Nvidia slashes stake in emerging rival as AI arms race heats up

Nvidia has trimmed its nascent investment portfolio by around 30%, including a big change in a key holding of a former takeover target.

Nvidia shares moved increased in early Tuesday procuring and selling and gape put to reach to levels reached sooner than the emergence of China-based DeepSeek in gradual January, as investors picked via small print of the latest tweaks in its nascent tech portfolio.

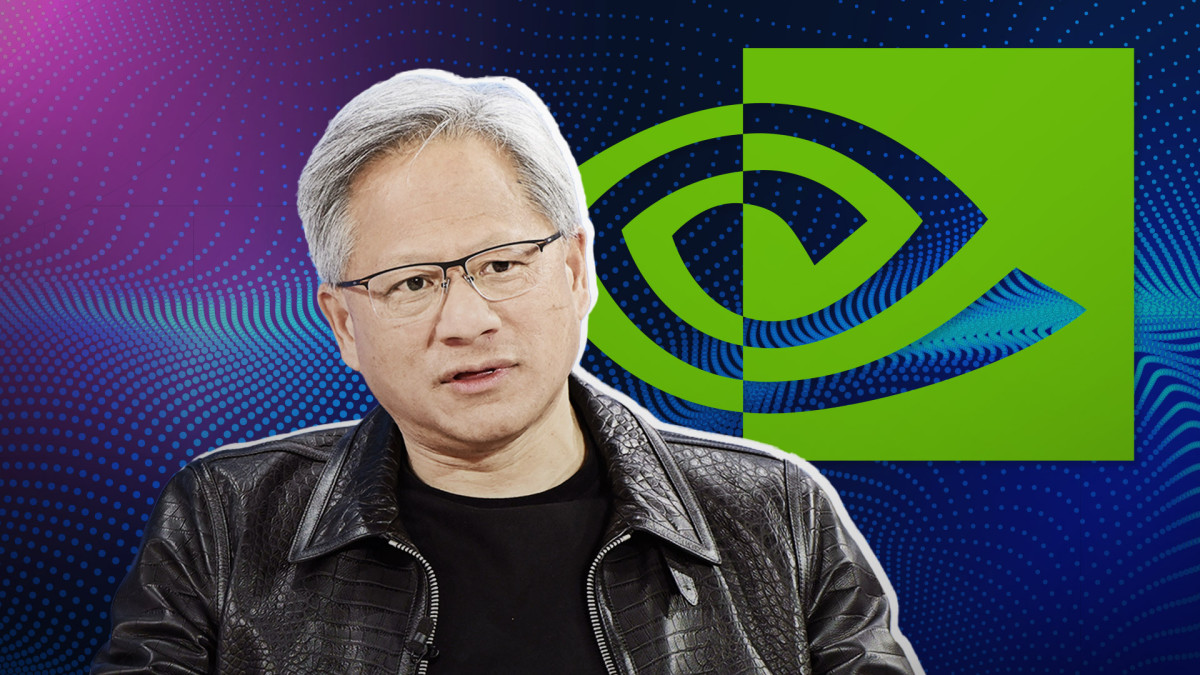

Nvidia (NVDA) which holds the market's dominant status in AI chipmaking making below CEO Jensen Huang, also runs a small portfolio of investments that, below Securities and Exchange Price principles, require quarterly public updates typically reserved for hedge funds and tall investment autos.

Within the community's latest 13-F filing, printed on the SEC internet plight Friday, Nvidia well-liked a large replace in its stake in Arm Holdings, the U.K.-based chip clothier it tried to aquire outright for $40 billion in 2020.

Nvidia owned spherical 1.1 million shares in the neighborhood on the pause of ultimate 365 days, its 13-F filing indicated, a 44% reduction from its prior document on the pause of the third quarter of ultimate 365 days. The most contemporary price of its retaining used to be pegged at spherical $181 million. Bloomberg/Getty Images

Nvidia known as off its tried aquire of Arm three years previously, citing stress from regulators on both sides of the Atlantic, apart from in China, over the impact of the deal on world competition.

“Arm has a radiant future, and we’ll continue to pink meat up them as a proud licensee for many years to reach aid,” Huang said on the time. “Arm is on the heart of the indispensable dynamics in computing. Even though we obtained’t be one company, we'll partner closely with Arm."

The most contemporary budge, however, may replicate Arm's reported interest in expanding its enterprise, which in the intervening time centers spherical licensing mental property for chip designs, to a extra proactive system that would possess designing and selling its hold line of processors.

Nvidia slashes Arm stake

Reuters reported final week that Arm is accelerating that effort, aiming to compete straight against a couple of of its hold licensing customers, which consist of Nvidia, Apple (AAPL) , and Qualcomm (QCOM) .

JPMorgan analyst Harland Sur, in a cowl printed final week, said that the planned investment by Arm's biggest shareholder, Japan-based SoftBank, in the U.S. AI venture Stargate may at final lead it into bid competition with Nvidia.

Related: An AI big poses a new menace to Nvidia

The analyst well-liked, however, that Broadcom (AVGO) is seemingly to be the largest beneficiary, given its market management in custom AI chips, a decrease-priced and extremely ambiance pleasant different to Nvidia's powerhouse GPUs.

“With the stepped-up focal level on compute effectivity (due to DeepSeek), we can figuring out these AI ASIC programs being accelerated to additional augment compute effectivity and drive a extra aggressive payment/compute curve," Harland wrote.

Nvidia also unveiled a new 1.7 million section stake in China-based WeRide, a shopper that makes utilize of the chipmaker's software and decrease-pause GPUs to vitality its self enough autos.

Nebius Neighborhood, an AI-focused tech community rebranded from Russia's Yandex, used to be also listed as a new Nvidia investment with a 1.2 million section stake price at spherical $33 million.

Shares of the Amsterdam-based community replace on the Nasdaq below the ticker image NBIS.

Sound Cloud, Abet Robotics out

Interestingly, Nvidia also closed out prior holdings in SoundCloud (SOUN) , which it unveiled in its maiden 13-F filing final 365 days, and Redwood, Calif.-based robot offer community Abet Robotics.

Nvidia will put up its fourth-quarter earnings after the close of procuring and selling on February 26, with analysts making an are attempting to search out general revenues to upward thrust spherical 66% to $24.5 billion and obtain earnings surging 62% to $20.85 billion.

More AI Shares:

- Analysts overhaul Apple stock price targets after file Q1 earnings

- Gentle fund supervisor reveals startling AI shares forecast for 2025

- These agentic AI shares may wing in 2025

Nvidia shares were final marked 1.9% increased in premarket procuring and selling. Arm Holdings shares, which fell 5% on Friday, edged 0.86% increased to $160.91 every.

SoundCloud fell 2.4% to $10.70 every while Abet Robotics slumped 4.8% to $13.18 every. Nano-X Imaging used to be final seen 0.74% increased at $6.77 every.

Related: Gentle fund supervisor issues dire S&P 500 warning for 2025

What's Your Reaction?