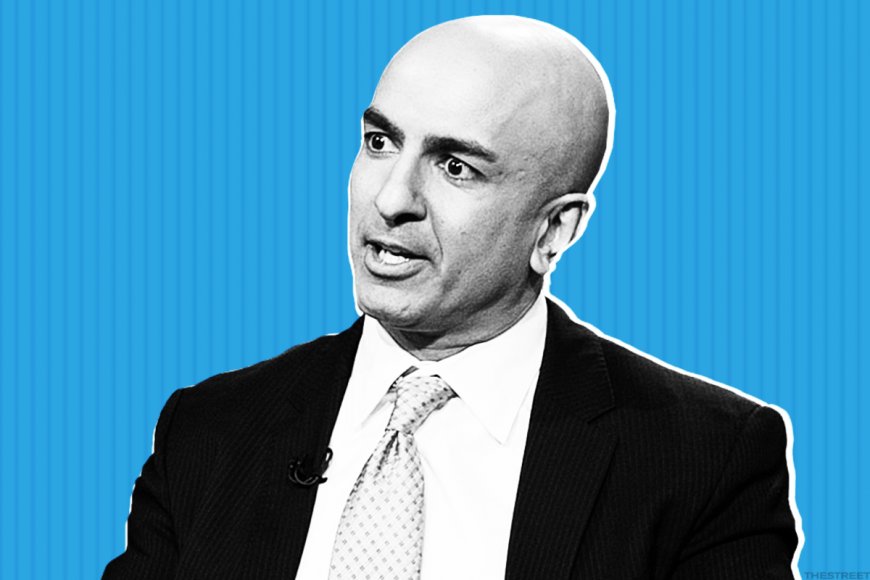

Fed President Neel Kashkari repeats 'higher for longer' rate warning

Minneapolis Fed President Neel Kashkari added to the central bank's 'higher for longer' messaging during a speech late Monday in Philadelphia.

Minneapolis Federal Reserve President Neel Kashkari reiterated the central bank's 'higher-for-longer' mantra during a speech in Pennsylvania late Monday, adding to market pressures heading into the autumn months.

Speaking at an event at Penn's Wharton School of Business in Philadelphia, Kashkari, a voting member of the Fed's rate-setting committee, said taming inflation will likely require higher interest rates, particularly in an out-performing economy.

"If the economy is fundamentally much stronger than we realized, on the margin, that would tell me rates probably have to go a little bit higher, and then be held higher for longer to cool things off," Kashkari said.

The Fed's new Summary of Economic projections, known as the dot plots, now calls for GDP stronger growth of 2.1% this year, more than double its prior forecast, with the forecast for unemployment coming down to 3.9% from a prior estimate of 4.1%.

In terms of inflation, the Fed's dot plots suggests rate-setters are seeing core personal consumption expenditures inflation, the bank's preferred measure, easing to 3.7% this year from its prior estimate of 3.9%.

The dots also suggest that 12 members of the FOMC see at least one more rate cut, with 7 indicating the need for a pause in order to determine the impact of past hikes on the economy.

The messaging from Kashkari, who described himself as 'hawkish' on rate forecasts, is largely consistent with the tone of Fed Chairman Jerome Powell's press conference last week, which followed its decision to hold rates steady at between 5.25% and 5.5%.

"We are prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we are confident that inflation is moving down sustainably toward our objective," Powell said.

At present, however, the CME Group's FedWatch tool is pricing in less than a 20% chance that the Fed will raise its benchmark lending rate by another quarter of a percentage on November 1. The odds of a final 2023 hike in December, however, have climbed to around 40%, with a 34.5% chance of a quarter point hike.

What's Your Reaction?