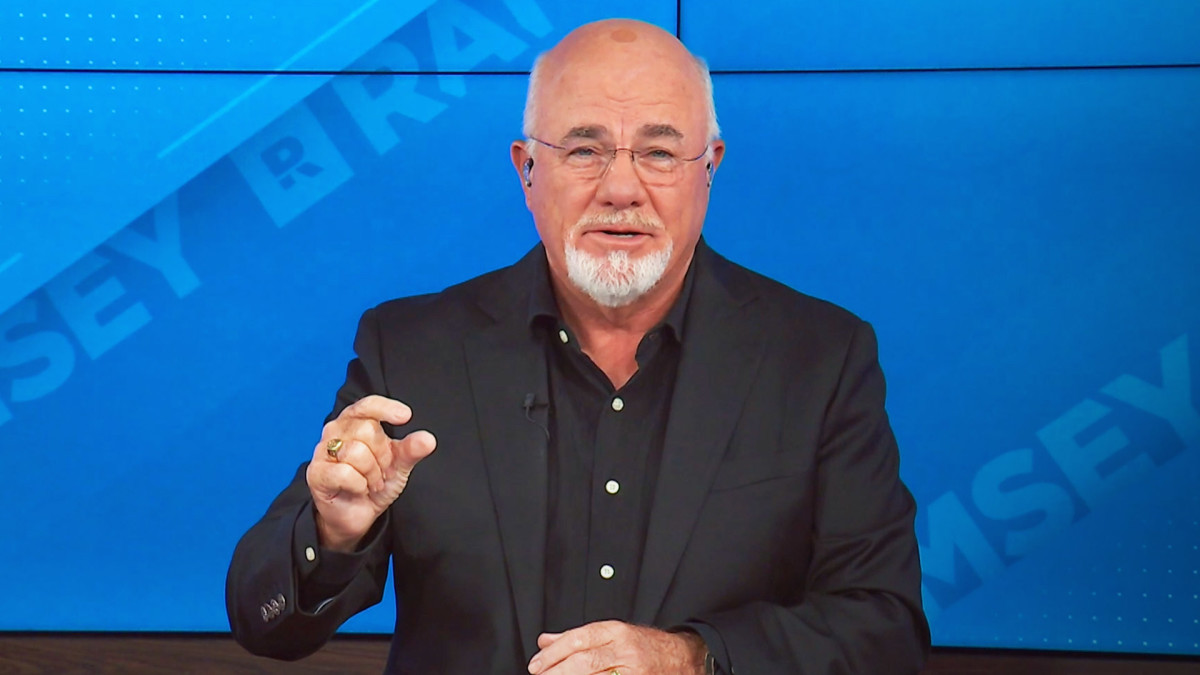

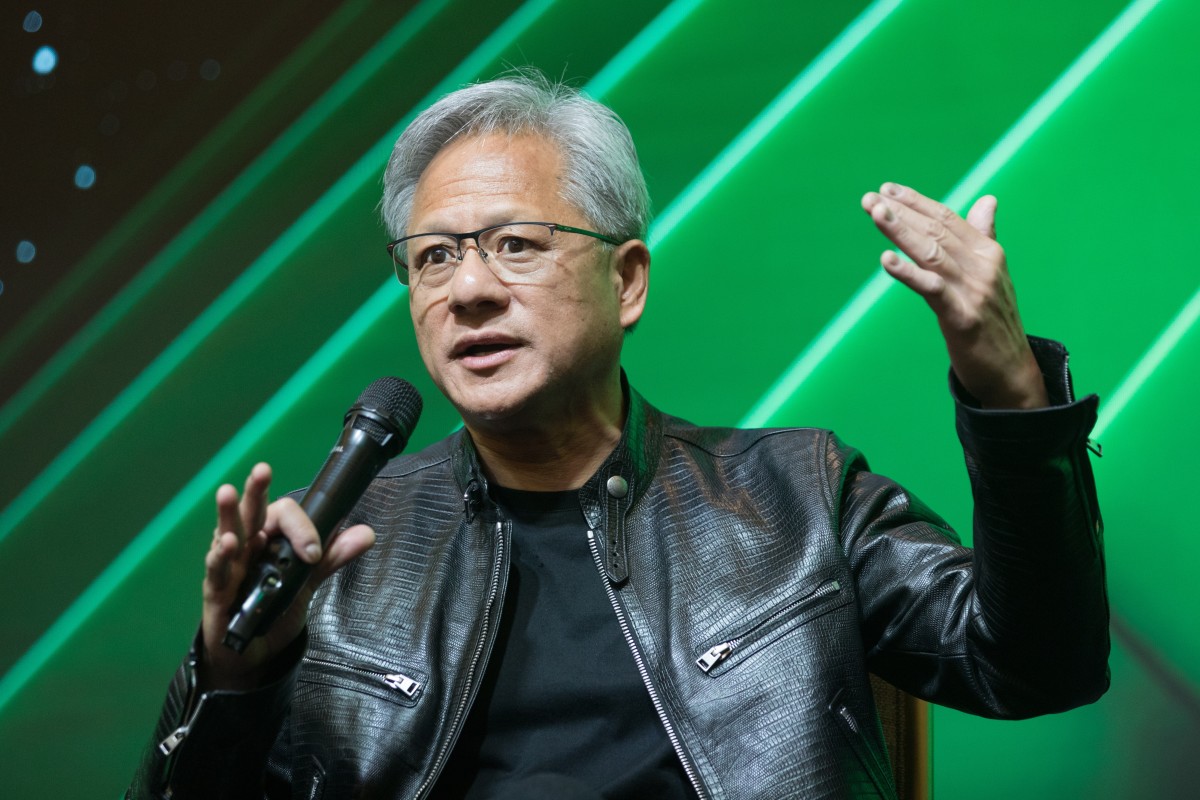

Additionally, he points to CEO Jensen Huang’s recent comments, forecasting that the next five quarters may need to rise by $70 to $80 billion, as another reason why Mr. Market is behind the curve.

Related: Goldman Sachs unveils stock market forecast through 2035

Surprisingly, despite bumping his own expectations above the consensus, Moore still feels his forecast is “conservative,” which says a lot about Nvidia’s momentum.

Quick takeaways from Morgan Stanley's pre-Q3 note on Nvidia stock:

- Demand signals for Blackwell and Vera Rubin are tracking well ahead of expectations.

- Moore feels Nvidia’s recent underperformance compared to its AI peers should reverse.

- Feedback from customers and suppliers suggests faster growth than Wall Street models.

Nvidia’s recent earnings streak

As we look to Q3, it’s perhaps worthwhile to step back at Nvidia’s recent earnings run. The company has scaled to levels that most megacaps might never reach, even as year-over-year gains naturally cool off.

- FQ2 2025 (July 2024): EPS of $0.68 and revenue of $30.04 billion, up 122.40% year over year.

- FQ3 2025 (October 2024): EPS of $0.81 and revenue of $35.08 billion, up 93.61%.

- FQ4 2025 (January 2025): EPS of $0.89 and revenue of $39.33 billion, up 77.94%.

- FQ1 2026 (April 2025): EPS of $0.81 and revenue of $44.06 billion, up 69.18%.

- FQ2 2026 (July 2025): EPS of $1.05 and revenue of $46.74 billion, up 55.60%.

Source: Seeking Alpha

Fund managers quietly trim Nvidia stakes in Q3 13F filings

It’s imperative to note that multiple buy-side heavyweights have been taking the opposite approach to Nvidia ahead of earnings.

The latest 13F filings show that multiple major fund managers are using Nvidia’s summer rally as a chance to lock in gains, while paring back their risks following a stellar, massive run-up.

The most headline-grabbing move came from maverick tech entrepreneur Peter Thiel. His Thiel Macro fund offloaded all 537,742 Nvidia shares it had held between July and September, an exit worth roughly $100 million at the stock’s average price during that quarter.

More Nvidia:

- Nvidia makes a major push for quantum computing

- Nvidia’s next big thing could be flying cars

- Bank of America revamps Nvidia stock price after meeting with CFO

Ray Dalio’s Bridgewater Associates followed a similar playbook, cutting its Nvidia position by nearly two-thirds while rotating toward broader large-cap index exposure.

Additionally, Coatue Management made more modest adjustments, reducing its stake by 14.1% while boosting its holdings in Microsoft, Meta, and Alibaba. Also, Michael Burry’s Scion Asset Management pared back its Nvidia bet.

That cooling sentiment went beyond the hedge funds.

SoftBank announced in early November that it had offloaded the entirety of its 32.1 million-share Nvidia stake for approximately $5.8 billion.

Related: Peter Thiel dumps top AI stock, stirring bubble fears

What's Your Reaction?