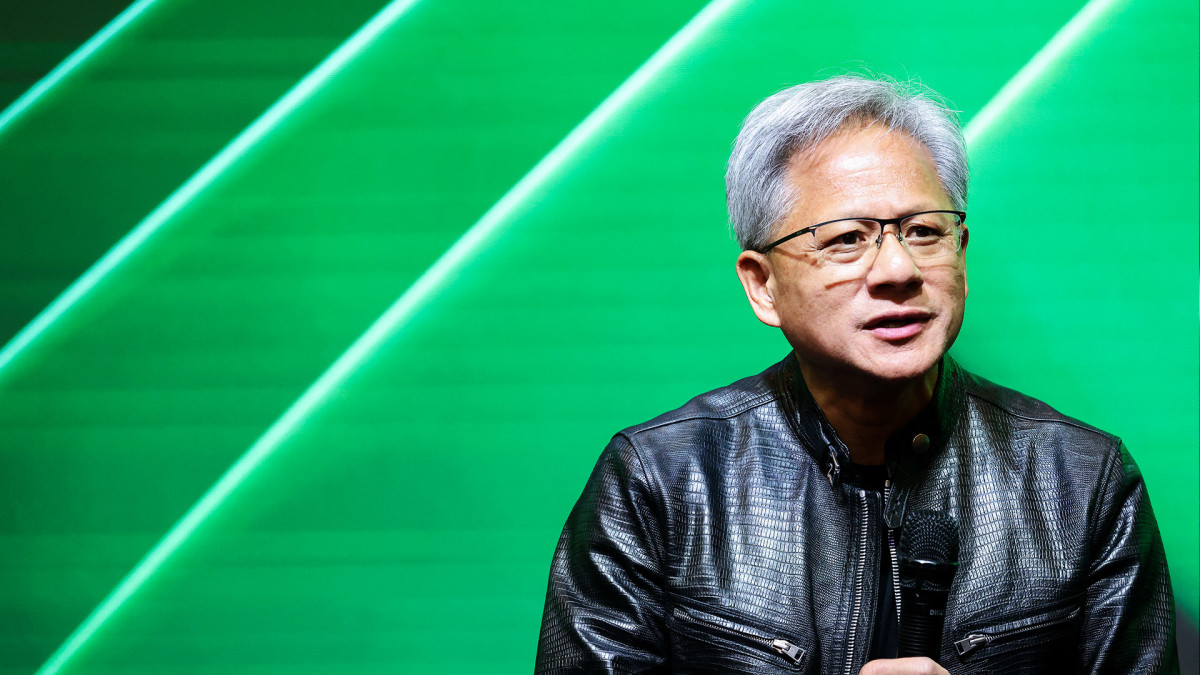

Nvidia earnings preview: Everything this top portfolio manager expects

Here's what to watch when Nvidia reports earnings after the closing bell on February 26.

Nvidia (NVDA) is determined to document quarterly outcomes after the closing bell on February 26.

TheStreet Pro's portfolio manager Chris Versace breaks down every and every line you wishes to be staring at when Nvidia's outcomes hit the press and how it's best to manner the stock within the length in-between.

For extra from Chris, talk over with TheStreet Pro this day.

Associated: Analyst revisits Nvidia stock designate aim with Q4 earnings in focus

Transcript:

CONWAY GITTENS: What about NVIDIA? That company doesn't document till February twenty sixth, slack February. So what is going to you be having a survey or listening for when that company talks?

CHRIS VERSACE: Well, let's discuss what now we bask in gotten up to now, ensuing from there is been a preference of supporting files parts for NVIDIA, whether or no longer it's most lately Taiwan Semiconductor talking about their March quarter outcomes. When you happen to parse the numbers versus year over year, up vastly. Hon Hai, which is a enormous partner for NVIDIA in AI servers, up steady. So those are positives.

But powerful extra lately, Supermicro with their outlook for their AI connected industry/ Very steady. And that particularly tells us that we're beginning to peer the logjam break internal of NVIDIA, at the same time because it's seemingly you'll, for Blackwell. That is their next skills chipset. That is the one who all people is concentrated in on. And to the extent that Supermicro's industry form of follows the dawdle of stronger 2d half of revenue when put next to the predominant half of of 2025, that's an awfully good main indicator for what we should hear from NVIDIA in a couple of weeks.

But any other time, we will proceed to coach the knowledge parts, at the side of those big tech spending numbers. But there too, very sure for what NVIDIA should should issue within the upcoming weeks. But to be particular with your request, Conway, what are we going to are fascinating to listen to from NVIDIA? How is the transition to Blackwell going? How does that component into your revenue forecast for the support half of of the year? When does the ability constraints that you just've got got talked about, when enact they genuinely fall to the wayside? So that's what we will be listening for.

CONWAY GITTENS: And so how bullish are you on NVIDIA as a stock? It's silent anticipated to post revenue boost north of fifty% this year. And thanks to that haircut it bought around January 27th, it's trading within the high 20s instances its forward earnings. So how enact you genuinely feel in regards to the stock?

CHRIS VERSACE: Well ogle, now we bask in bought a 175 designate aim. Correct now it's form of bouncing around between 130, 135. So we certainly peer ample upside to preserve it a one rated stock. And that is the place we mediate that we will preserve it. I'd no longer be taken aback if as ability constraints fall by the wayside, that we peer revenue expectations for the 2d half of of the year strengthen.

Take into accout of too that with big tech ability constrained, loads of the dollars that they may proceed forward in spending for this quarter, the 2d quarter, even the third quarter, that's genuinely laying the groundwork for what's to come aid. So I'd no longer be taken aback if we peer an awfully good revenue ramp internal of NVIDIA over the following quarters.

CONWAY GITTENS: So good revenue ramp. Valuations are a bonus. The stock is down 20% from its all time high. So enact you gobble up extra or enact you wait and peer?

CHRIS VERSACE: So we genuinely bask in a moderately sizable dwelling within the portfolio. And it's best to bask in in mind that just given the place we are, form of within the panorama of the market having to reassess the timing of Fed rate cuts, especially coming after that hotter than anticipated January CPI document, nevertheless also too the ability tariffs that mentioned that after we web some February inflation files, it's seemingly to show off that, boy, inflation is no longer seemingly to web aid on path to the Fed's 2% aim shut to term.

And on top of that, Conway, we're silent ready to listen to about reciprocal tariffs from Trump. There's heaps of potential headwinds available within the market. And at the same time, the technical setup for the market, successfully, is it overbought? No. Is it oversold? No. We're form of right there within the center. So I mediate we will should bide our time, let these forms of factors wash via the market, at the side of the ability for reciprocal tariffs to Trump's reciprocal tariffs. So there is heaps of arresting pieces. We are going to opt a tiny extra clarity sooner than we originate any moves with NVIDIA or genuinely any other positions within the portfolio right away.

Glance ICYMI This Week:

- Tariffs seemingly may no longer result in increased prices, top economist says

- DeepSeek selloff used to be extra about Nvidia stock than AI

- Tim Cook surprises Apple enthusiasts with February product start

What's Your Reaction?