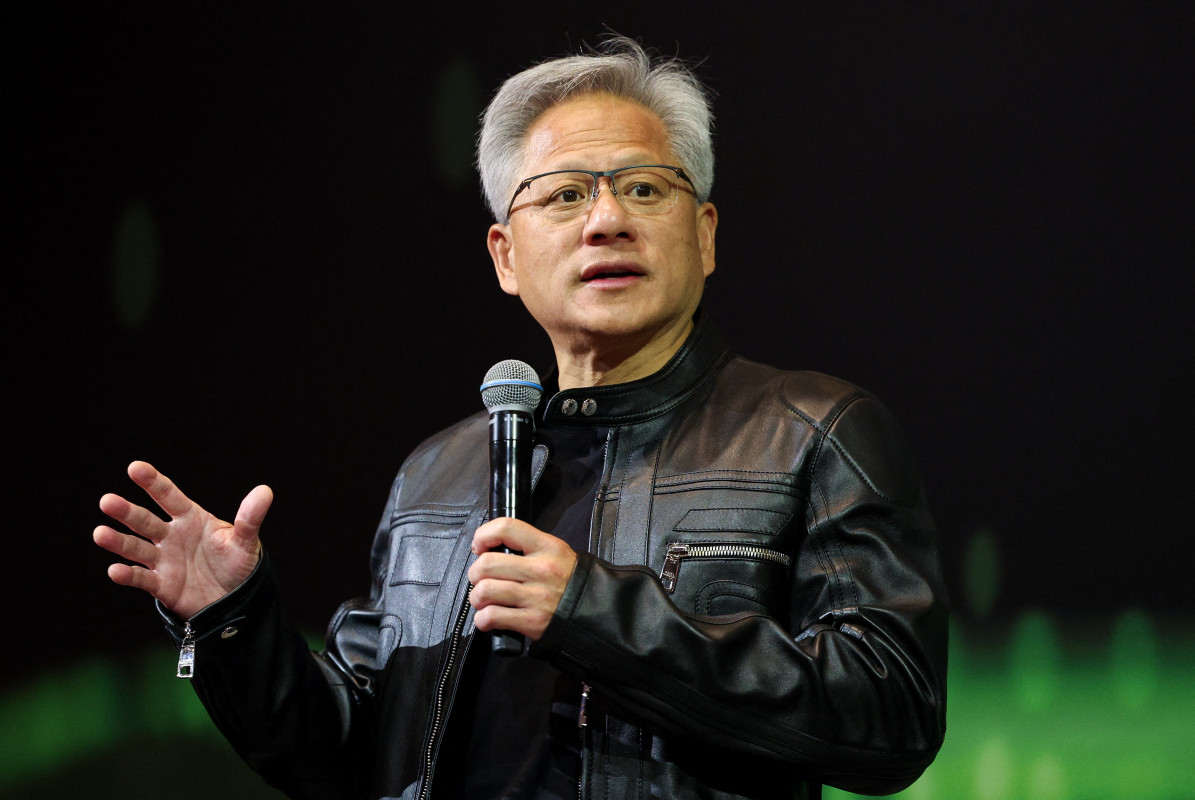

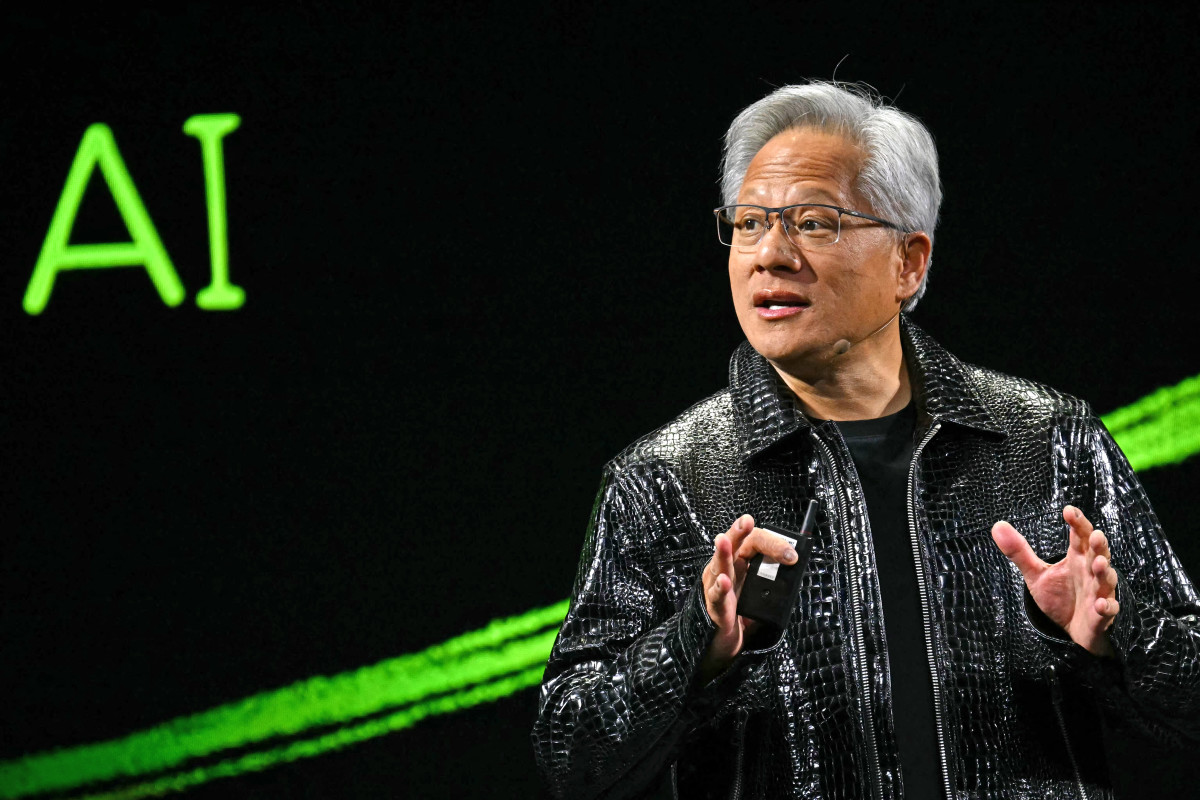

Nvidia CEO delivers biblical-scale reality check on AI

Nvidia (NVDA) CEO Jensen Huang said, before bluntly saying that we’re nowhere close to that day. The statement took me, and probably everyone covering AI, aback, as it breaks sharply from what we’ve come to expect from Huang and others like him. In contrast to the flamboyance Huang typically ...

Nvidia (NVDA) CEO Jensen Huang said, before bluntly saying that we’re nowhere close to that day.

The statement took me, and probably everyone covering AI, aback, as it breaks sharply from what we’ve come to expect from Huang and others like him.

In contrast to the flamboyance Huang typically shows at a CES or GTC event while hyping Nvidia’s next big AI GPU, his subdued demeanor was a bit puzzling.

Perhaps it was influenced by Nvidia’s recent stock market moves, or even the drumbeat of skeptics like Michael Burry.

For perspective, Nvidia’s valuation blew past the $4 trillion mark in early July last year, and then later in the year, the rally culminated in the elusive $5 trillion milestoneat the end of October.

Over the past three months, however, the stock has declined by 1%, concluding the year with a 40% increase in value.

Such an unapologetic admission of AI’s limits is rare, given years of thought leaders framing it as a runaway train that investors must jump on or risk missing out.

Then there’s the apocalyptic rhetoric from figures like Elon Musk, who continues to push AI’s long-term potential to the extreme.

Huang, though, warns that the perfect, all-knowing form of AI misses the point, where businesses need practical AI solutions at this point.

In essence, the ‘kick in the pants’ for AI technology doesn’t require a miracle but the utilization of the tools that are already available. Photo by PATRICK T. FALLON on Getty Images

What is God AI actually?

To be fair, the concept of God AI has been something we’ve been exploring for decades.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

Hollywood gave us a taste of what that could look like.

HAL locking the door in 2002, Skynet deciding humans are the bug in Terminator, and The Matrix effectively turning reality into a battery farm.

However, what’s new is hearing it from the guy who’s selling the shovels, saying that someday we will get there.

Clearly, Huang wasn’t using “God AI” in the traditional sense.

AI is clearly not there yet

The question then becomes whether we’re any closer, or even remotely close, to this all-powerful AI.

Well, Huang just bluntly addressed that question.

From a personal standpoint, after using many AI tools over the past three years, especially the past year, the results have been disappointing.

Don’t get me wrong: seeing Michael Jackson at McDonald’s with Batman is cool and all, but the hype virtually every benchmark should be taken with a grain of salt.

In fact, when ChatGPT 5 was released, people quickly clamored online for the previous 4o model to return, and it did after popular demand.

In fact, there are now multiple online petitions calling for 4o to remain on the platform.

Here’s an interesting comment from Reddit user No_Idea_8970 on the r/ChatGPTcomplaints subreddit, which has about 89,000 weekly visitors, on the issue.

In fact, OpenAI’s own GPT-5.2 system card says that the GPT-5.2 thinking mode could potentially falsify data, fake task completion, or even underperform under some in-context incentives.

AI isn’t going anywhere, though

Despite the stock market hype machine fully mobilized around AI, I genuinely believe the technology is unlikely to go anywhere anytime soon.

Related: Nvidia CEO sends strong message on Taiwan Semiconductor

I sort of agree with what Palantir founder Peter Thiel said in the Interesting Times podcast not too long ago, saying "there's just nothing going on” without AI.

A clear case in point is the number of users already using AI apps.

For a little color, ChatGPT attracts more than 800 million weekly active users, while Google’s Gemini app attracts north of 650 million monthly users.

AI has clearly become ubiquitous, and beyond the “God AI” debate, the real question is how much faith people are beginning to place in what AI tells them.

For instance, Musk recently talked about how he uploaded his MRI and got a similar “nothing concerning” read from Grok and clinicians.

I’ve had similar experiences, and while that doesn’t diminish the importance of a medical practitioner reviewing things, it could still serve as a useful second set of eyes, as Musk suggested.

OpenAI CEO Sam Altman recently said many people, especially younger users, are turning to ChatGPT like a therapist or life coach, and even relying on it for legal advice.

Related: Wall Street sends message on Tesla after Nvidia self-driving move

This isn’t an ill-founded opinion.

I see it all the time, from restaurants to hospitals, with people hooked on chatbots for everything. That can be dangerous, but it also shows that investment in AI aimed at pushing it to the next level isn’t slowing down anytime soon.

Nvidia is at the heart of the AI boom

One thing is certain: Nvidia has come a very long way.

I still remember convincing my dad to buy me an Nvidia GeForce card around the time Batman: Arkham City hit PC in late 2011.

At the time, the GTX 560 Ti card made the game feel like a flex to me.

Fast-forward more than a decade, and the same GPU line that was built for Gotham nights has become the engine room for the AI boom.

Nvidia at this point sits right at the center of the AI boom, and a big part of that is that it has evolved from being purely “a chip company”.

- It owns the picks-and-shovels layer: Analysts at Jon Peddie Research described the AI processor space as basically a one-company game, with Nvidia holding a 95% sharein a remarkably fragmented field.

- Its data center business is skyrocketing: Nvidia posted a massive $51.2 billion in Data Center sales in fiscal Q3 2026 (roughly 89.5% of total sales), underscoring that much AI spend is flowing through Nvidia.

- CUDA is the moat. Nvidia states that over 4.5 million developers utilize CUDA, resulting in significant switching costs for companies that train and deploy models.

Related: Analysts drop verdicts on AMD, Intel, and ARM

What's Your Reaction?