Oil slides as Israel, Iran downplay attacks, but markets remain on edge

Iran, OPEC's fourth-largest producer, has seen its output levels rise by nearly a third since Russia's invasion of Ukraine in 2022.

Global oil prices whipsawed Friday as investors weighed the impact of a reported Israeli missile strike on Iran that could escalate tensions in the region while adding further concerns for supply disruption through one of the market's key delivery hubs.

Reports suggest Israel carried out a 'limited' missile strike on Iranian military targets late Thursday, in retaliation for Tehran's unprecedented attack on Israeli soil earlier this month. The strikes, while highly-anticipated, rattled global markets and briefly lifted global oil prices north of $90 per barrel.

Both sides appear to have down-played the event, however, with Iran describing the attacks as a failed effort from "infiltrators" and Israel thus far refusing to claim official responsibility.

That, as well as the fact that no oil installations appear to have been damaged in the strikes, allowed global prices to ease in the aftermath, although investors remain on high-alert for any reprisal efforts from Iran or Israel.

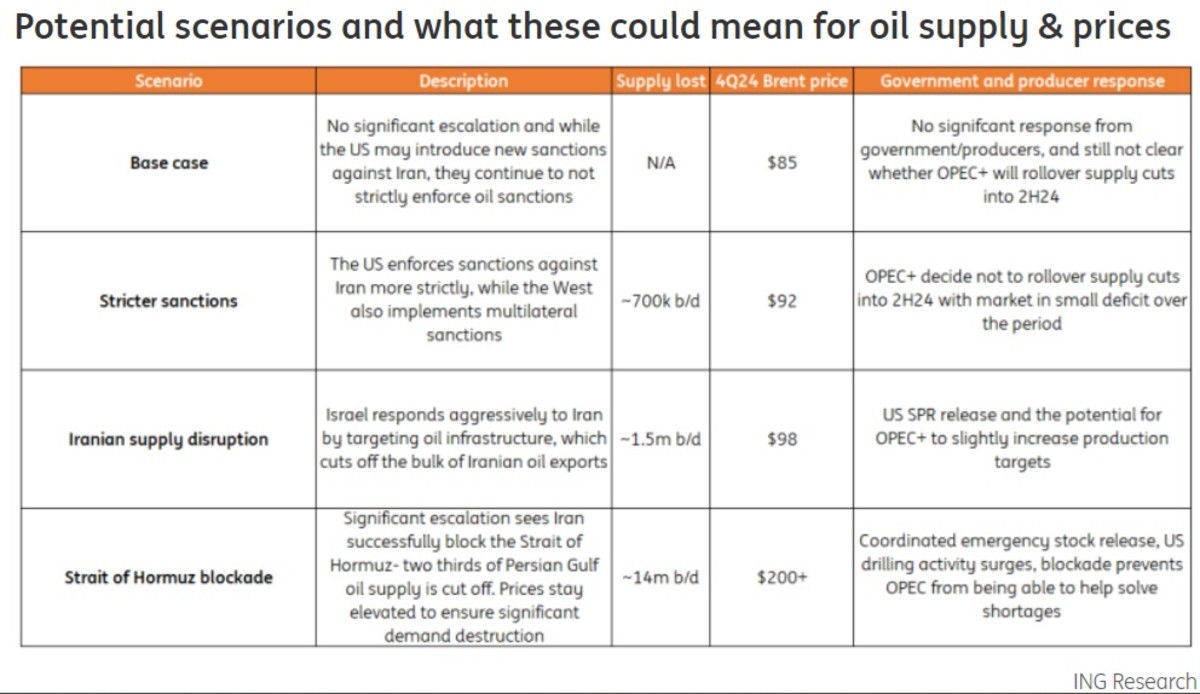

"If these reports turn out to be true, fears over further escalation will only grow, as well as concerns that we are potentially moving closer towards a situation where oil supply risks lead to actual supply disruptions," said ING's chief commodity strategist Warren Patterson.

Brent futures contacts for June delivery, the global pricing benchmark, were last trading 45 cents lower on the session at $86.66 per barrel.

WTI contacts for May delivery, which are tightly-linked to U.S. gasoline prices, slipped 83 cents to $81.90 per barrel, after hitting $85 a barrel earlier in the overnight session.

Oil prices have risen more than 20% so far this year, powered in part by a resilient global economy, improving demand from China and the ongoing OPEC cartel production cuts that are taking more than $2 million barrels of crude from the market each day.

Iran, which is OPEC's fourth-largest producer, has been under U.S. sanctions in terms of oil exports for a number of years over its links to terror groups in the region and its pursuit of a nuclear weapons program.

Related: No landing, no Fed rate cuts: the markets' new bet on 2024

Russia's invasion of Ukraine in 2022, however, has meant that some of those sanctions have gone unenforced, allowing Iran to boost its overall crude output from 2.5 million barrels per day to around 3.5 million as of last month.

That's meant that any attack on Iran now has a greater impact on global supplies, while any spillover of the region's conflict into the Strait of Hormuz, where more than 20 million barrels of crude, around a fifth of all global supplies, travels each day.

"The potential impact would dwarf the disruptions we have seen in the Red Sea in recent months, given the volume of oil that flows through the Strait and also due to the fact that there is no alternative route for the bulk of these oil exports," said ING's Patterson.

Record U.S. oil production is also easing some of the west's broader supply concerns, with domestic drillers pumping 13.1 million barrels each day, up from around 12.5 million over the same period last year.

Domestic crude stockpiles are also rising, according to recent Energy Department data, with inventories up by 2.7 million barrels last week to around 460 million barrels.

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

That's likely to leave oil prices trading inside a tight recent range of between $85 and $90 per barrel over the near-term, a level that is also likely to stoke headline inflation pressures, as traders monitor weekend developments heading into Monday's Passover observances.

Overall, most of the five-dollar range seen this past week has been driven traders attempt to quantify the level of risk premium needed to reflect heightened tensions but with no impact on supply," said Saxo Bank's head commodity strategist Ole Hansen. "Expect prices to bid ahead of the weekend."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?